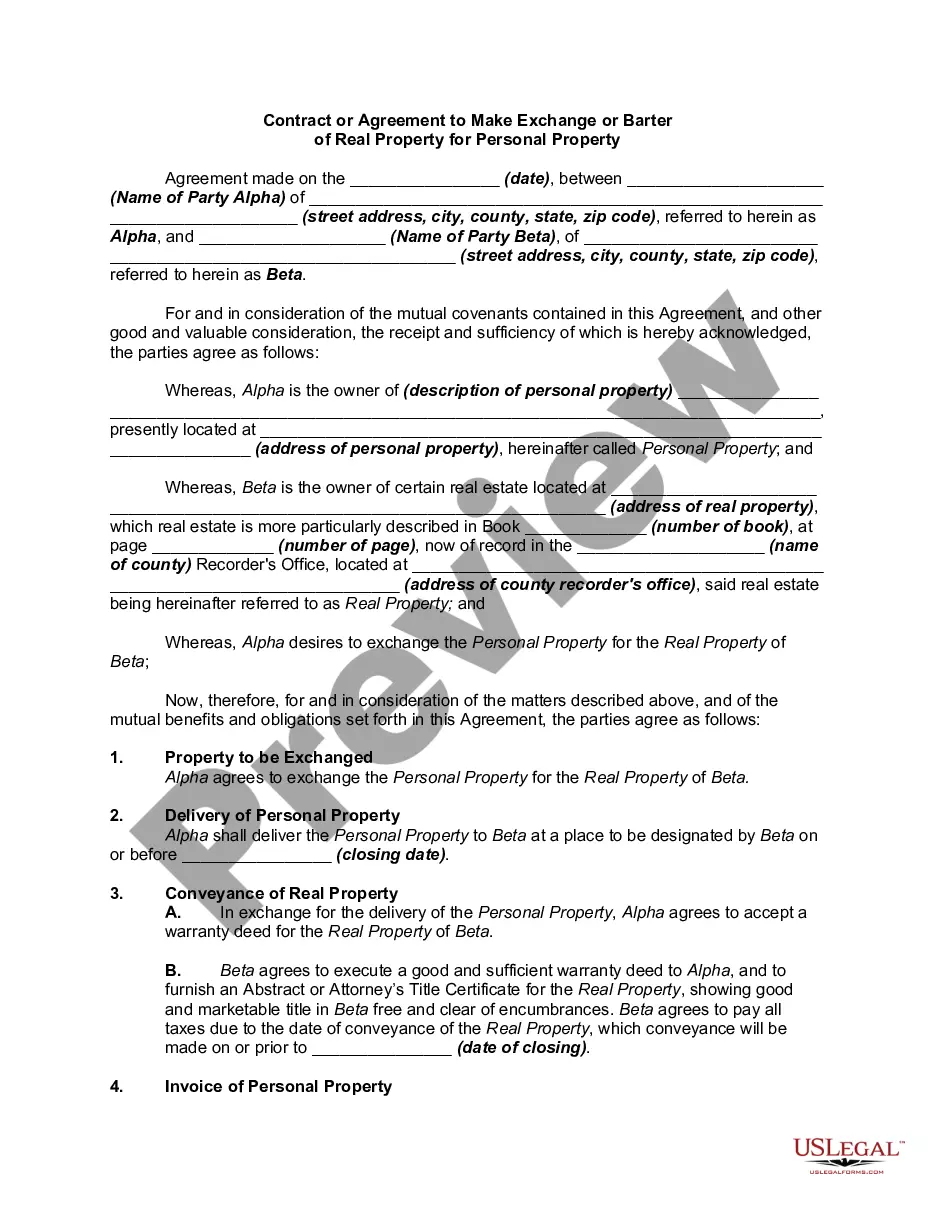

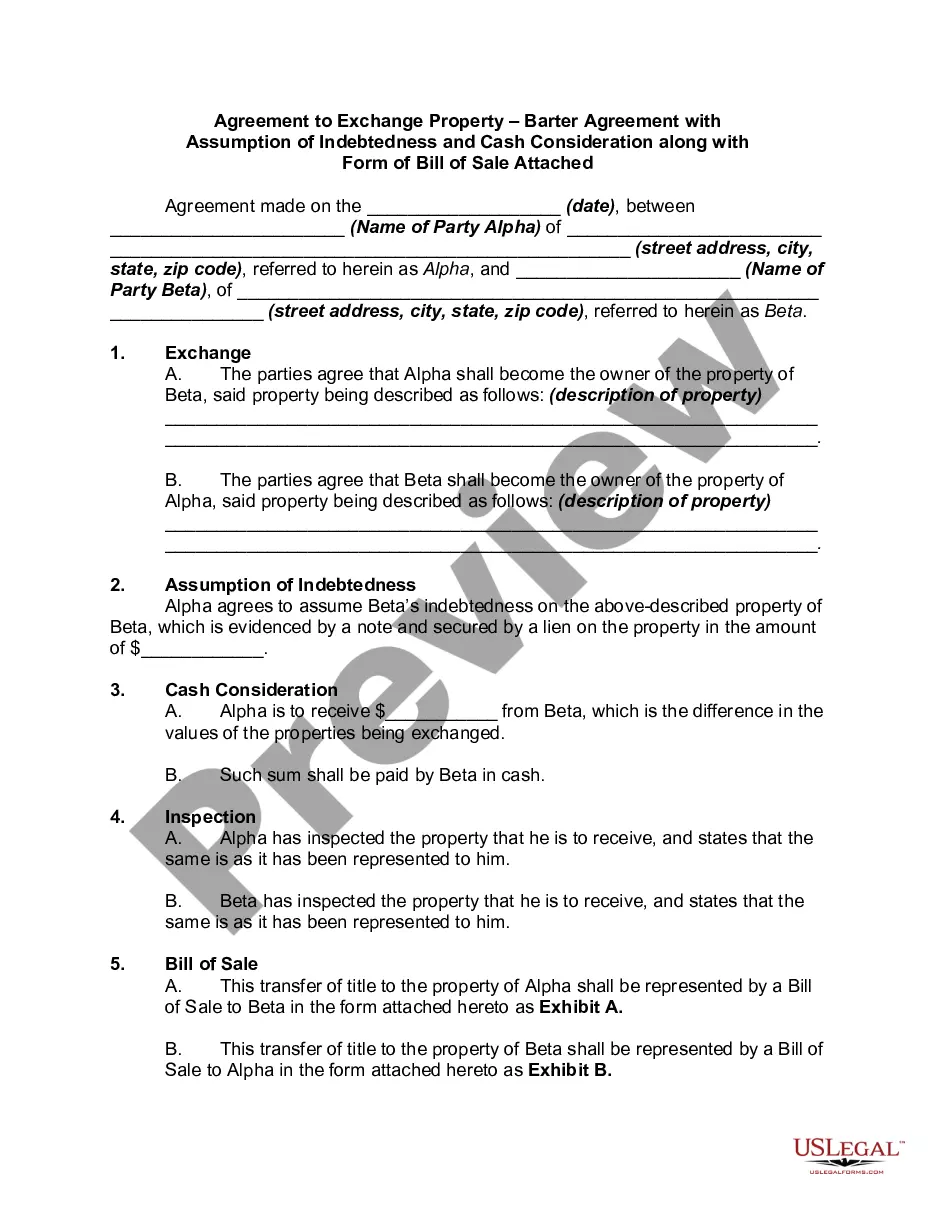

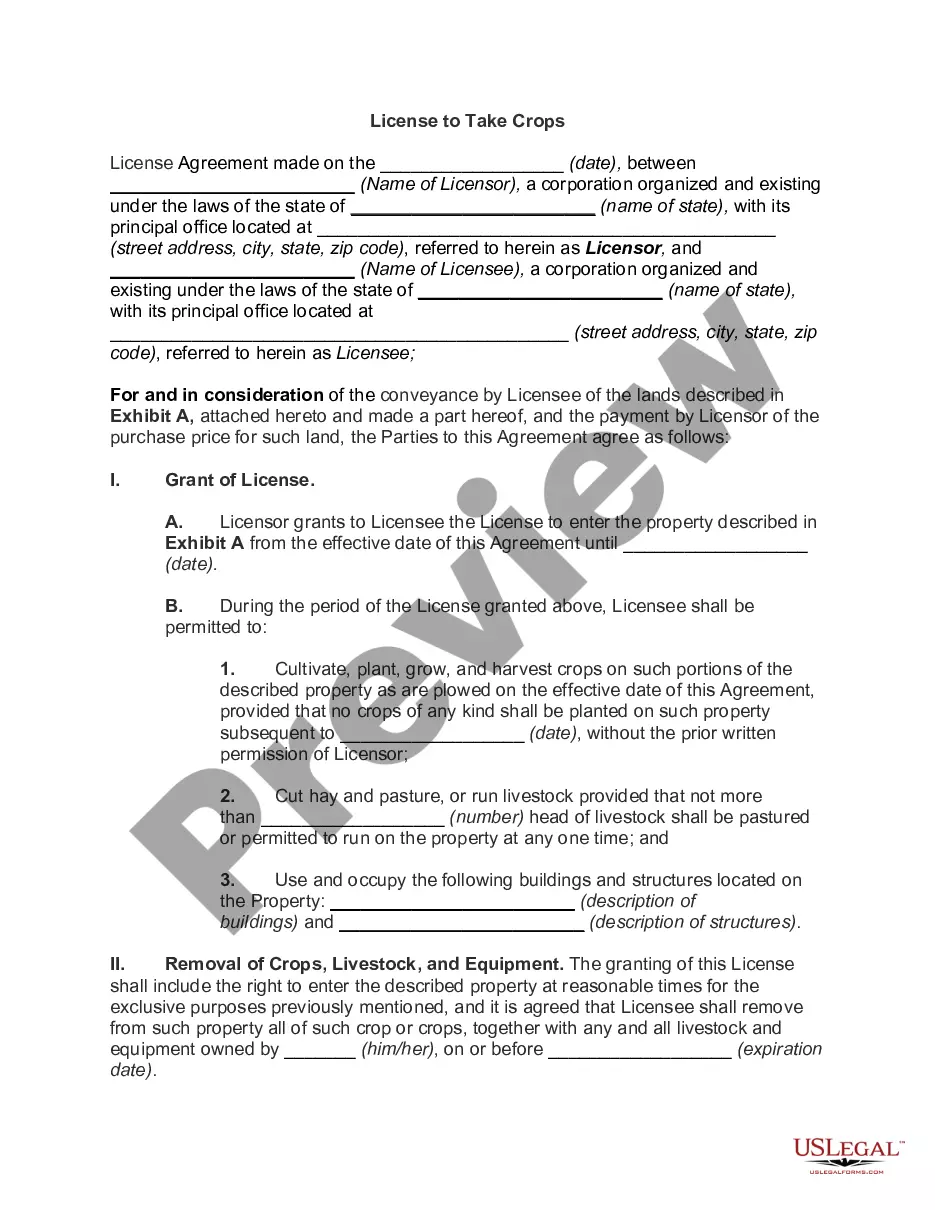

Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

If you desire to be thorough, obtain, or print legal document forms, utilize US Legal Forms, the largest assortment of legal templates available online.

Leverage the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal use are organized by categories and states, or by keywords.

Step 4. Once you have found the form you need, click the Buy Now button. Choose your preferred pricing plan and provide your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finish the transaction.

- Utilize US Legal Forms to discover the Arkansas Bartering Contract or Exchange Agreement within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Arkansas Bartering Contract or Exchange Agreement.

