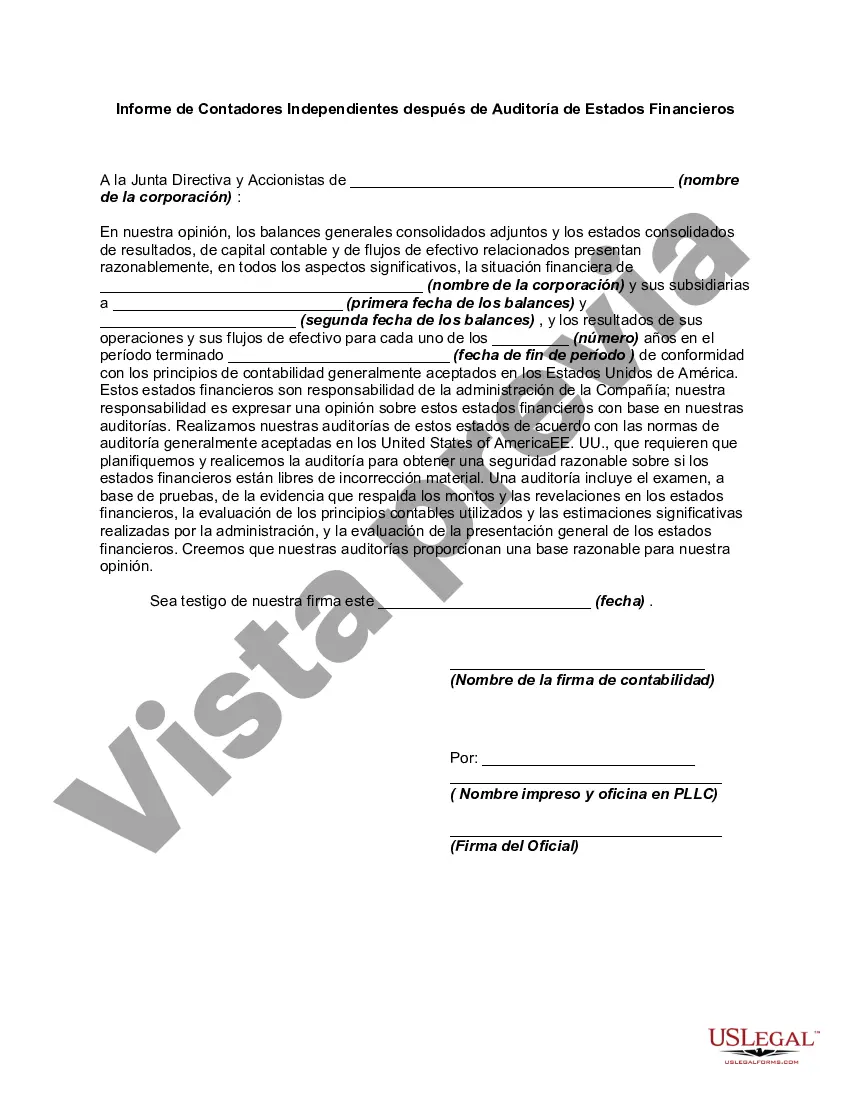

As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

The Arkansas Report of Independent Accountants after Audit of Financial Statements refers to a comprehensive report prepared by an independent accounting firm in Arkansas after conducting audits of a company or organization's financial statements. This report focuses on assessing the accuracy, reliability, and compliance of financial information presented in those statements. The purpose of the Arkansas Report of Independent Accountants after Audit of Financial Statements is to provide an objective evaluation of the financial statements, offering an opinion on their fairness, adherence to accounting principles, and overall reliability. This report serves as a crucial tool for businesses, investors, creditors, and other stakeholders in assessing the financial health and performance of the audited entity. Keywords related to the Arkansas Report of Independent Accountants after Audit of Financial Statements include: 1. Audit: The systematic examination and verification of an organization's financial records, transactions, and controls. 2. Financial statements: Documents that present an entity's financial performance, position, and cash flows, including balance sheets, income statements, and cash flow statements. 3. Independent accountants: Certified and impartial accounting professionals who perform audits and provide independent opinions on financial statements. 4. Compliance: Adherence to accounting principles, guidelines, legal regulations, and standards established by regulatory bodies like the Financial Accounting Standards Board (FAST). 5. Objectivity: The impartial and unbiased nature of the audit, ensuring that the independent accountants evaluate financial statements without any conflicts of interest. 6. Fairness: The accuracy, transparency, and reliability of financial statements without any material misstatements or omissions. 7. Accounting principles: Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) that govern the preparation and presentation of financial statements. 8. Stakeholders: Individuals or groups with an interest in the audited entity, such as investors, lenders, government agencies, employees, and customers. 9. Financial health: The overall financial well-being, stability, and performance of the audited entity, as demonstrated by key financial ratios, trends, and indicators. 10. Opinion: The conclusion reached by the independent accountants regarding the fairness and reliability of the audited financial statements, typically classified as unqualified (clean opinion), qualified, adverse, or disclaimer of opinion. Different types of Arkansas Report of Independent Accountants after Audit of Financial Statements include: 1. Unqualified opinion: This type of report implies that the financial statements present fairly, in all material respects, the financial position and performance of the audited entity, and comply with relevant accounting principles. 2. Qualified opinion: This report indicates that the financial statements comply with accounting principles, except for certain specified matters that do not have a pervasive effect on the overall financial statements. 3. Adverse opinion: A report stating that the financial statements do not present fairly the financial position, performance, or cash flows of the audited entity, or they fail to comply with accounting principles. 