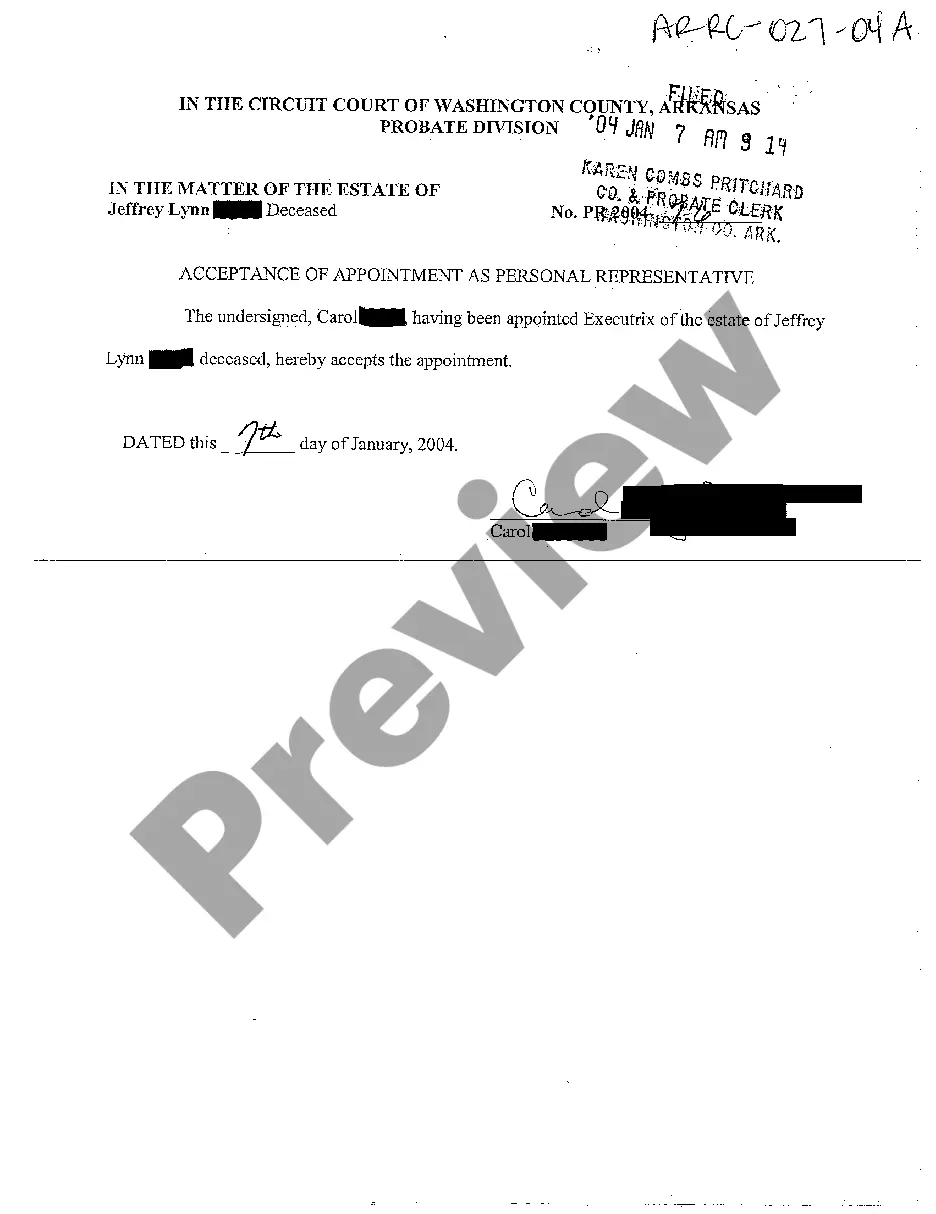

Arkansas Acceptance of Appointment as Personal Representative

Description

How to fill out Arkansas Acceptance Of Appointment As Personal Representative?

Among the many paid and complimentary templates available online, you cannot guarantee their dependability.

For instance, who developed them or if they possess sufficient expertise to handle what you require.

Always remain composed and utilize US Legal Forms!

