Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas Demand for Accounting from a Fiduciary

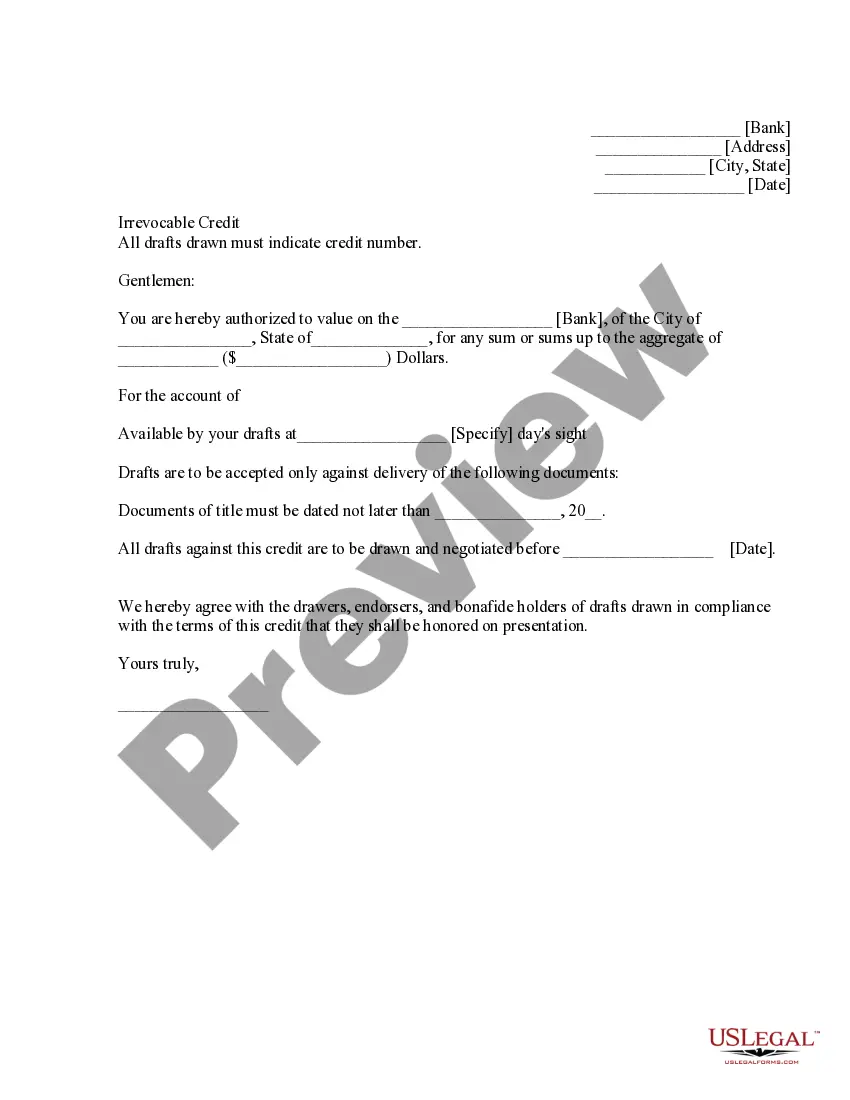

Description

How to fill out Demand For Accounting From A Fiduciary?

If you need to gather, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online. Utilize the site’s simple and user-friendly search feature to locate the documents you need.

Various templates for business and individual purposes are categorized by type and jurisdiction, or search terms. Use US Legal Forms to quickly find the Arkansas Demand for Accounting from a Fiduciary with just a few clicks.

If you are already a US Legal Forms member, Log In to your account and click the Acquire button to obtain the Arkansas Demand for Accounting from a Fiduciary. You can also access forms you previously downloaded in the My documents section of your account.

Every legal document template you purchase is yours permanently. You will have access to each form you have downloaded in your account. Go to the My documents section and select a form to print or download again.

Be proactive and download and print the Arkansas Demand for Accounting from a Fiduciary with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview feature to review the form’s contents. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred payment plan and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Arkansas Demand for Accounting from a Fiduciary.

Form popularity

FAQ

There is indeed a time limit to start probate in Arkansas, set at three years from the decedent's death. This timeframe ensures that the estate is settled in an orderly manner and that beneficiaries receive their rightful shares. Starting probate within this period also protects the estate against claims and ensures compliance with legal requirements. For assistance, consider using resources like the Arkansas Demand for Accounting from a Fiduciary to maintain accountability in estate matters.

Yes, there is a time limit on probate in Arkansas. The formal probate process must be initiated within three years from the death of the decedent. After this period, the right to file may be denied, complicating the estate administration. If you require clarity on the estate’s management, an Arkansas Demand for Accounting from a Fiduciary can help to guide this process.

In Arkansas, you generally have three years from the date of death to file probate. However, initiate the process sooner to prevent potential legal issues or challenges to the estate. Timely filing allows for proper administration and can help address any Arkansas Demand for Accounting from a Fiduciary. Taking action promptly benefits all parties involved.

In Arkansas, an estate must be worth more than $100,000 for it to require probate. Smaller estates may qualify for a simplified process, but larger ones necessitate going through formal probate. This ensures that assets are accounted for and distributed correctly. Utilizing the Arkansas Demand for Accounting from a Fiduciary can aid in managing the process and ensuring transparency.

If you do not file probate in Arkansas, the estate may face complications that delay the distribution of assets. Heirs might not receive their inheritance promptly, and creditors could pursue claims without proper oversight. Additionally, an Arkansas Demand for Accounting from a Fiduciary may arise to clarify the estate's status, which can make the situation more complex. Filing for probate protects both the estate and its beneficiaries.

Arkansas Code 28-65-320 outlines the fiduciary's obligations in managing trusts and estates. This code emphasizes the duty of fiduciaries to act in the best interest of beneficiaries. If you feel a fiduciary is not fulfilling their obligations based on this code, an Arkansas Demand for Accounting from a Fiduciary might be necessary to ensure compliance and accountability. Legal guidance can help you understand the implications of this code.

The success rate of contesting a trust can vary considerably based on the circumstances of each case. Factors like the evidence gathered, the clarity of the trust's terms, and legal representation all influence outcomes. An Arkansas Demand for Accounting from a Fiduciary may strengthen your position by revealing inconsistencies or mismanagement. Consulting a lawyer can provide valuable insight into your chances of success.

Certain wills, such as those made while the testator was declared mentally incompetent, can be contested. However, a will created under proper legal guidelines, without coercion or fraud, typically stands firm. If you have concerns about a will's validity, it may relate to issues addressed in an Arkansas Demand for Accounting from a Fiduciary. Understanding these factors helps to navigate your next steps.

In Arkansas, trust beneficiaries possess various rights, including the right to access trust information and receive distributions according to the trust terms. Beneficiaries can request an Arkansas Demand for Accounting from a Fiduciary to ensure transparency and proper accounting of trust assets. It is essential for beneficiaries to be informed about these rights to safeguard their interests.

A trust can become null and void due to factors like lack of legal capacity, improper execution, or failure to meet statutory requirements. If there are issues with the terms of the trust or if the grantor lacked intention at creation, the trust might lack validity. Filing an Arkansas Demand for Accounting from a Fiduciary can address mismanagement and help clarify these issues. Always consult a legal professional to understand your specific situation.