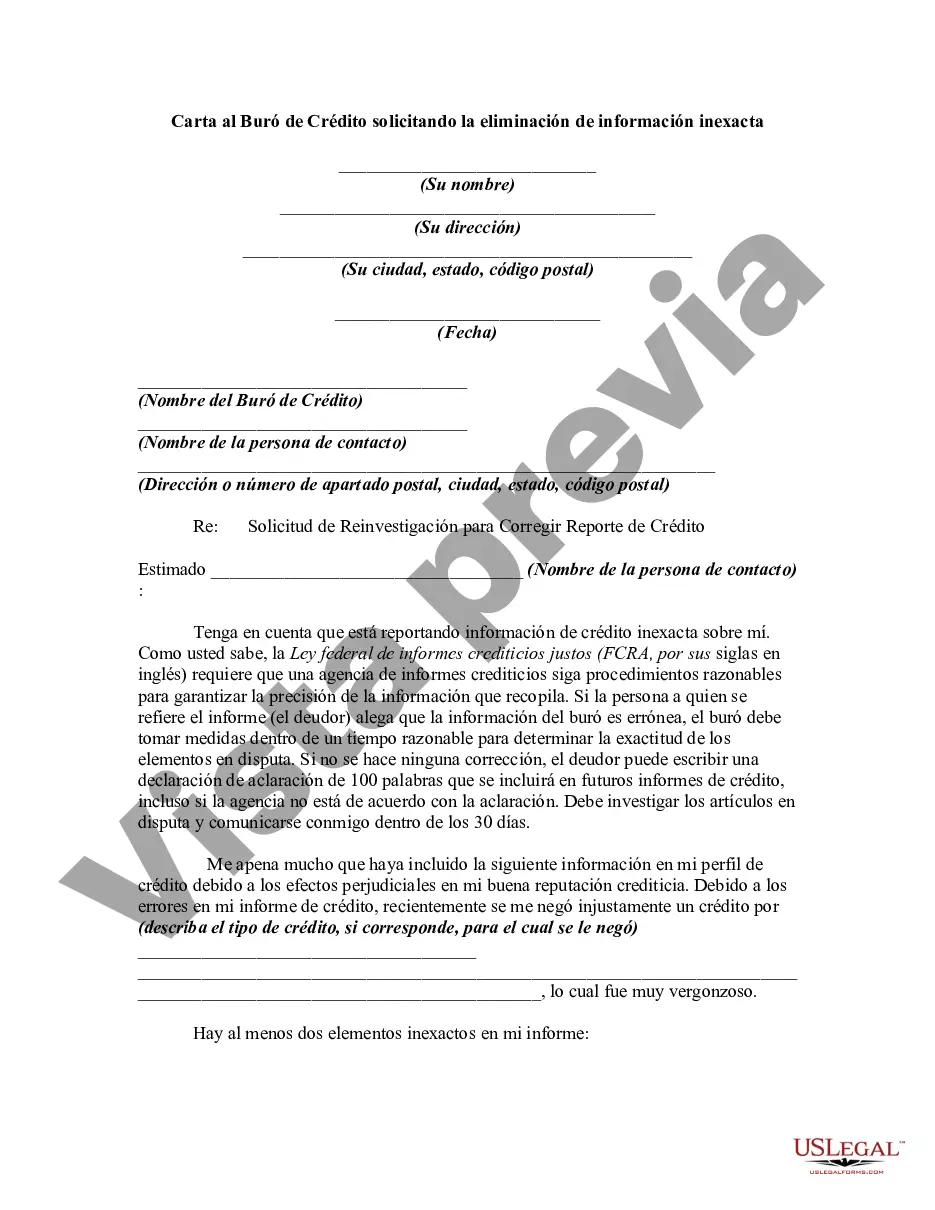

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Keywords: Arkansas, letter, credit bureau, removal, inaccurate information Title: A Comprehensive Guide to Writing Arkansas Letter to Credit Bureau Requesting the Removal of Inaccurate Information Introduction: In Arkansas, individuals have the right to dispute inaccurate information on their credit reports. An Arkansas letter to credit bureau requesting the removal of inaccurate information is a formal way to address any errors and ensure the accuracy of your credit history. This detailed guide aims to provide step-by-step instructions on how to draft an effective letter, including different types of Arkansas letters one can use. Types of Arkansas Letters to Credit Bureau Requesting the Removal of Inaccurate Information: 1. Basic Letter Format: The basic Arkansas letter to the credit bureau is suitable for disputing inaccurate information such as incorrect personal details, outdated accounts, or typographical errors. This letter should include essential details, like your full name, address, Social Security number, account details, and a clear explanation of the errors found on your credit report. 2. Identity Theft Letter: If you suspect identity theft or fraudulent accounts listed on your credit report in Arkansas, it is crucial to draft a unique letter specifically addressing this concern. This letter should detail the necessary information to prove that the accounts in question are not yours and provide supporting evidence, such as police reports or affidavits. 3. Collection Agency Validation Letter: Sometimes, inaccurate information may stem from a collection agency that reports false debts to the credit bureaus. In such cases, an Arkansas letter requesting validation of the debts can be written. This letter should challenge the validity of the debt, request proper validation from the collection agency, and demand immediate removal if validation is not provided within a defined time frame. 4. Dispute Letter for Late Payments: If you notice incorrect late payments reported on your credit report in Arkansas, use this letter format to request their removal. Clearly explain the discrepancy by providing evidence, such as payment receipts or bank statements, and request an investigation for the removal of any inaccurate late payment notations. 5. Error in Account Status Letter: In case the account status on your credit report is reported inaccurately, such as a "charged-off" account that is still active and making payments, you may write an Arkansas letter to the credit bureau. Include details about the account, supporting documents, and request swift resolution to correct the account status. Conclusion: Writing an Arkansas letter to the credit bureau requesting the removal of inaccurate information is a crucial step towards maintaining an accurate credit history. By utilizing the different types of letters mentioned above, individuals can address specific types of credit report inaccuracies effectively. Always remember to keep copies of all correspondence and document any communication with the credit bureau, ensuring a strong paper trail for reference in