An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

You can spend hours online looking for the legal document format that meets the state and federal standards you require.

US Legal Forms provides a vast collection of legal forms that have been reviewed by professionals.

You can effortlessly download or print the Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust from our services.

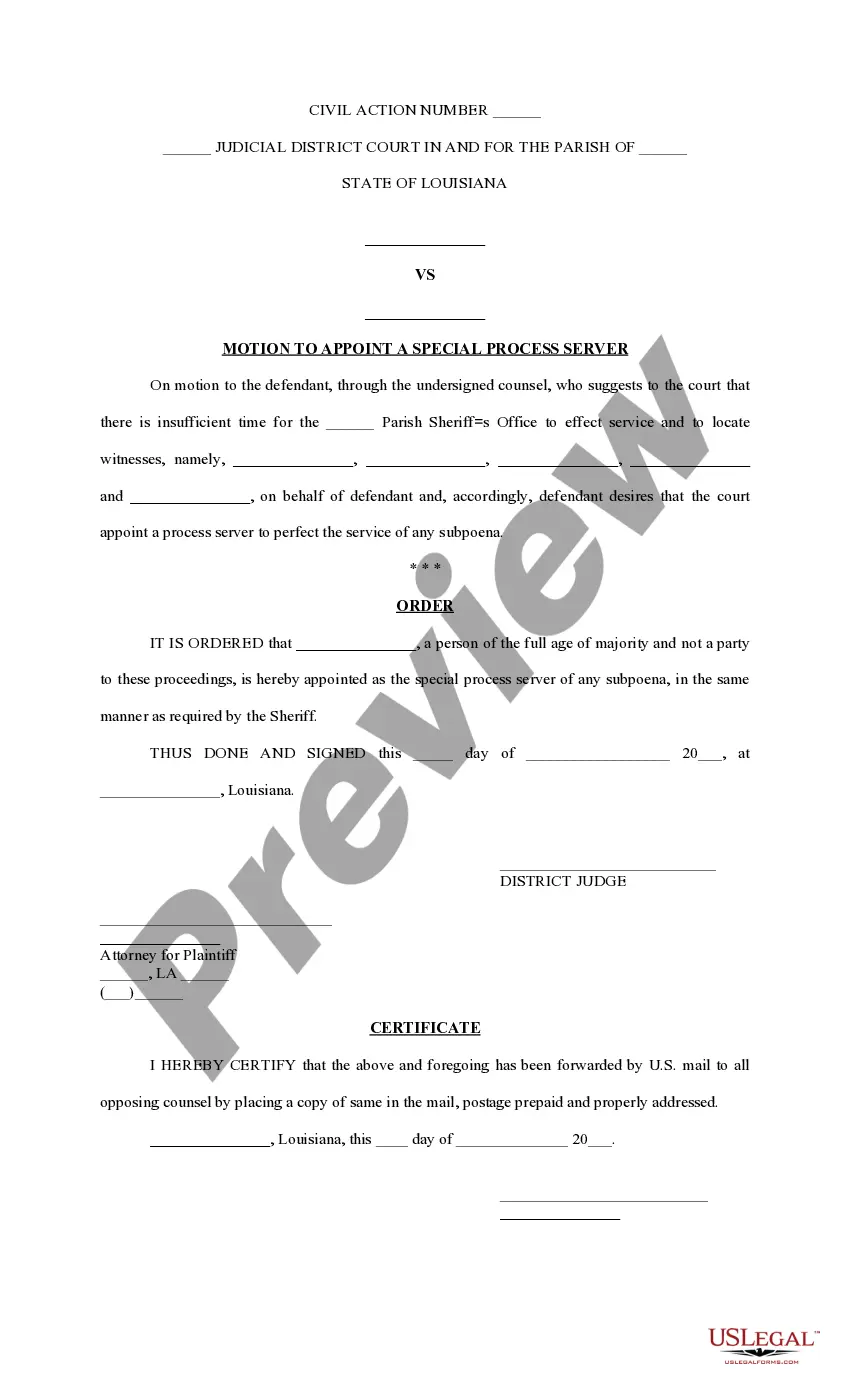

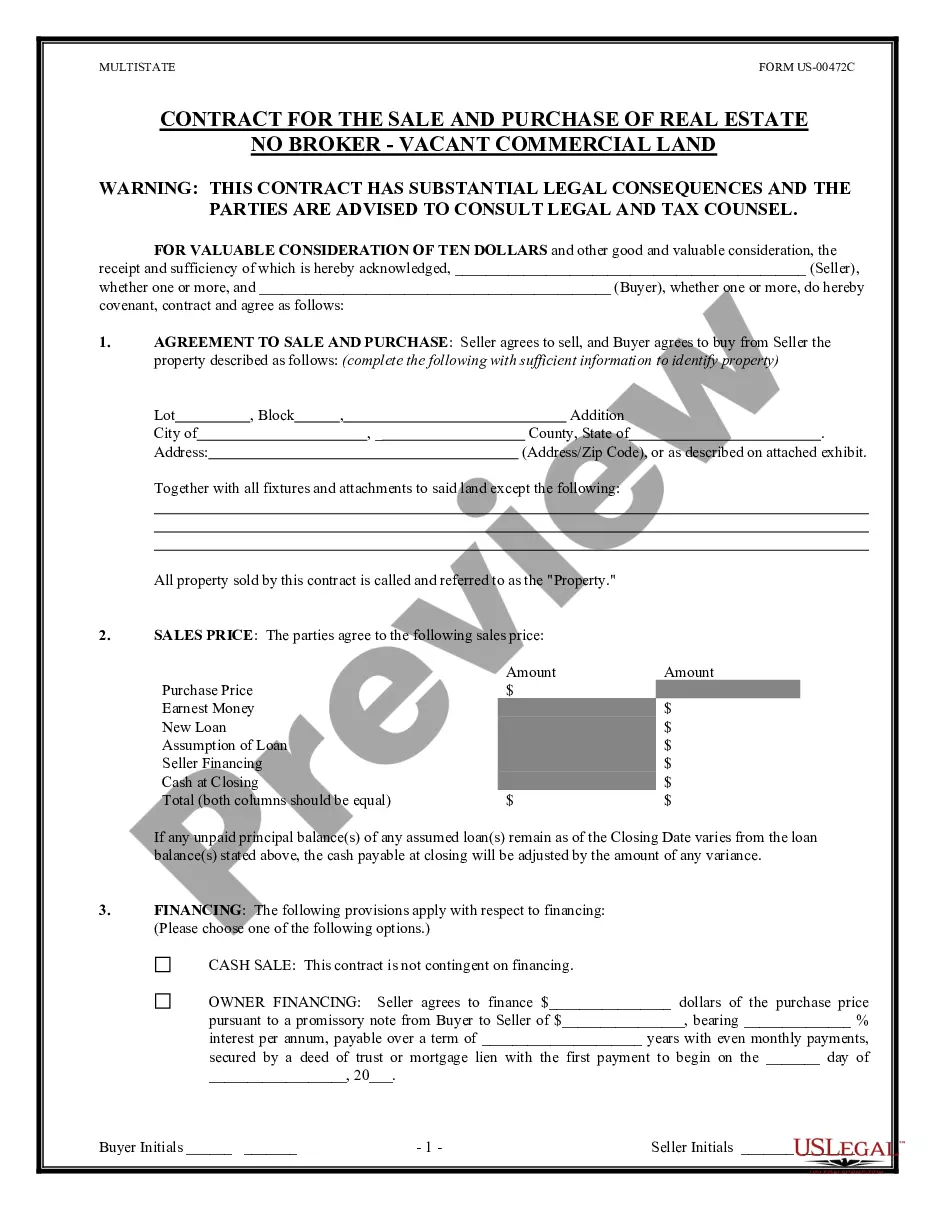

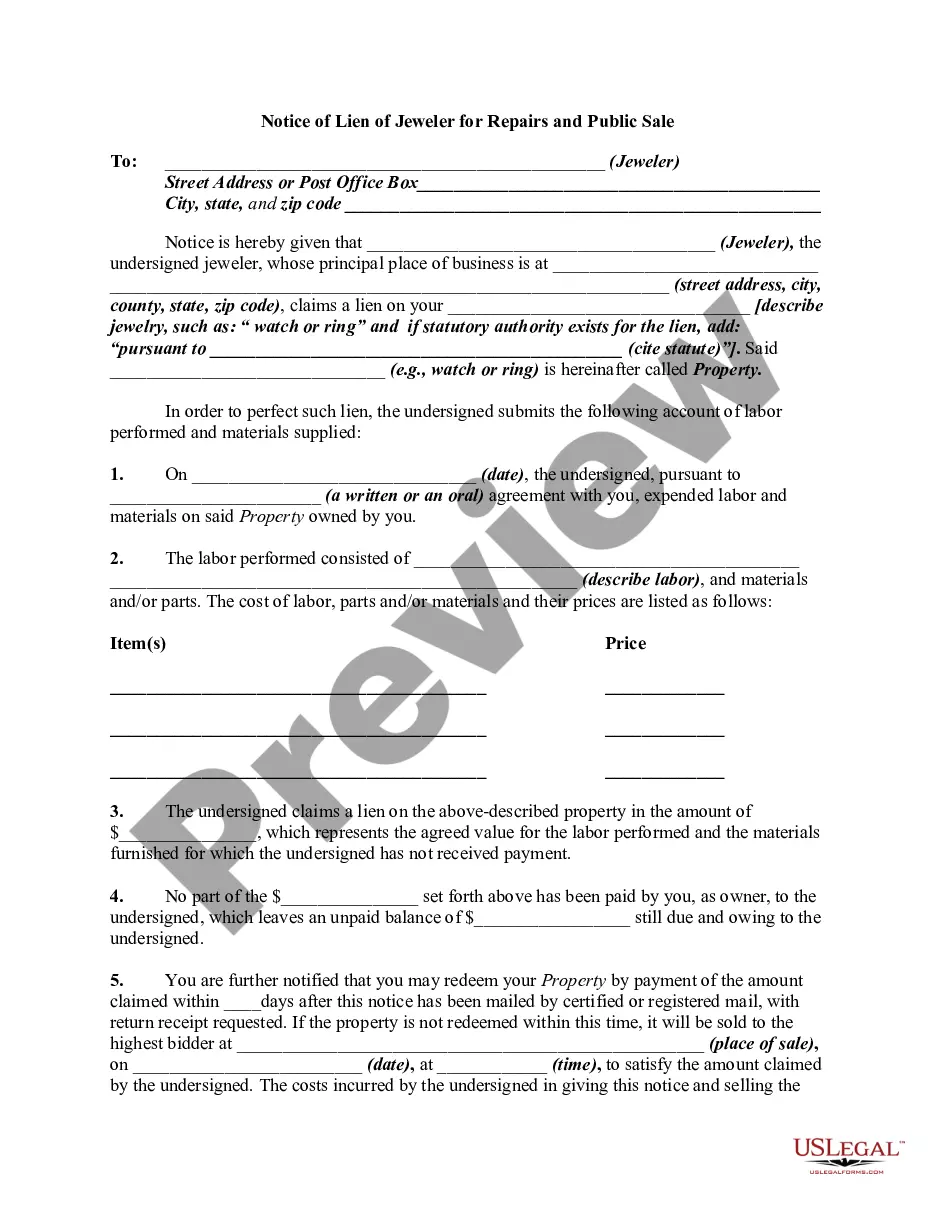

If available, utilize the Preview option toview the document format as well.

- If you already possess a US Legal Forms account, you can Log In and then select the Download option.

- Afterward, you can complete, modify, print, or sign the Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust.

- Every legal document format you purchase is yours permanently.

- To retrieve another copy of the acquired form, navigate to the My documents tab and click on the respective option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document format for the state/city of your choice.

- Review the form details to confirm you have selected the right form.

Form popularity

FAQ

The distributable income of a trust is the total income that is available to be distributed to beneficiaries at a given time. This figure can vary based on the trust's income sources and the provisions set in the trust document, especially under the Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust. It’s crucial for beneficiaries to monitor this amount to plan their personal finances effectively. Understanding distributable income can lead to better timing and strategy for taking distributions.

