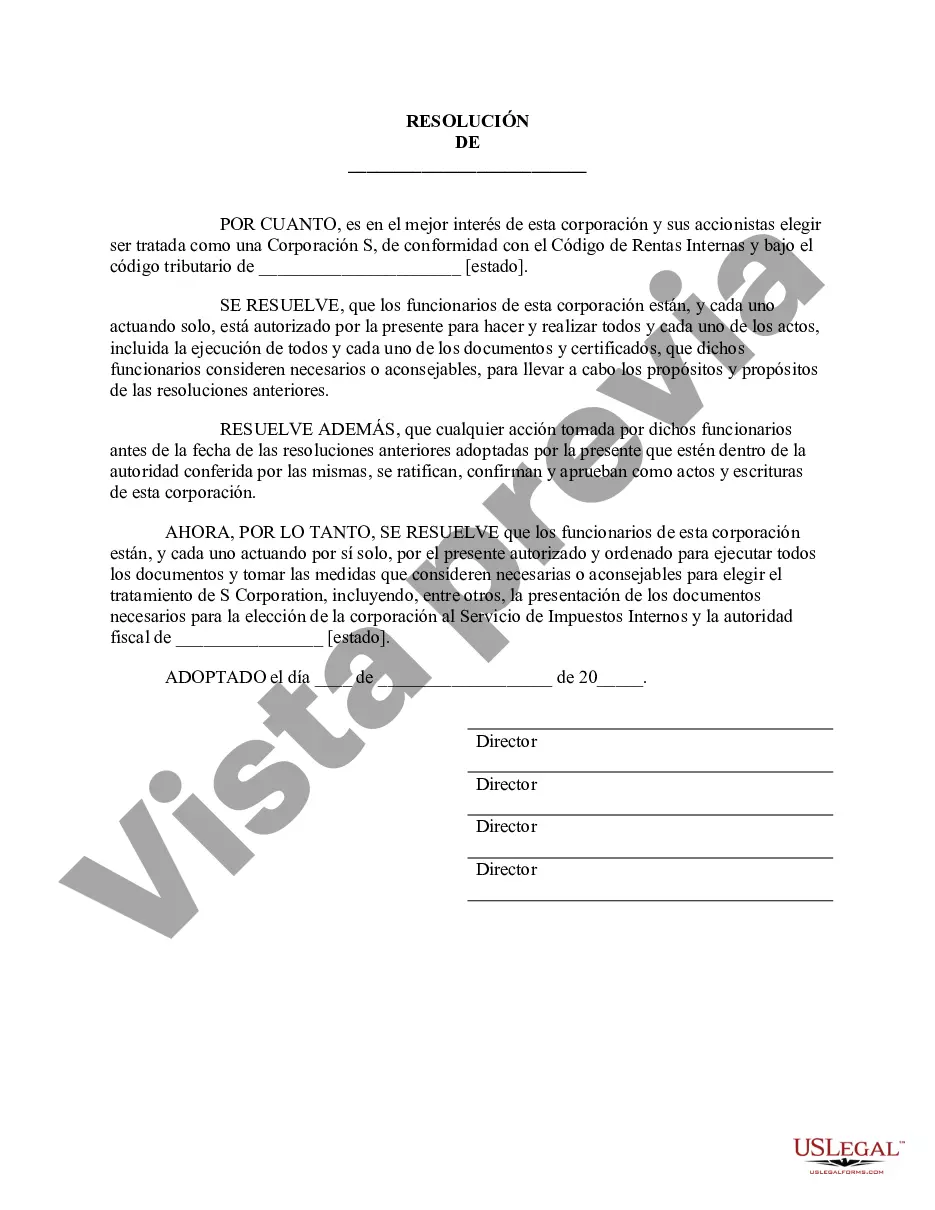

Arkansas Obtain S Corporation Status — Corporate Resolutions Forms are legal documents required for businesses in Arkansas to obtain S Corporation status. S Corporation status is a tax designation granted by the Internal Revenue Service (IRS) that allows a business to avoid double taxation by passing its income, deductions, and credits through to its shareholders. In order to obtain S Corporation status in Arkansas, businesses must file specific corporate resolutions forms that outline the steps taken by the corporation's board of directors and shareholders to elect this tax status. There are several types of Arkansas Obtain S Corporation Status — Corporate Resolutions Forms, including: 1. Certificate of Corporate Resolution: This form is typically used to document the resolutions passed by the corporation's board of directors, such as the decision to elect S Corporation status. It includes details such as the date the resolution was adopted, the names of the directors who voted, and the specific resolution passed. 2. Shareholders' Consent to Election of S Corporation Status: This form is used to obtain the consent of the corporation's shareholders for the election of S Corporation status. It includes information such as the names of the shareholders, the number of shares they hold, and their signatures indicating their consent. 3. IRS Form 2553, Election by a Small Business Corporation: This federal tax form is required to be filed with the IRS to officially elect S Corporation status. It includes information such as the name and address of the corporation, its employer identification number (EIN), the effective date of the election, and the signatures of the corporation's officers. Businesses seeking S Corporation status in Arkansas must ensure that all required corporate resolutions forms are completed accurately and submitted within the designated timeframe. It is advisable to consult with a qualified attorney or tax professional to ensure compliance with all applicable state and federal laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arkansas Obtener el estado de S Corporation - Formularios de resoluciones corporativas - Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Arkansas Obtener El Estado De S Corporation - Formularios De Resoluciones Corporativas?

If you want to full, acquire, or print lawful record templates, use US Legal Forms, the largest variety of lawful varieties, which can be found online. Make use of the site`s simple and easy convenient research to discover the documents you require. Numerous templates for business and individual reasons are categorized by types and says, or search phrases. Use US Legal Forms to discover the Arkansas Obtain S Corporation Status - Corporate Resolutions Forms with a couple of click throughs.

If you are previously a US Legal Forms consumer, log in for your profile and then click the Download key to obtain the Arkansas Obtain S Corporation Status - Corporate Resolutions Forms. You may also gain access to varieties you in the past delivered electronically within the My Forms tab of your profile.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for that proper city/country.

- Step 2. Take advantage of the Preview option to examine the form`s articles. Never overlook to read through the information.

- Step 3. If you are unsatisfied together with the kind, take advantage of the Research field at the top of the monitor to discover other types of the lawful kind web template.

- Step 4. After you have discovered the shape you require, click the Get now key. Select the costs plan you choose and add your references to register for the profile.

- Step 5. Procedure the deal. You can use your Мisa or Ьastercard or PayPal profile to perform the deal.

- Step 6. Pick the file format of the lawful kind and acquire it on your own product.

- Step 7. Complete, edit and print or sign the Arkansas Obtain S Corporation Status - Corporate Resolutions Forms.

Each lawful record web template you get is the one you have permanently. You have acces to every single kind you delivered electronically within your acccount. Select the My Forms section and decide on a kind to print or acquire yet again.

Remain competitive and acquire, and print the Arkansas Obtain S Corporation Status - Corporate Resolutions Forms with US Legal Forms. There are many professional and status-certain varieties you can use for your business or individual needs.