This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

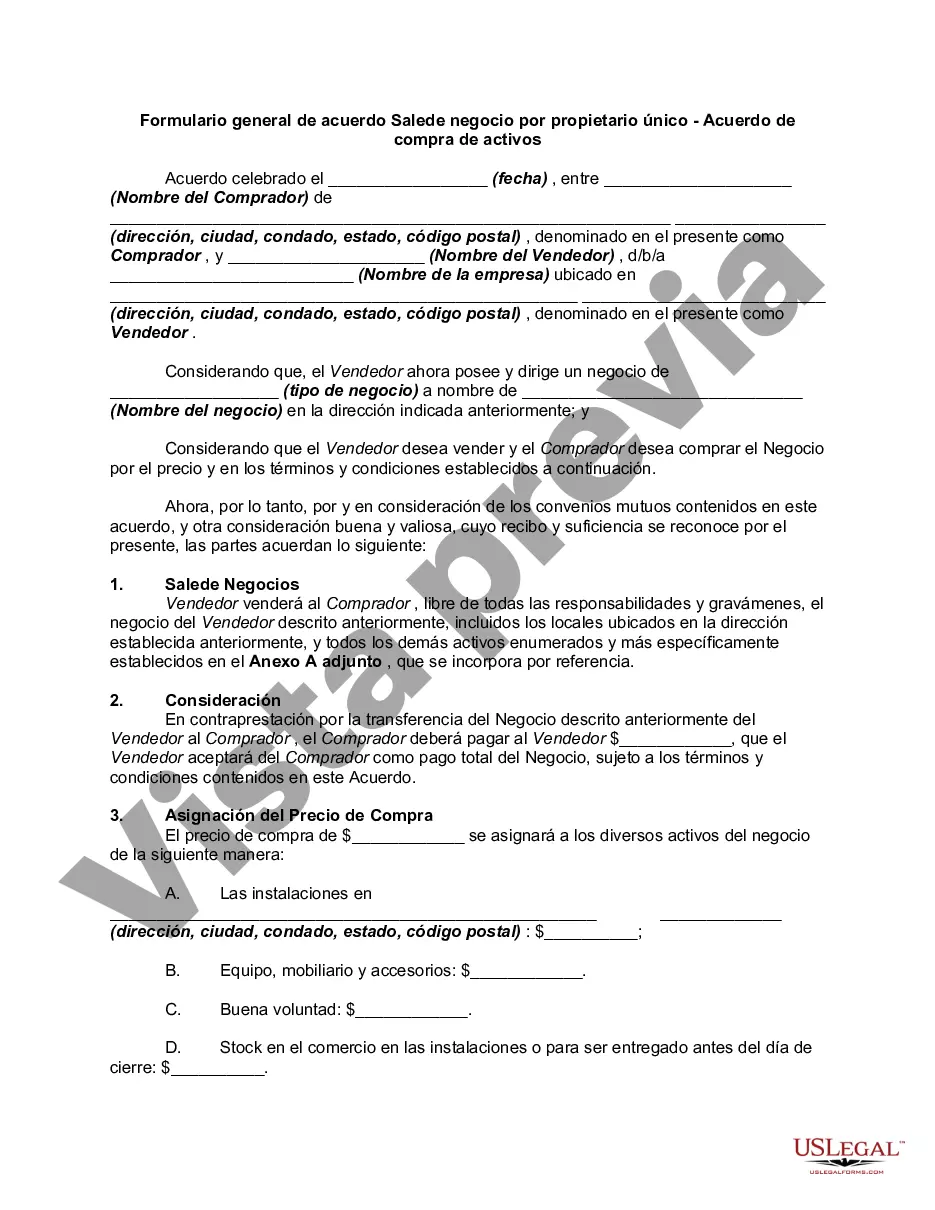

Arkansas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions for the sale of a business by a sole proprietor in the state of Arkansas. This agreement ensures that both the buyer and seller are protected and aware of their rights and responsibilities during the transaction. Some relevant keywords associated with Arkansas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement include: 1. Asset Purchase Agreement: This refers to the type of agreement in which the buyer purchases specific assets of a business rather than acquiring the entire business entity. 2. Sale of Business: The agreement focuses on the sale of a business in its entirety, including its assets, goodwill, and customer base. 3. Sole Proprietor: This refers to a business owned and operated by a single individual, who is solely responsible for all business decisions and liabilities. 4. Sale Price and Payment Terms: This section outlines the agreed-upon sale price for the business and the payment terms, such as the down payment, financing arrangements, or installment payments. 5. Assets Included: The agreement specifies the assets included in the sale, such as real estate, inventory, equipment, intellectual property, contracts, and customer lists. 6. Allocation of Purchase Price: This section outlines how the purchase price will be allocated among the various assets being sold, which is important for tax purposes. 7. Representations and Warranties: Both the seller and the buyer make certain representations and warranties related to the business, its assets, financials, and legal compliance, ensuring the accuracy of the information provided. 8. Non-Competition and Non-Solicitation: This clause restricts the seller from competing with the buyer's business or soliciting customers or employees for a specific period following the sale. 9. Closing Conditions: This section outlines the conditions that must be met before the sale is officially closed, such as obtaining necessary approvals, clearances, or consents. 10. Indemnification: The agreement includes provisions for indemnification, where one party agrees to compensate the other for any losses, damages, or liabilities arising from breaches or misrepresentations. It's worth noting that while there may be variations in the specific terms and language used, the overall structure and content of the agreement generally remain the same.Arkansas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions for the sale of a business by a sole proprietor in the state of Arkansas. This agreement ensures that both the buyer and seller are protected and aware of their rights and responsibilities during the transaction. Some relevant keywords associated with Arkansas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement include: 1. Asset Purchase Agreement: This refers to the type of agreement in which the buyer purchases specific assets of a business rather than acquiring the entire business entity. 2. Sale of Business: The agreement focuses on the sale of a business in its entirety, including its assets, goodwill, and customer base. 3. Sole Proprietor: This refers to a business owned and operated by a single individual, who is solely responsible for all business decisions and liabilities. 4. Sale Price and Payment Terms: This section outlines the agreed-upon sale price for the business and the payment terms, such as the down payment, financing arrangements, or installment payments. 5. Assets Included: The agreement specifies the assets included in the sale, such as real estate, inventory, equipment, intellectual property, contracts, and customer lists. 6. Allocation of Purchase Price: This section outlines how the purchase price will be allocated among the various assets being sold, which is important for tax purposes. 7. Representations and Warranties: Both the seller and the buyer make certain representations and warranties related to the business, its assets, financials, and legal compliance, ensuring the accuracy of the information provided. 8. Non-Competition and Non-Solicitation: This clause restricts the seller from competing with the buyer's business or soliciting customers or employees for a specific period following the sale. 9. Closing Conditions: This section outlines the conditions that must be met before the sale is officially closed, such as obtaining necessary approvals, clearances, or consents. 10. Indemnification: The agreement includes provisions for indemnification, where one party agrees to compensate the other for any losses, damages, or liabilities arising from breaches or misrepresentations. It's worth noting that while there may be variations in the specific terms and language used, the overall structure and content of the agreement generally remain the same.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.