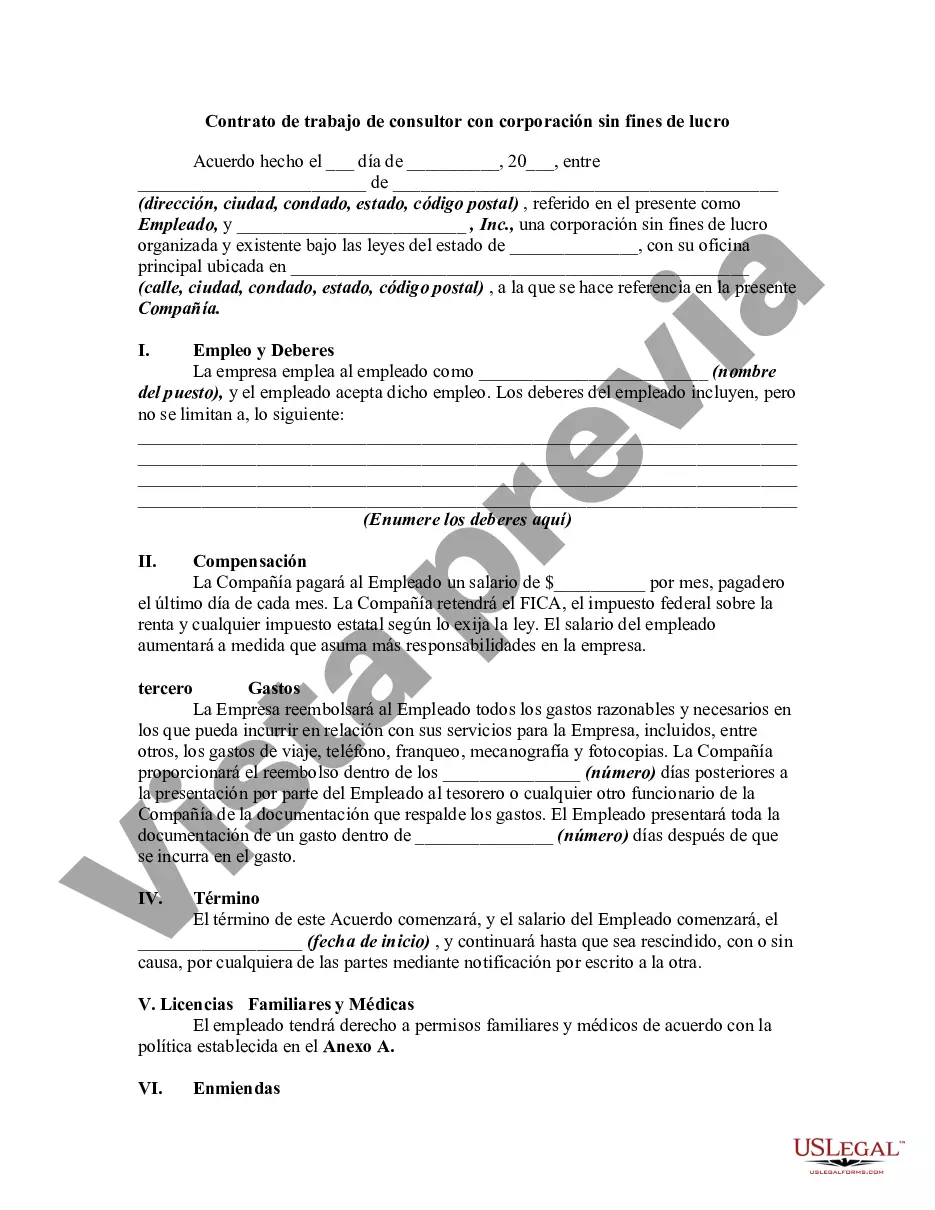

Arkansas Employment Contract of Consultant with Nonprofit Corporation serves as a legally binding agreement established between a consultant and a nonprofit corporation based in Arkansas. This contract outlines the terms and conditions of the consultant's engagement with the organization, ensuring clarity and protection for both parties involved. The key elements typically covered in an Arkansas Employment Contract of Consultant with Nonprofit Corporation include: 1. Parties Involved: This section identifies the nonprofit corporation and the consultant, including their legal names, addresses, and contact information. 2. Scope of Work: Here, the contract details the specific tasks, duties, and responsibilities the consultant will undertake for the nonprofit corporation. It may include project deliverables, milestones, timelines, and expected outcomes. 3. Compensation: This section outlines the consultant's compensation structure, payment terms, and any additional benefits or reimbursements they may be entitled to. It may specify whether the consultant will receive a fixed fee, hourly rate, or commission. 4. Term and Termination: The contract indicates the duration of the consultancy engagement and the conditions under which either party can terminate the agreement. This may involve providing notice periods or fulfilling certain obligations before termination. 5. Confidentiality and Non-Disclosure: To protect sensitive information, this section emphasizes the consultant's obligation to maintain confidentiality regarding the nonprofit's proprietary information, trade secrets, donor lists, and any other confidential material encountered during the engagement. 6. Intellectual Property: If the consultant generates or contributes to any intellectual property during the contract period, this section establishes the ownership rights and usage permissions. It may address copyright, trademarks, patents, or other forms of intellectual property. 7. Independent Contractor Relationship: To ensure the consultant is not perceived as an employee, this clause explicitly states that the relationship between the consultant and the nonprofit corporation is that of an independent contractor. It highlights that the consultant is responsible for their own taxes, insurance, and benefits. 8. Governing Law and Dispute Resolution: This section identifies that the contract will be governed by the laws of the state of Arkansas. It also outlines the methods for dispute resolution, such as mediation or arbitration, to settle any conflicts that may arise during the consultancy. While there may not be specific types of Arkansas Employment Contract of Consultant with Nonprofit Corporation, the contract terms can vary depending on the nature of the consultancy