- You can also view forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Another term for exchange bartering is trade. This concept emphasizes the mutual benefit of trading goods or services without monetary transactions. When engaging in such trades, consider using an Arkansas Bartering Contract or Exchange Agreement to clearly outline terms and expectations, which can enhance the overall experience.

Yes, the IRS recognizes and allows bartering as a means of conducting business. When entering into an Arkansas Bartering Contract or Exchange Agreement, report the value of traded goods or services as income for tax purposes. Doing so maintains your compliance with tax regulations. For seamless management of your bartering activities, consider leveraging platforms like uslegalforms.

No, bartering is not illegal in the United States, including Arkansas. The Arkansas Bartering Contract or Exchange Agreement serves as a legal framework for these transactions. It enables parties to trade goods and services while ensuring compliance with local laws. Just be mindful of tax implications and strive to keep records of your barter agreements.

Absolutely, bartering is very much possible today and has gained renewed interest in various communities. The Arkansas Bartering Contract or Exchange Agreement helps individuals and businesses engage in effective trading of services and goods. Many online platforms and local networks facilitate such exchanges. Consider exploring these options to enhance your trading experience.

The IRS considers bartering as a form of taxable income. When you engage in an Arkansas Bartering Contract or Exchange Agreement, you must report the fair market value of the goods or services received on your tax return. This treatment helps ensure transparency and compliance with tax laws. Keep accurate records to make the process easier.

Bartering can be considered a business activity if it involves exchanging goods or services with the intention of profit. When frequent or organized, such transactions could qualify under business regulations. Therefore, it's wise to set up an Arkansas Bartering Contract or Exchange Agreement to clarify your intentions and protect your rights.

Bartering is treated as income for tax purposes, meaning you must report the fair market value of goods or services exchanged. Both parties are responsible for reporting their side of the barter transaction. Understanding these tax implications is crucial, especially when drafting an Arkansas Bartering Contract or Exchange Agreement, to ensure you meet all legal requirements.

To record a barter transaction, document the exchanged items, their fair market values, and the date of the transaction. It is essential to keep records for tax reporting and possible audits. Using dedicated accounting software or a service like US Legal Forms can simplify this process, ensuring your Arkansas Bartering Contract or Exchange Agreement is accurately captured and reported.

The rule of bartering generally requires that both parties agree on the value of the items exchanged and that each party reports these items for tax purposes. Transparency is essential in maintaining trust and legality in the transaction. By following these principles, you can establish a solid foundation for an Arkansas Bartering Contract or Exchange Agreement, making future exchanges smoother.

