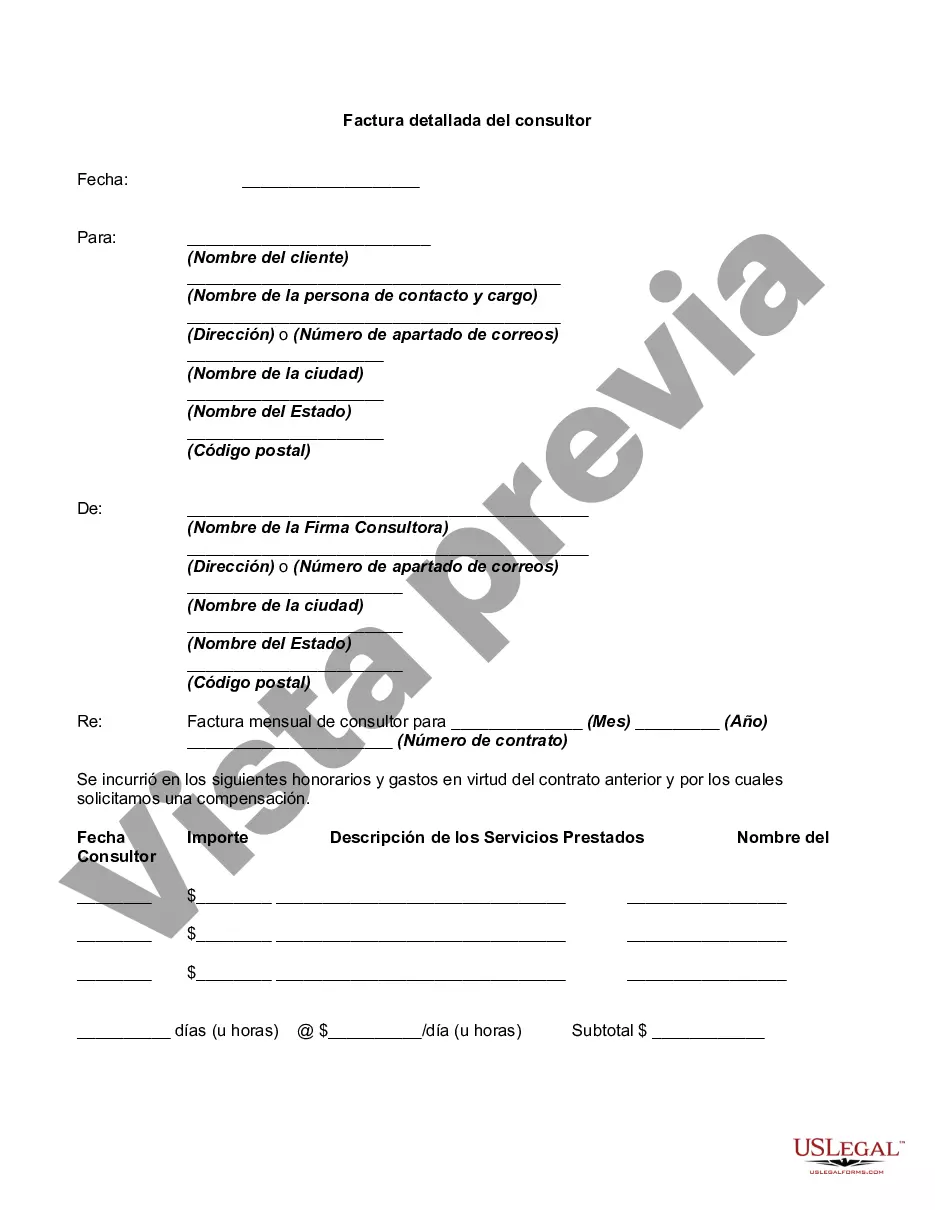

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas Detailed Consultant Invoice is a comprehensive and itemized document provided by consultants in the state of Arkansas to their clients. It serves as a detailed record of the services rendered, related costs, and payment terms. This invoice is an essential tool for maintaining transparency and accountability in financial transactions between consultants and their clients. The Arkansas Detailed Consultant Invoice typically includes the following components: 1. Contact Information: The invoice starts with the consultant's name, address, phone number, and email address. The client's contact details, including their name, address, and contact information, are also mentioned. 2. Invoice Number: Each invoice is assigned a unique identification number to facilitate easy tracking and reference. 3. Date: The date when the invoice is issued is included to establish the invoice's validity. 4. Description of Services: This section provides a thorough breakdown of the services the consultant has provided, listing each service separately. It includes details such as the scope of work, duration, hourly rate, and any additional expenses incurred during the project. 5. Hourly Rate or Fee: Consultants state their standard hourly rate or fixed fee for their services. This rate could differ based on the nature of the consulting project or client agreement. 6. Calculation of Charges: The invoice calculates the total cost by multiplying the hours worked or the fixed fee by the hourly rate or amount agreed upon. In some cases, taxes or applicable surcharges may also be added. 7. Expenses Incurred: If the consultant incurred any additional expenses during the project, such as travel expenses or software subscriptions, they are itemized in this section. These expenses are typically accompanied by receipts or supporting documents. 8. Payment Details: The payment terms, including due date, payment methods accepted, and any late payment penalties, are clearly indicated in the invoice. Consultants may provide their bank account details or other payment options to facilitate timely payments. 9. Terms and Conditions: This section outlines any specific terms and conditions related to the consulting services, including warranties, liability, intellectual property rights, and termination clauses. Types of Arkansas Detailed Consultant Invoices: 1. Professional Services Invoice: This type of invoice is used for consultants offering professional services such as legal, accounting, marketing, or human resources consulting. 2. IT Consulting Invoice: IT consultants providing specialized services such as software development, website design, or network maintenance use this type of invoice. 3. Management Consulting Invoice: Consultants assisting businesses with strategic planning, organizational development, or process improvement use this type of invoice. 