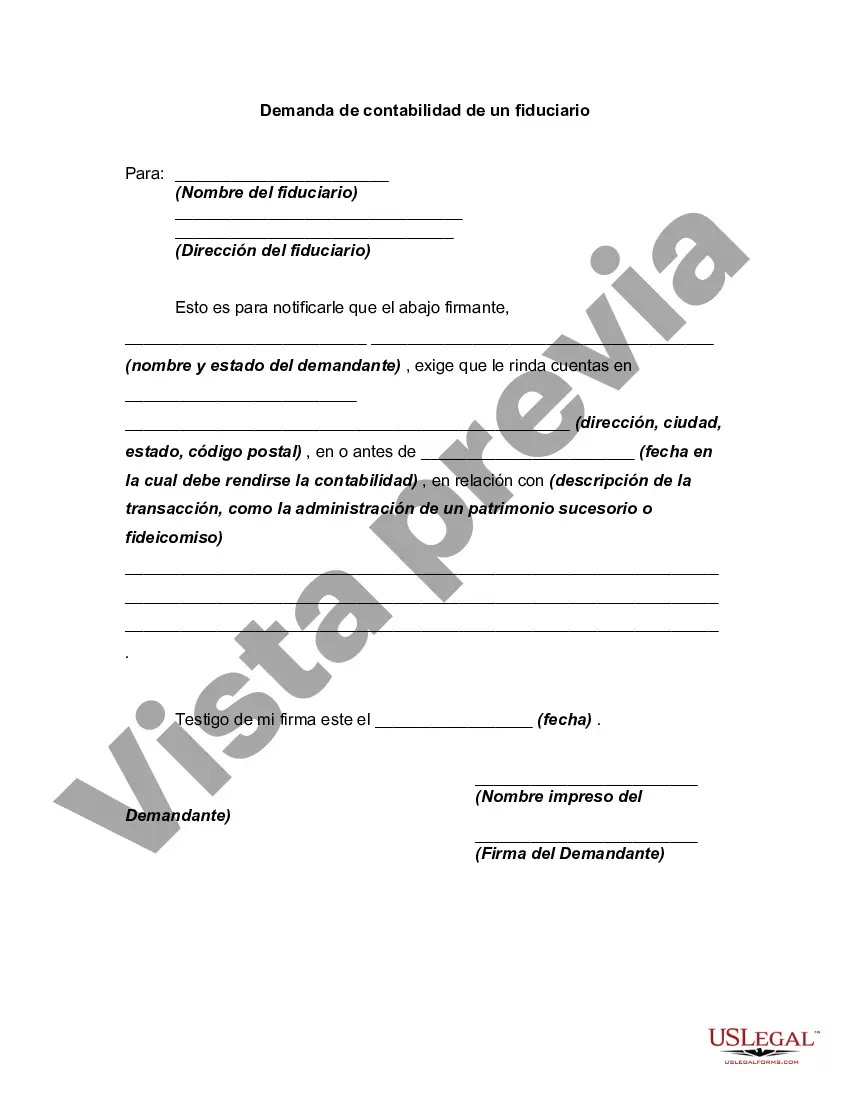

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas Demand for Accounting from a Fiduciary: A Comprehensive Overview In the state of Arkansas, the demand for accounting from a fiduciary refers to the legal process by which a beneficiary requests a detailed account and documentation of the management and distribution of assets held in a fiduciary relationship. Whether initiated during probate administration, trust management, or guardianship proceedings, obtaining an accurate and transparent accounting from a fiduciary is crucial in safeguarding the interests of beneficiaries and ensuring the proper administration of assets. Keywords: Arkansas, demand for accounting, fiduciary, beneficiary, probate administration, trust management, guardianship proceedings. Types of Arkansas Demand for Accounting from a Fiduciary: 1. Probate Accounting: Probate administration involves the settlement of a deceased person's estate where assets are distributed following the individual's will or based on applicable laws of intestacy. Beneficiaries of an estate have the right to request a detailed accounting of the decedent's assets, income, expenses, debts, and any distributions made by the personal representative or executor during the probate process. 2. Trust Accounting: Trusts are legal entities created to hold assets for the benefit of beneficiaries. Trustees are responsible for managing trust assets and fulfilling the terms of the trust agreement. Beneficiaries of trusts in Arkansas are entitled to demand an accounting that outlines the trust's financial transactions, investments, income, disbursements, and any other relevant details regarding the administration of the trust. 3. Guardianship Accounting: Guardianship involves the appointment of a guardian to handle the affairs of an incapacitated individual or a minor. In Arkansas, guardians are typically required to provide periodic accounting to the court detailing the protected person's assets, income, expenses, and the actions taken on behalf of the ward. Beneficiaries of guardianship have the right to demand an accounting to ensure the guardian's proper management of the ward's finances and property interests. In Arkansas, the demand for accounting from a fiduciary is subject to specific legal procedures and deadlines. Beneficiaries should consult with an attorney familiar with Arkansas probate, trust, or guardianship laws to ensure their rights are protected. Timely and accurate accounting from a fiduciary is essential to prevent the misappropriation of assets, identify potential misconduct, and resolve any disputes that may arise during the administration of an estate, trust, or guardianship. In conclusion, the Arkansas demand for accounting from a fiduciary encompasses the legal process through which beneficiaries request detailed financial information and documentation from a fiduciary responsible for managing another party's assets. Whether in the context of probate administration, trust management, or guardianship proceedings, obtaining an accounting ensures transparency, accountability, and the fair treatment