Arkansas Revocable Trust for Grandchildren

Description

How to fill out Revocable Trust For Grandchildren?

Finding the appropriate legal document template can be challenging.

Naturally, there are numerous templates accessible online, but how can you locate the legal form you need.

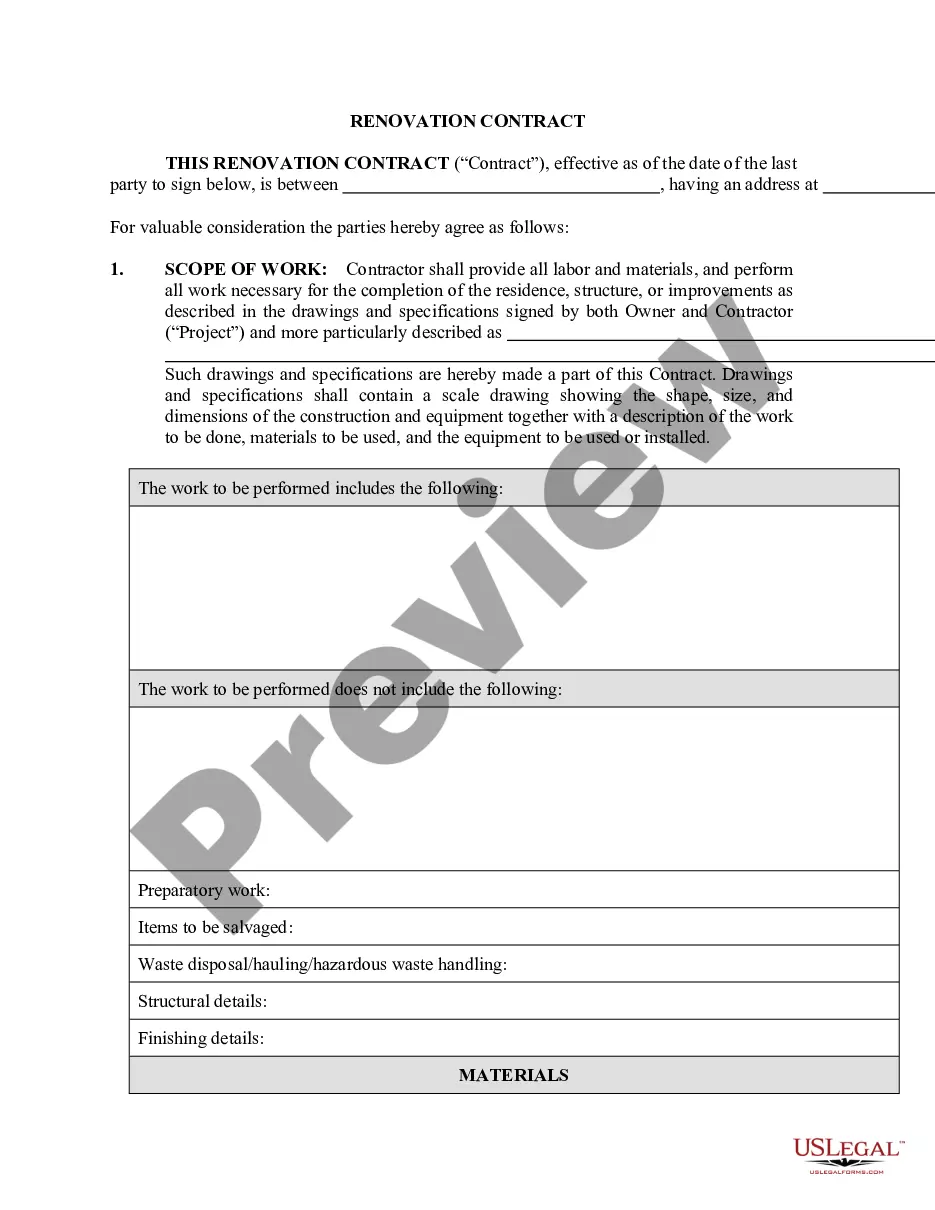

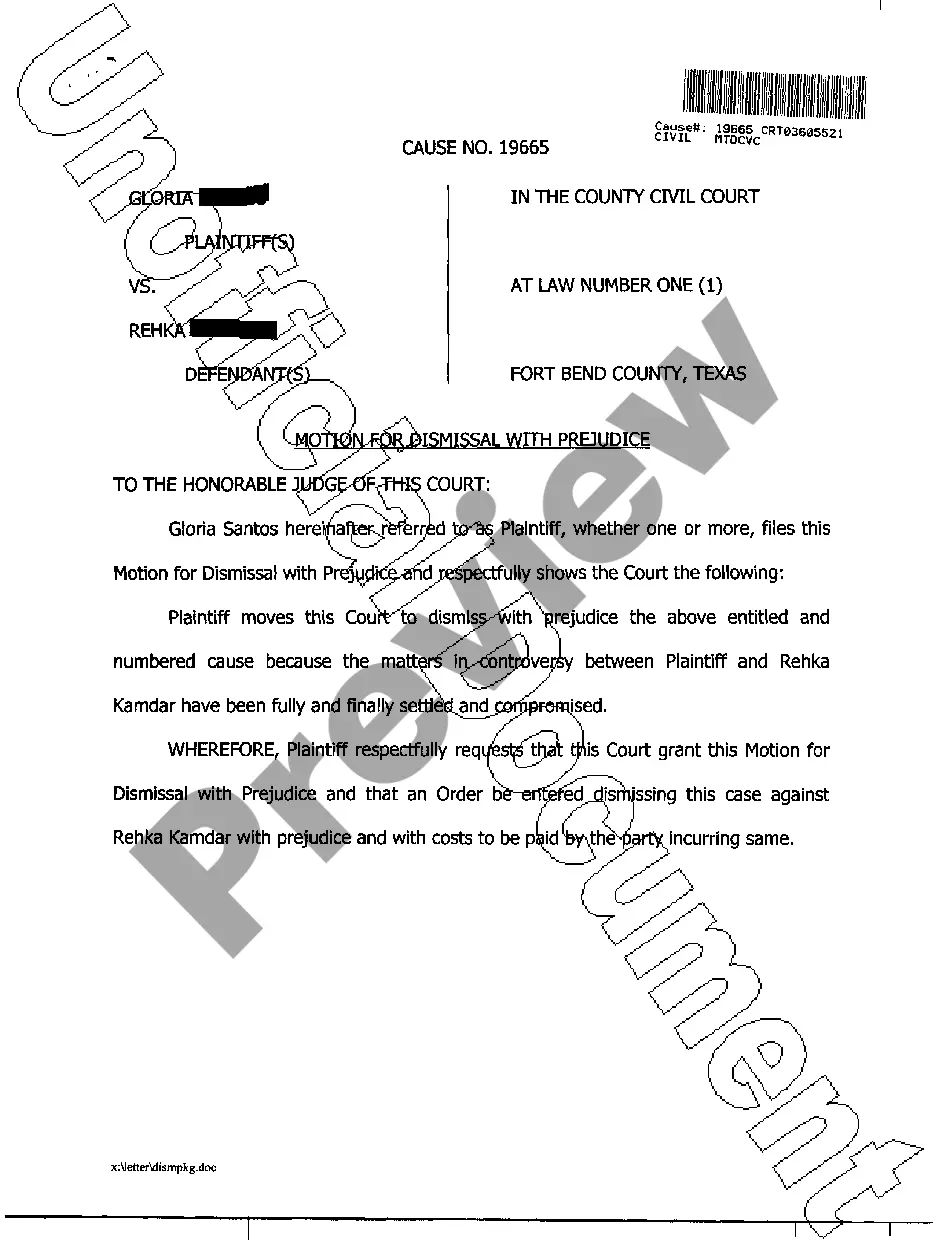

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Arkansas Revocable Trust for Grandchildren, suitable for both business and personal requirements.

You can preview the form using the Preview button and review the form details to confirm this is suitable for you.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click on the Download button to retrieve the Arkansas Revocable Trust for Grandchildren.

- Use your account to browse through the legal forms you have previously obtained.

- Proceed to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your state/region.

Form popularity

FAQ

The biggest mistake parents make when setting up a trust fund is failing to review and update the trust periodically. Considering life's changes, such as marriage, divorce, or the birth of additional grandchildren, it is essential to reflect these changes in an Arkansas Revocable Trust for Grandchildren. Neglecting to update can lead to misallocation of assets or misunderstandings among beneficiaries.

One negative aspect of a trust can be the ongoing management and administration required, which may involve additional costs and responsibilities. For an Arkansas Revocable Trust for Grandchildren, this means you or a designated trustee must maintain records and ensure compliance with legal obligations. Additionally, if not set up correctly, it could lead to conflicts among family members.

An Arkansas Revocable Trust for Grandchildren is often a suitable choice, as it allows you to maintain control over your assets during your lifetime. You can designate how and when the assets will be distributed to your grandchildren, tailoring it to their specific needs. This type of trust provides flexibility and can be amended as circumstances change.

To set up an Arkansas Revocable Trust for Grandchildren, begin by determining your goals and the assets you wish to include. Gather necessary documents and create a trust agreement that outlines the terms and conditions. It is wise to consider consulting a professional or using a platform like USLegalForms for templates that can guide you through the process effectively.