To avoid taxes on trust distributions, it’s essential to understand how distributions are taxed based on the trust's structure. Strategies may include distributing income to beneficiaries in lower tax brackets or using tax-exempt investments. Engaging with the Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust can help you strategically plan distributions to minimize tax liabilities. Consulting with tax professionals can also provide valuable insights.

Calculating trust income involves identifying all earnings generated by the trust during a specific period. This includes interest, dividends, and any other income-producing activities. When utilizing the Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust, beneficiaries may receive a share based on predetermined percentages. Proper calculation ensures fair distribution and transparency among beneficiaries.

The current income beneficiary of a trust is the individual who receives the income generated by the trust's assets during the trust's term. In many cases, this is tied to the Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust. These beneficiaries typically have the right to receive distributions as outlined in the trust document. Knowing who the income beneficiary is can clarify responsibilities and rights regarding trust assets.

Distribution of income from a trust refers to how the trust's earnings are allocated to beneficiaries. In the context of the Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust, this means that specific percentages can be assigned to beneficiaries. The distribution may include dividends, interest, and rental income generated by the trust's assets. Understanding these distributions can help beneficiaries make informed financial decisions.

Net income in a trust refers to the total income earned by the trust after deducting expenses, taxes, and fees. This calculation is crucial for determining the amount that can be distributed to beneficiaries under an Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust. Knowing how net income is calculated can help beneficiaries better manage their financial interests in the trust. If you need assistance in navigating this process, consider using USLegalForms to access helpful resources.

A beneficiary is a person or entity entitled to receive benefits from a trust, while an income beneficiary specifically receives income generated by the trust's assets. In an Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust, it is important to distinguish these roles, as not all beneficiaries may receive income. Clarifying these terms can aid in understanding your rights and expectations regarding trust distributions.

The beneficiary income of a trust refers to the portion of income generated by the trust that is distributed to its beneficiaries. This income can come from various sources, such as interest, dividends, and rental income. In the context of the Arkansas Assignment by Beneficiary of a Percentage of the Income of a Trust, beneficiaries can receive designated percentages of this income. Understanding this concept helps beneficiaries plan for their financial future effectively.

When reporting inheritance income to the IRS, beneficiaries must list their inheritance as income when applicable, such as when it includes earnings from trusts. This may involve utilizing tax forms like Form 1040 and potentially Form 706 for estate taxes. Utilizing a platform like uslegalforms can provide the necessary resources to understand tax implications fully.

Income in respect of a decedent trust includes earnings that were due to the deceased but were not received before their death. This type of income must be reported and can lead to tax implications for the beneficiaries. It’s important to clarify this income type when preparing tax returns to ensure compliance.