of beneficiaries.Arkansas Demand for Accounting from a Fiduciary: A Comprehensive Overview In the state of Arkansas, the demand for accounting from a fiduciary refers to the legal process by which a beneficiary requests a detailed account and documentation of the management and distribution of assets held in a fiduciary relationship. Whether initiated during probate administration, trust management, or guardianship proceedings, obtaining an accurate and transparent accounting from a fiduciary is crucial in safeguarding the interests of beneficiaries and ensuring the proper administration of assets. Keywords: Arkansas, demand for accounting, fiduciary, beneficiary, probate administration, trust management, guardianship proceedings. Types of Arkansas Demand for Accounting from a Fiduciary: 1. Probate Accounting: Probate administration involves the settlement of a deceased person's estate where assets are distributed following the individual's will or based on applicable laws of intestacy. Beneficiaries of an estate have the right to request a detailed accounting of the decedent's assets, income, expenses, debts, and any distributions made by the personal representative or executor during the probate process. 2. Trust Accounting: Trusts are legal entities created to hold assets for the benefit of beneficiaries. Trustees are responsible for managing trust assets and fulfilling the terms of the trust agreement. Beneficiaries of trusts in Arkansas are entitled to demand an accounting that outlines the trust's financial transactions, investments, income, disbursements, and any other relevant details regarding the administration of the trust. 3. Guardianship Accounting: Guardianship involves the appointment of a guardian to handle the affairs of an incapacitated individual or a minor. In Arkansas, guardians are typically required to provide periodic accounting to the court detailing the protected person's assets, income, expenses, and the actions taken on behalf of the ward. Beneficiaries of guardianship have the right to demand an accounting to ensure the guardian's proper management of the ward's finances and property interests. In Arkansas, the demand for accounting from a fiduciary is subject to specific legal procedures and deadlines. Beneficiaries should consult with an attorney familiar with Arkansas probate, trust, or guardianship laws to ensure their rights are protected. Timely and accurate accounting from a fiduciary is essential to prevent the misappropriation of assets, identify potential misconduct, and resolve any disputes that may arise during the administration of an estate, trust, or guardianship. In conclusion, the Arkansas demand for accounting from a fiduciary encompasses the legal process through which beneficiaries request detailed financial information and documentation from a fiduciary responsible for managing another party's assets. Whether in the context of probate administration, trust management, or guardianship proceedings, obtaining an accounting ensures transparency, accountability, and the fair treatment of beneficiaries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.