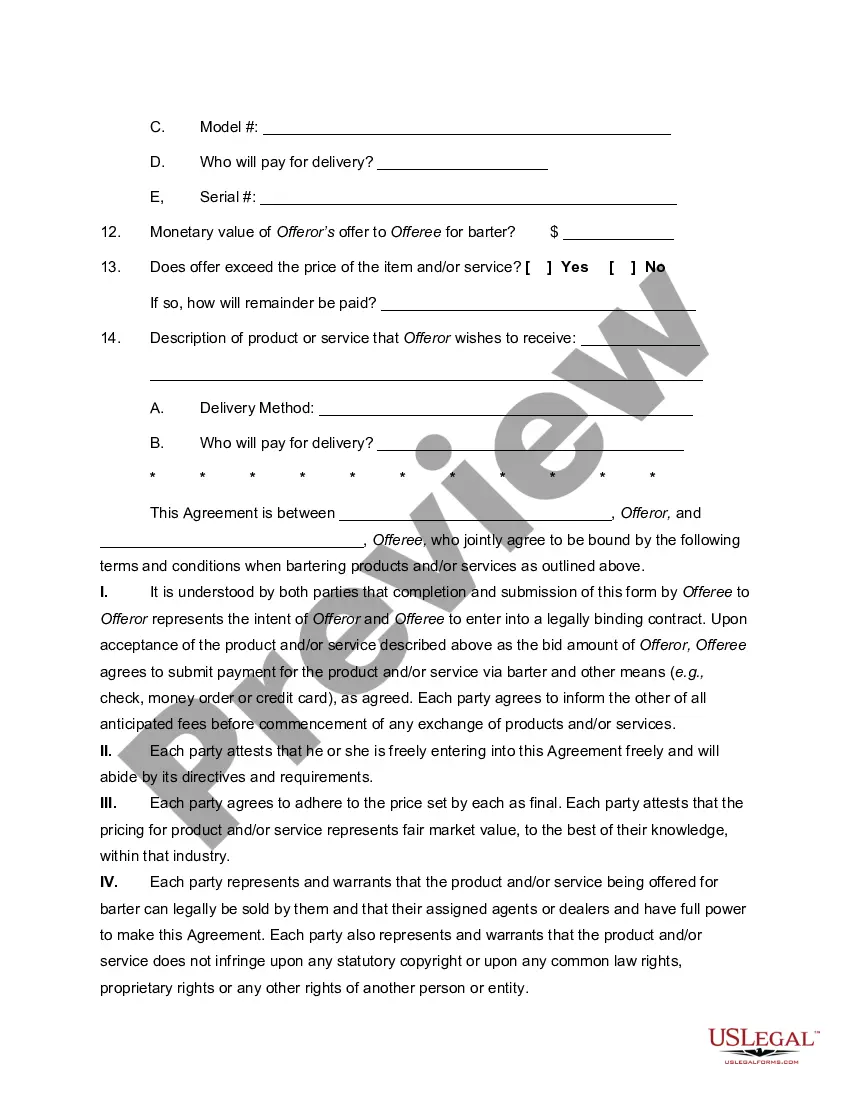

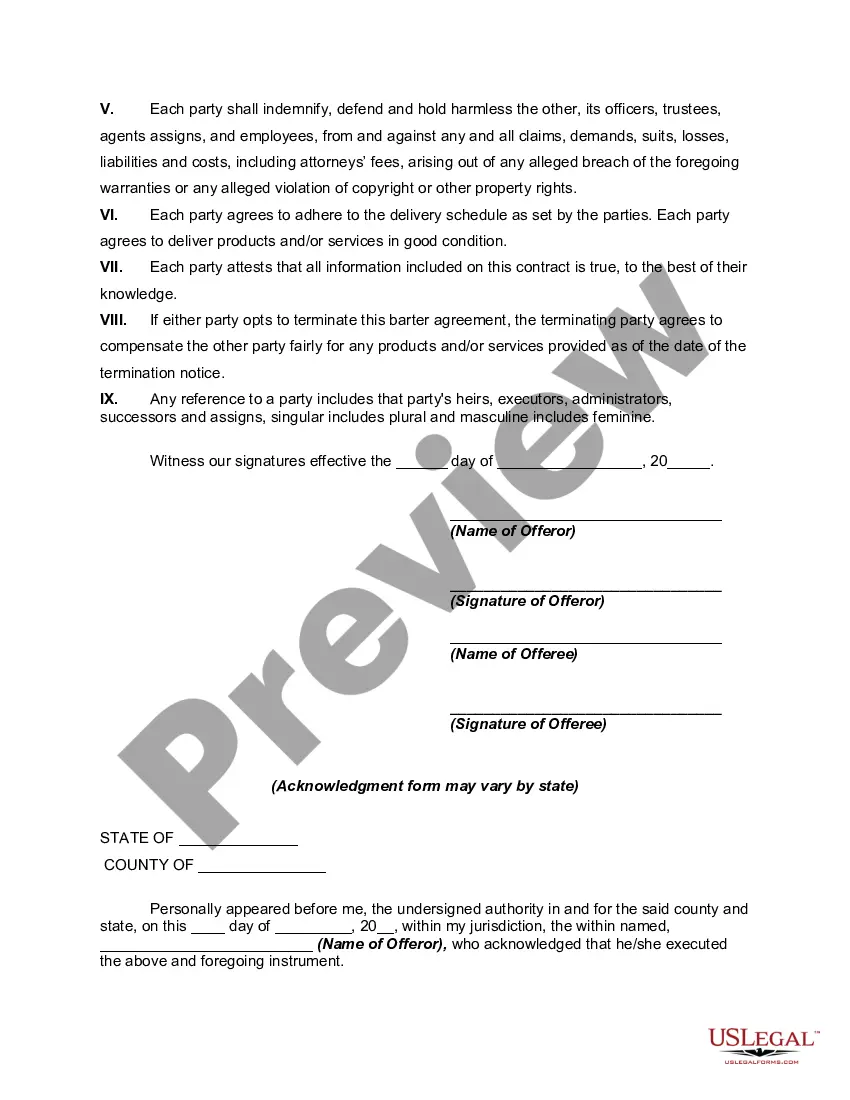

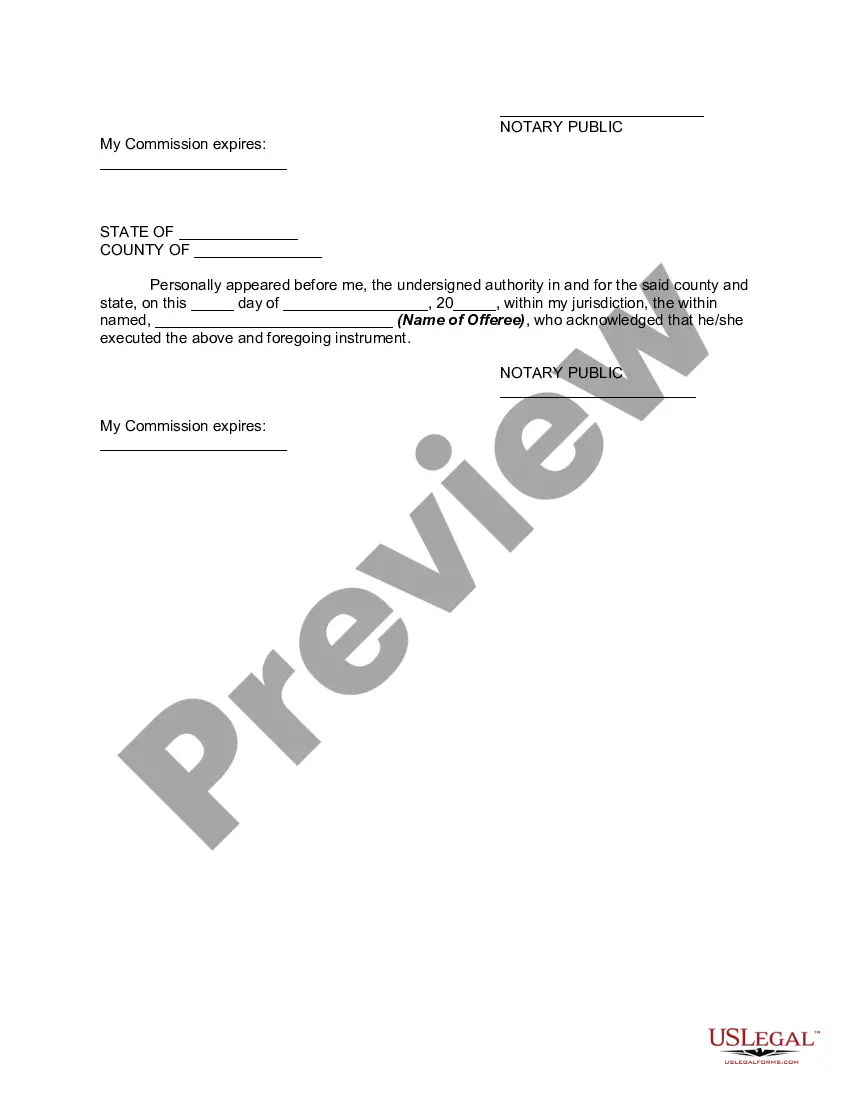

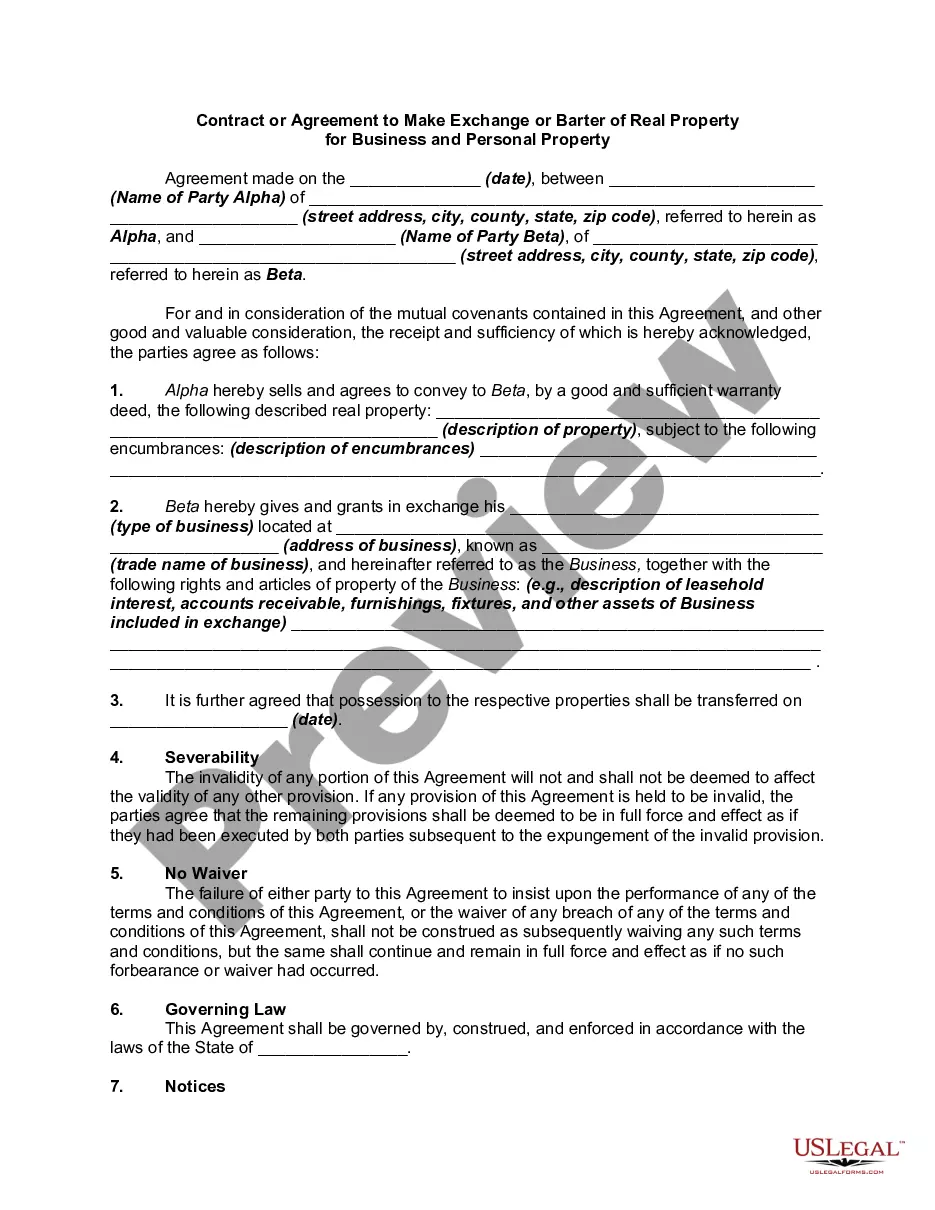

To write an effective barter agreement, start by outlining the items or services being exchanged, along with their agreed-upon values. Clearly specify the terms of the exchange, including delivery details, payment deadlines, and any warranties. Using a template or service, like US Legal Forms, can streamline this process and help ensure that your Arkansas Bartering Contract or Exchange Agreement is compliant and thorough.