Arkansas UCC-1 for Real Estate

Description

How to fill out UCC-1 For Real Estate?

You can dedicate numerous hours online looking for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

It is easy to download or print the Arkansas UCC-1 for Real Estate from their services.

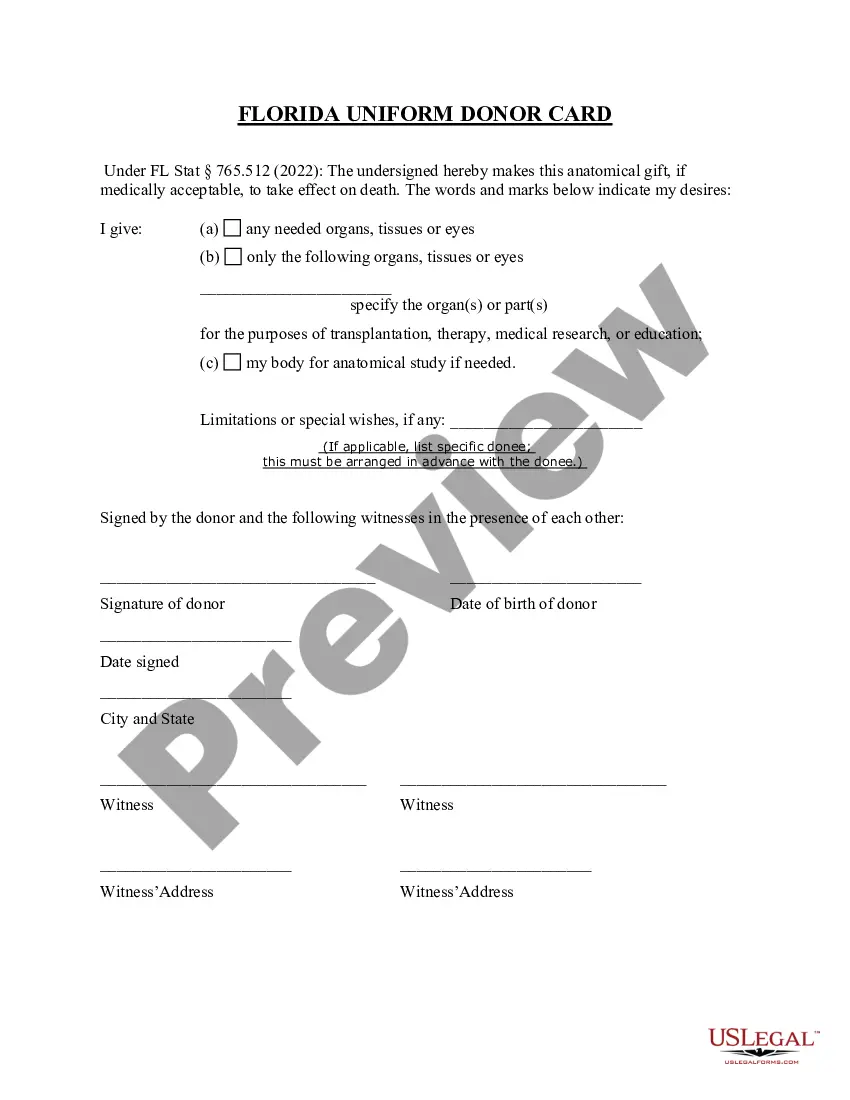

If available, utilize the Preview option to view the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and select the Obtain option.

- Then, you can complete, modify, print, or sign the Arkansas UCC-1 for Real Estate.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

- First, ensure that you have chosen the correct document template for the county/region that you select.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

The U.C.C. stands for the Uniform Commercial Code. The laws concerning commercial and private transactions for the sale and leasing of goods developed out of the common law of both England and the United States.

A UCC3 is a change statement to a UCC1. It's an amendment filing to an original UCC1 financing statement that changes or adds information to the originally filed UCC1. It's a filing tool secured parties use to manage their UCC portfolio to maintain their perfected security interests.

Filing a UCC-1 allows creditors to collateralize or secure their loan by utilizing the personal property assets of their customers. In the event of the customer defaulting on their loan or filing for bankruptcy, a UCC-1 elevates the lender's status to a secured creditor, ensuring they will be paid.

The Uniform Commercial Code (UCC) is a set of business laws that regulate financial contracts and transactions employed across states. The UCC code consists of nine separate articles, each of which covers separate aspects of banking and loans.

UCC filings or liens are legal forms that a creditor files to give notice that it has an interest in the personal or business property of a debtor. Essentially, UCC lien filings allow a lender to formally lay claim to collateral that a debtor pledges to secure their financing.

Most lenders will require UCC-1 filings and collateral to secure their loans, and you don't want to spread your assets across multiple lenders. In the event you can't repay your loans, lenders could seize a significant portion of your personal and business assets.

When is a UCC-1 filed? UCC-1 filings typically happen when a loan is first originated. If the borrower has loans from more than one lender, the first lender to file the UCC-1 is first in line for the borrower's assets. This motivates lenders to file a UCC-1 as soon as a loan is made.

Uniform Closing Dataset (UCD) Specification. Issued by Fannie Mae and Freddie Mac.

1 filing is good for five years. After five years, it is considered lapsed and no longer valid. Should your debtor remain in debt to you and encounter financial difficulty or file for bankruptcy, you have no secured interest if your UCC1 filing has lapsed.

Accordingly, UCC-1 filings are generally filed as soon as the loan is made.