4. Financial Consulting Invoice: This type of invoice is used by financial consultants offering services like investment advice, financial planning, or risk management. In conclusion, the Arkansas Detailed Consultant Invoice is a crucial document that ensures transparency and clarity in financial transactions between consultants and clients in Arkansas. Its detailed nature helps both parties maintain accurate records and facilitate prompt and fair payments.Arkansas Detailed Consultant Invoice is a comprehensive and itemized document provided by consultants in the state of Arkansas to their clients. It serves as a detailed record of the services rendered, related costs, and payment terms. This invoice is an essential tool for maintaining transparency and accountability in financial transactions between consultants and their clients. The Arkansas Detailed Consultant Invoice typically includes the following components: 1. Contact Information: The invoice starts with the consultant's name, address, phone number, and email address. The client's contact details, including their name, address, and contact information, are also mentioned. 2. Invoice Number: Each invoice is assigned a unique identification number to facilitate easy tracking and reference. 3. Date: The date when the invoice is issued is included to establish the invoice's validity. 4. Description of Services: This section provides a thorough breakdown of the services the consultant has provided, listing each service separately. It includes details such as the scope of work, duration, hourly rate, and any additional expenses incurred during the project. 5. Hourly Rate or Fee: Consultants state their standard hourly rate or fixed fee for their services. This rate could differ based on the nature of the consulting project or client agreement. 6. Calculation of Charges: The invoice calculates the total cost by multiplying the hours worked or the fixed fee by the hourly rate or amount agreed upon. In some cases, taxes or applicable surcharges may also be added. 7. Expenses Incurred: If the consultant incurred any additional expenses during the project, such as travel expenses or software subscriptions, they are itemized in this section. These expenses are typically accompanied by receipts or supporting documents. 8. Payment Details: The payment terms, including due date, payment methods accepted, and any late payment penalties, are clearly indicated in the invoice. Consultants may provide their bank account details or other payment options to facilitate timely payments. 9. Terms and Conditions: This section outlines any specific terms and conditions related to the consulting services, including warranties, liability, intellectual property rights, and termination clauses. Types of Arkansas Detailed Consultant Invoices: 1. Professional Services Invoice: This type of invoice is used for consultants offering professional services such as legal, accounting, marketing, or human resources consulting. 2. IT Consulting Invoice: IT consultants providing specialized services such as software development, website design, or network maintenance use this type of invoice. 3. Management Consulting Invoice: Consultants assisting businesses with strategic planning, organizational development, or process improvement use this type of invoice. 4. Financial Consulting Invoice: This type of invoice is used by financial consultants offering services like investment advice, financial planning, or risk management. In conclusion, the Arkansas Detailed Consultant Invoice is a crucial document that ensures transparency and clarity in financial transactions between consultants and clients in Arkansas. Its detailed nature helps both parties maintain accurate records and facilitate prompt and fair payments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.