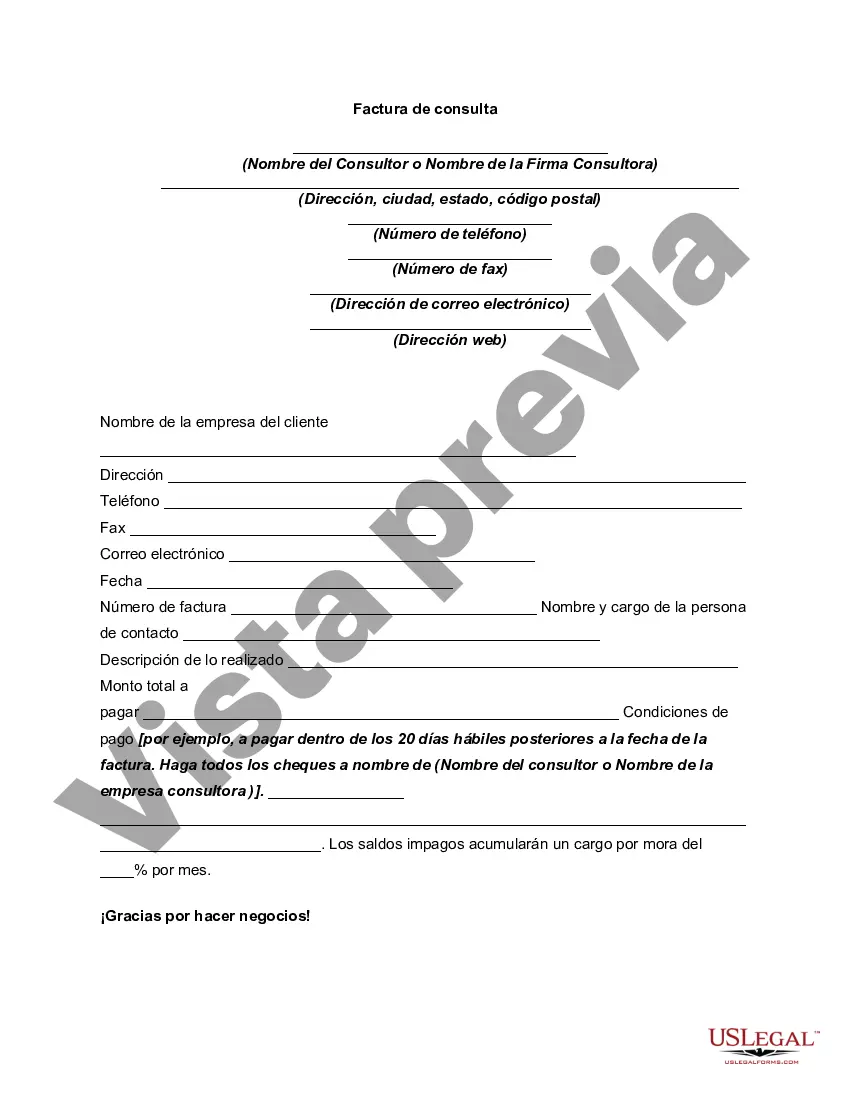

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas Consulting Invoice is a legally binding document supplied by consulting firms or individuals for services rendered to clients in Arkansas, the southern state of the United States. This invoice serves as a record of the consulting services provided and the corresponding charges, enabling a smooth payment process between the consulting firm and the client. The Arkansas Consulting Invoice typically includes essential information such as the name and contact details of the consulting firm or individual, the client's name, and contact information. Moreover, it should display an invoice number and invoice date for tracking and reference purposes. Additionally, a precise description of the services provided should be included, highlighting the nature of the consulting work conducted in Arkansas. Furthermore, the invoice must mention the duration or timeframe during which the consulting services were rendered. It is also essential to detail the number of hours worked per service, the hourly rate, and any additional expenses incurred while delivering the consulting services. This ensures transparency and helps clients understand the billing structure. The Arkansas Consulting Invoice should explicitly state the total amount due, along with any applicable taxes. A breakdown of the charges and a payment due date should also be included, enabling the client to proceed with payment efficiently. Consulting firms may choose to provide various payment options, such as bank transfer, credit card, or check, to cater to client preferences. Different types of Arkansas Consulting Invoices may include: 1. Fixed Fee Invoice: This type of invoice states a predetermined fixed amount for the consulting service, irrespective of the hours worked. It is appropriate when charging a flat fee for a specific project or a recurring service. 2. Hourly Rate Invoice: This invoice type is based on the number of hours spent on consulting services. It lists the hourly rate applied to each service and calculates the total charge accordingly. 3. Retainer Invoice: Retainer invoices are common in long-term consulting relationships. Here, a predetermined upfront fee is paid by the client to retain the consulting services for a fixed period. The invoice details the deliverables within the retainer agreement. 4. Expense-based Invoice: This kind of invoice includes additional expenses incurred during the consulting engagement, such as travel expenses, accommodation costs, or other specific project-related expenditures. It is crucial to provide a detailed breakdown of these expenses to justify the billed amount. In conclusion, the Arkansas Consulting Invoice serves as a critical document for consulting firms operating in Arkansas, ensuring clear communication of services provided, charges involved, and prompt payment. Choosing the appropriate invoice type, whether fixed fee, hourly rate, retainer-based, or expense-based, allows for tailored invoicing based on the nature and requirements of the consulting engagement.Arkansas Consulting Invoice is a legally binding document supplied by consulting firms or individuals for services rendered to clients in Arkansas, the southern state of the United States. This invoice serves as a record of the consulting services provided and the corresponding charges, enabling a smooth payment process between the consulting firm and the client. The Arkansas Consulting Invoice typically includes essential information such as the name and contact details of the consulting firm or individual, the client's name, and contact information. Moreover, it should display an invoice number and invoice date for tracking and reference purposes. Additionally, a precise description of the services provided should be included, highlighting the nature of the consulting work conducted in Arkansas. Furthermore, the invoice must mention the duration or timeframe during which the consulting services were rendered. It is also essential to detail the number of hours worked per service, the hourly rate, and any additional expenses incurred while delivering the consulting services. This ensures transparency and helps clients understand the billing structure. The Arkansas Consulting Invoice should explicitly state the total amount due, along with any applicable taxes. A breakdown of the charges and a payment due date should also be included, enabling the client to proceed with payment efficiently. Consulting firms may choose to provide various payment options, such as bank transfer, credit card, or check, to cater to client preferences. Different types of Arkansas Consulting Invoices may include: 1. Fixed Fee Invoice: This type of invoice states a predetermined fixed amount for the consulting service, irrespective of the hours worked. It is appropriate when charging a flat fee for a specific project or a recurring service. 2. Hourly Rate Invoice: This invoice type is based on the number of hours spent on consulting services. It lists the hourly rate applied to each service and calculates the total charge accordingly. 3. Retainer Invoice: Retainer invoices are common in long-term consulting relationships. Here, a predetermined upfront fee is paid by the client to retain the consulting services for a fixed period. The invoice details the deliverables within the retainer agreement. 4. Expense-based Invoice: This kind of invoice includes additional expenses incurred during the consulting engagement, such as travel expenses, accommodation costs, or other specific project-related expenditures. It is crucial to provide a detailed breakdown of these expenses to justify the billed amount. In conclusion, the Arkansas Consulting Invoice serves as a critical document for consulting firms operating in Arkansas, ensuring clear communication of services provided, charges involved, and prompt payment. Choosing the appropriate invoice type, whether fixed fee, hourly rate, retainer-based, or expense-based, allows for tailored invoicing based on the nature and requirements of the consulting engagement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.