case of future disputes.Keywords: Arkansas, letter, credit bureau, removal, inaccurate information Title: A Comprehensive Guide to Writing Arkansas Letter to Credit Bureau Requesting the Removal of Inaccurate Information Introduction: In Arkansas, individuals have the right to dispute inaccurate information on their credit reports. An Arkansas letter to credit bureau requesting the removal of inaccurate information is a formal way to address any errors and ensure the accuracy of your credit history. This detailed guide aims to provide step-by-step instructions on how to draft an effective letter, including different types of Arkansas letters one can use. Types of Arkansas Letters to Credit Bureau Requesting the Removal of Inaccurate Information: 1. Basic Letter Format: The basic Arkansas letter to the credit bureau is suitable for disputing inaccurate information such as incorrect personal details, outdated accounts, or typographical errors. This letter should include essential details, like your full name, address, Social Security number, account details, and a clear explanation of the errors found on your credit report. 2. Identity Theft Letter: If you suspect identity theft or fraudulent accounts listed on your credit report in Arkansas, it is crucial to draft a unique letter specifically addressing this concern. This letter should detail the necessary information to prove that the accounts in question are not yours and provide supporting evidence, such as police reports or affidavits. 3. Collection Agency Validation Letter: Sometimes, inaccurate information may stem from a collection agency that reports false debts to the credit bureaus. In such cases, an Arkansas letter requesting validation of the debts can be written. This letter should challenge the validity of the debt, request proper validation from the collection agency, and demand immediate removal if validation is not provided within a defined time frame. 4. Dispute Letter for Late Payments: If you notice incorrect late payments reported on your credit report in Arkansas, use this letter format to request their removal. Clearly explain the discrepancy by providing evidence, such as payment receipts or bank statements, and request an investigation for the removal of any inaccurate late payment notations. 5. Error in Account Status Letter: In case the account status on your credit report is reported inaccurately, such as a "charged-off" account that is still active and making payments, you may write an Arkansas letter to the credit bureau. Include details about the account, supporting documents, and request swift resolution to correct the account status. Conclusion: Writing an Arkansas letter to the credit bureau requesting the removal of inaccurate information is a crucial step towards maintaining an accurate credit history. By utilizing the different types of letters mentioned above, individuals can address specific types of credit report inaccuracies effectively. Always remember to keep copies of all correspondence and document any communication with the credit bureau, ensuring a strong paper trail for reference in case of future disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.