If you already have a subscription, Log In to your account and locate the Download button adjacent to the file you seek. You will also have access to all of your previously obtained samples in the My documents section. If you are visiting our website for the first time, adhere to the instructions below to quickly acquire your Arkansas Acceptance of Appointment as Personal Representative: Ensure that the document you see is legitimate in your residing state. Examine the document by reviewing the details for utilizing the Preview feature. Click Buy Now to initiate the ordering process or search for another template using the Search bar situated in the header. Select a payment plan and establish an account. Remit payment for the subscription using your credit/debit card or PayPal. Download the form in your desired file format. Once you have signed up and purchased your subscription, you may use your Arkansas Acceptance of Appointment as Personal Representative as frequently as needed or for as long as it remains valid in your area. Revise it in your preferred online or offline editor, complete it, sign it, and print it. Accomplish more for less with US Legal Forms!

- Locate Arkansas Acceptance of Appointment as Personal Representative samples produced by experienced lawyers.

- Sidestep the expensive and time-consuming task of searching for an attorney and subsequently compensating them to draft documents for you that you can effortlessly obtain independently.

Form popularity

FAQ

In Arkansas, not all wills must go through the probate process, but it is generally required to ensure the proper distribution of assets. If the estate is small and meets certain criteria, it may qualify for a simplified procedure. Engaging in Arkansas Acceptance of Appointment as Personal Representative can help clarify the probate requirements for a specific estate and streamline the process, especially when using platforms like USLegalForms.

Arkansas Code 28 41 102 discusses the criteria and procedures for the acceptance of a personal representative's appointment. This section of the law emphasizes the responsibilities associated with managing an estate effectively. If you are navigating the Arkansas Acceptance of Appointment as Personal Representative, this code provides invaluable information to ensure compliance with state law.

In Arkansas, creditors typically have a period of three years to file claims against a deceased person's estate after their death. This limitation applies to most unsecured debts. It's essential for personal representatives to be aware of these time constraints when handling Arkansas Acceptance of Appointment as Personal Representative, as they must settle the estate's obligations properly.

The statute 28-41-101 in Arkansas pertains to the appointment of a personal representative for estate administration. This statute outlines the qualifications and powers granted to an individual designated to manage a deceased person's estate. Understanding this statute is crucial for anyone engaging in the process of Arkansas Acceptance of Appointment as Personal Representative.

To obtain letters testamentary in Arkansas, you must file a petition for probate with the appropriate court, including the deceased's will, a death certificate, and other necessary documents. Once the court verifies your status as the executor, it will issue letters testamentary, allowing you to act on behalf of the estate. Understanding the Arkansas Acceptance of Appointment as Personal Representative facilitates this process and confirms your authority.

You can avoid probate in Arkansas by establishing joint ownership of property, utilizing payable-on-death accounts, or creating a living trust. These methods ensure that assets pass directly to beneficiaries without the need for a lengthy probate process. The Arkansas Acceptance of Appointment as Personal Representative can guide you in managing your estate efficiently, making the avoidance of probate smoother.

To file a small estate affidavit in Arkansas, gather all required documents and complete the affidavit form, ensuring accuracy. Next, submit the form to the probate court, along with necessary supporting documents like the death certificate. Utilizing the Arkansas Acceptance of Appointment as Personal Representative can help you navigate this filing process with confidence.

To obtain a small estate affidavit in Arkansas, you need to complete the specific form for a small estate affidavit and file it with the probate court in your jurisdiction. Make sure to include all required information, such as the value of the estate and a copy of the death certificate. By leveraging the Arkansas Acceptance of Appointment as Personal Representative, you can efficiently manage the estate process.

In Arkansas, the highest priority to be appointed as a personal representative is typically given to the executor named in the deceased's will. If no will exists, the court will prioritize surviving spouses, adult children, and parents of the deceased. Understanding how the Arkansas Acceptance of Appointment as Personal Representative works can help you navigate this important decision.

In Arkansas, the small estate limit is $100,000 for personal property and $200,000 for real property. If your estate falls below this threshold, you may qualify for a small estate affidavit, streamlining the process of distributing assets without probate. Utilizing the Arkansas Acceptance of Appointment as Personal Representative can further simplify your responsibilities in managing the estate within these limits.