engagement and the nonprofit's requirements. These contracts can be tailored to include project-specific clauses, such as confidentiality agreements, non-compete clauses, or performance evaluation criteria. Furthermore, different nonprofits may have their own preferred templates or additional provisions they incorporate into the contract. Therefore, it is essential for both parties to carefully review and negotiate the terms to ensure that the agreement aligns with their respective needs and priorities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arkansas Contrato de trabajo de consultor con corporación sin fines de lucro - Employment Contract of Consultant with Nonprofit Corporation

Description

How to fill out Arkansas Contrato De Trabajo De Consultor Con Corporación Sin Fines De Lucro?

Are you within a place in which you need files for possibly company or person purposes nearly every day? There are tons of authorized papers web templates available on the net, but getting kinds you can depend on is not straightforward. US Legal Forms delivers a large number of develop web templates, such as the Arkansas Employment Contract of Consultant with Nonprofit Corporation, that are created to fulfill federal and state needs.

Should you be already acquainted with US Legal Forms website and possess a merchant account, just log in. Next, you are able to download the Arkansas Employment Contract of Consultant with Nonprofit Corporation web template.

Unless you provide an accounts and want to start using US Legal Forms, abide by these steps:

- Get the develop you want and make sure it is for your proper town/region.

- Utilize the Preview switch to check the form.

- Browse the description to actually have selected the right develop.

- If the develop is not what you`re trying to find, make use of the Research discipline to discover the develop that meets your needs and needs.

- When you get the proper develop, click Buy now.

- Opt for the prices prepare you want, submit the necessary details to make your bank account, and pay for the transaction using your PayPal or charge card.

- Select a practical paper structure and download your backup.

Discover all of the papers web templates you have bought in the My Forms food list. You can get a extra backup of Arkansas Employment Contract of Consultant with Nonprofit Corporation anytime, if required. Just select the needed develop to download or produce the papers web template.

Use US Legal Forms, one of the most extensive collection of authorized forms, to conserve time and stay away from blunders. The service delivers skillfully created authorized papers web templates that can be used for a variety of purposes. Produce a merchant account on US Legal Forms and commence producing your lifestyle a little easier.