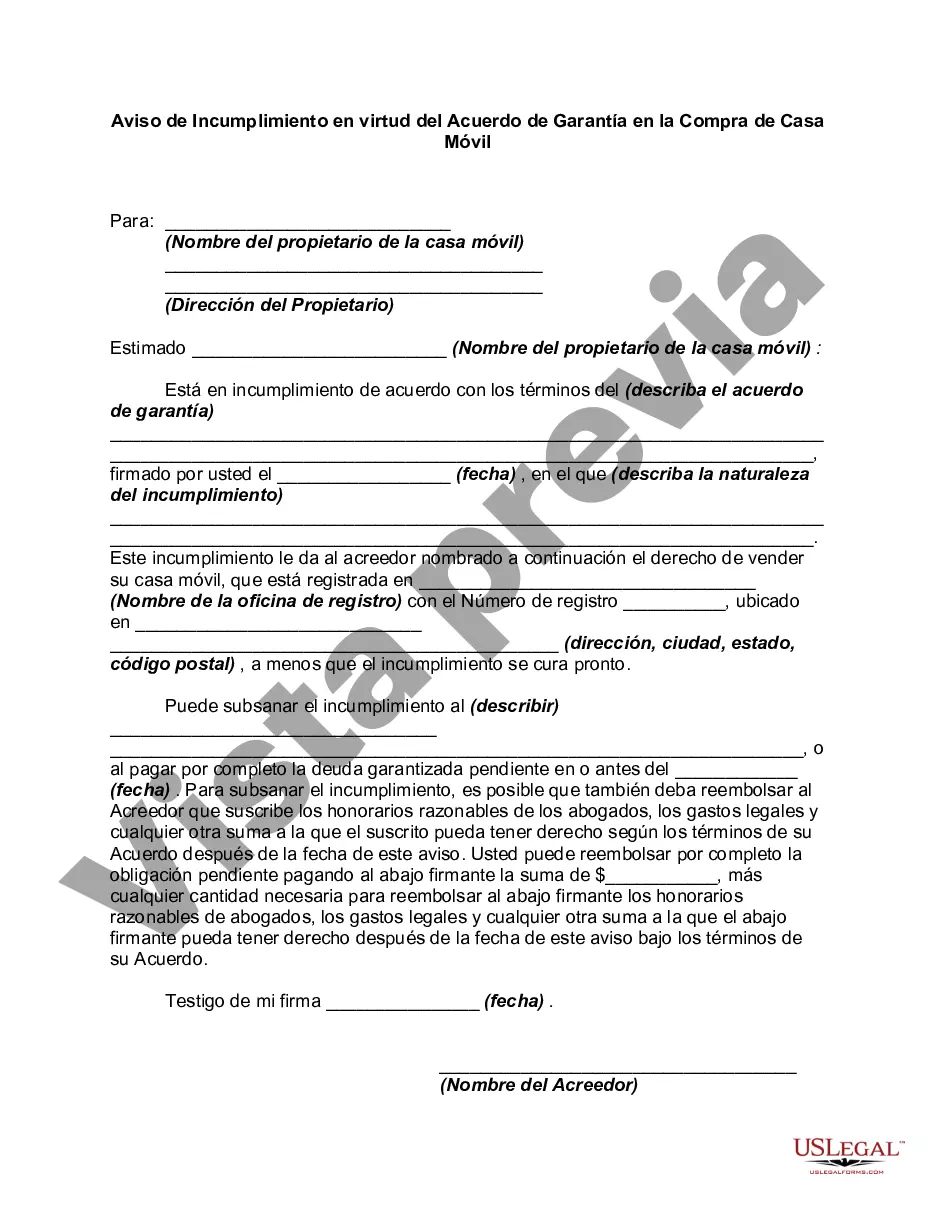

An Arkansas notice of default under a security agreement in the purchase of a mobile home is a legal document that notifies the borrower or debtor that they have defaulted on their obligations outlined in the security agreement regarding the mobile home's purchase. This notice is an important step in the repossession process that allows the creditor to take appropriate actions to recover their investment. Arkansas' law recognizes different types of notices of default under security agreements in the purchase of mobile homes. These may include: 1. Initial Notice of Default: Upon the borrower's default, the creditor sends an initial notice of default to inform them of their breach of the terms outlined in the security agreement. This notice gives the debtor an opportunity to rectify the default and bring the payments up to date. 2. Cure Notice: If the borrower fails to rectify the default within the specified timeframe mentioned in the initial notice, the creditor may send a cure notice. This notice provides an additional opportunity for the borrower to cure the default by paying the outstanding amount, including any late fees or penalties. 3. Final Notice of Default: If the borrower fails to cure the default within the timeframe given in the cure notice, the creditor sends a final notice of default. This notice informs the debtor that the creditor will proceed with further legal actions to repossess the mobile home unless the default is rectified immediately. 4. Repossession Notice: If the borrower fails to cure the default after receiving the final notice, the creditor may send a repossession notice. This notice informs the borrower that the creditor will repossess the mobile home as permitted by Arkansas law. It also provides details on the time and location where the repossession will take place. It is crucial for both creditors and borrowers to understand their rights and obligations outlined in the security agreement, as well as the requirements set by Arkansas law regarding notices of default under security agreements in the purchase of mobile homes. Seeking legal advice or consulting relevant state statutes can provide a comprehensive understanding of the process and help navigate the complexities involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arkansas Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Arkansas Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

US Legal Forms - among the greatest libraries of lawful kinds in America - gives an array of lawful papers layouts it is possible to down load or print. Utilizing the internet site, you will get 1000s of kinds for enterprise and person functions, categorized by groups, suggests, or keywords.You can find the most up-to-date types of kinds such as the Arkansas Notice of Default under Security Agreement in Purchase of Mobile Home within minutes.

If you currently have a subscription, log in and down load Arkansas Notice of Default under Security Agreement in Purchase of Mobile Home from the US Legal Forms catalogue. The Download switch will show up on each develop you perspective. You have access to all formerly acquired kinds from the My Forms tab of your own account.

If you wish to use US Legal Forms for the first time, allow me to share straightforward guidelines to help you get started:

- Be sure to have picked the correct develop for your town/area. Go through the Preview switch to analyze the form`s information. Browse the develop information to ensure that you have selected the right develop.

- If the develop does not match your requirements, use the Research discipline at the top of the display screen to find the one which does.

- If you are happy with the form, confirm your choice by clicking the Acquire now switch. Then, opt for the pricing prepare you favor and give your accreditations to register for the account.

- Approach the purchase. Use your credit card or PayPal account to accomplish the purchase.

- Find the structure and down load the form on your own product.

- Make alterations. Fill out, modify and print and signal the acquired Arkansas Notice of Default under Security Agreement in Purchase of Mobile Home.

Every single web template you included with your money does not have an expiry particular date and it is your own for a long time. So, if you want to down load or print an additional version, just go to the My Forms area and click on in the develop you want.

Get access to the Arkansas Notice of Default under Security Agreement in Purchase of Mobile Home with US Legal Forms, probably the most extensive catalogue of lawful papers layouts. Use 1000s of professional and state-certain layouts that meet your small business or person requires and requirements.