4. Disclaimer of opinion: This occurs when the independent accountants are unable to express an opinion on the financial statements due to significant limitations or uncertainties affecting the audit procedures. In conclusion, the Arkansas Report of Independent Accountants after Audit of Financial Statements is a comprehensive evaluation of the financial statements of an entity in Arkansas, providing valuable insights regarding their accuracy, compliance, and reliability. This report is crucial for stakeholders in making informed decisions and assessing the financial health of the audited entity.The Arkansas Report of Independent Accountants after Audit of Financial Statements refers to a comprehensive report prepared by an independent accounting firm in Arkansas after conducting audits of a company or organization's financial statements. This report focuses on assessing the accuracy, reliability, and compliance of financial information presented in those statements. The purpose of the Arkansas Report of Independent Accountants after Audit of Financial Statements is to provide an objective evaluation of the financial statements, offering an opinion on their fairness, adherence to accounting principles, and overall reliability. This report serves as a crucial tool for businesses, investors, creditors, and other stakeholders in assessing the financial health and performance of the audited entity. Keywords related to the Arkansas Report of Independent Accountants after Audit of Financial Statements include: 1. Audit: The systematic examination and verification of an organization's financial records, transactions, and controls. 2. Financial statements: Documents that present an entity's financial performance, position, and cash flows, including balance sheets, income statements, and cash flow statements. 3. Independent accountants: Certified and impartial accounting professionals who perform audits and provide independent opinions on financial statements. 4. Compliance: Adherence to accounting principles, guidelines, legal regulations, and standards established by regulatory bodies like the Financial Accounting Standards Board (FAST). 5. Objectivity: The impartial and unbiased nature of the audit, ensuring that the independent accountants evaluate financial statements without any conflicts of interest. 6. Fairness: The accuracy, transparency, and reliability of financial statements without any material misstatements or omissions. 7. Accounting principles: Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) that govern the preparation and presentation of financial statements. 8. Stakeholders: Individuals or groups with an interest in the audited entity, such as investors, lenders, government agencies, employees, and customers. 9. Financial health: The overall financial well-being, stability, and performance of the audited entity, as demonstrated by key financial ratios, trends, and indicators. 10. Opinion: The conclusion reached by the independent accountants regarding the fairness and reliability of the audited financial statements, typically classified as unqualified (clean opinion), qualified, adverse, or disclaimer of opinion. Different types of Arkansas Report of Independent Accountants after Audit of Financial Statements include: 1. Unqualified opinion: This type of report implies that the financial statements present fairly, in all material respects, the financial position and performance of the audited entity, and comply with relevant accounting principles. 2. Qualified opinion: This report indicates that the financial statements comply with accounting principles, except for certain specified matters that do not have a pervasive effect on the overall financial statements. 3. Adverse opinion: A report stating that the financial statements do not present fairly the financial position, performance, or cash flows of the audited entity, or they fail to comply with accounting principles. 4. Disclaimer of opinion: This occurs when the independent accountants are unable to express an opinion on the financial statements due to significant limitations or uncertainties affecting the audit procedures. In conclusion, the Arkansas Report of Independent Accountants after Audit of Financial Statements is a comprehensive evaluation of the financial statements of an entity in Arkansas, providing valuable insights regarding their accuracy, compliance, and reliability. This report is crucial for stakeholders in making informed decisions and assessing the financial health of the audited entity.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.