Some common pitfalls of setting up a trust include inadequate funding and improper language in the trust document. If you do not transfer assets into your Arkansas Revocable Trust for Grandchildren, it will not serve its intended purpose. Additionally, complicated language can create confusion and disputes among beneficiaries, so clarity is crucial.

Although this question pertains to the UK, parents often overlook the specific needs of their children or grandchildren when establishing a trust. An Arkansas Revocable Trust for Grandchildren requires careful consideration of beneficiaries' current and future situations. Failing to personalize the trust can lead to unintended consequences regarding asset distribution.

Yes, you can set up an Arkansas Revocable Trust for Grandchildren without an attorney, but it is recommended to have professional guidance. Creating a trust involves specific legal language that must be precise to ensure its validity. While you can use online resources or templates, consulting with a professional can help you avoid costly mistakes and ensure your trust reflects your intentions accurately.

Yes, you can create your own living trust in Arkansas. Utilizing resources from platforms like uslegalforms can guide you through the process of establishing an Arkansas Revocable Trust for Grandchildren. However, it's essential to ensure that your trust document complies with state laws and accurately reflects your wishes. While doing it yourself is possible, consulting with a legal expert can offer peace of mind and help avoid potential pitfalls.

The best person to set up a trust is typically a qualified estate planning attorney who understands your specific needs. Choosing someone experienced with Arkansas Revocable Trust for Grandchildren can ensure that the trust meets local laws and your family's requirements. Alternatively, you can turn to platforms like uslegalforms, which provide user-friendly resources to help you create and manage your trust effectively. Selecting the right professional is essential for a smooth estate planning process.

One downside of an irrevocable trust is that you cannot easily change or terminate it once established. This lack of flexibility can be a concern, especially when planning for an Arkansas Revocable Trust for Grandchildren, as your circumstances may change over time. Additionally, assets transferred into an irrevocable trust may not be accessible to you, which can limit your financial options later. It's important to carefully weigh these drawbacks before making any decisions.