This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

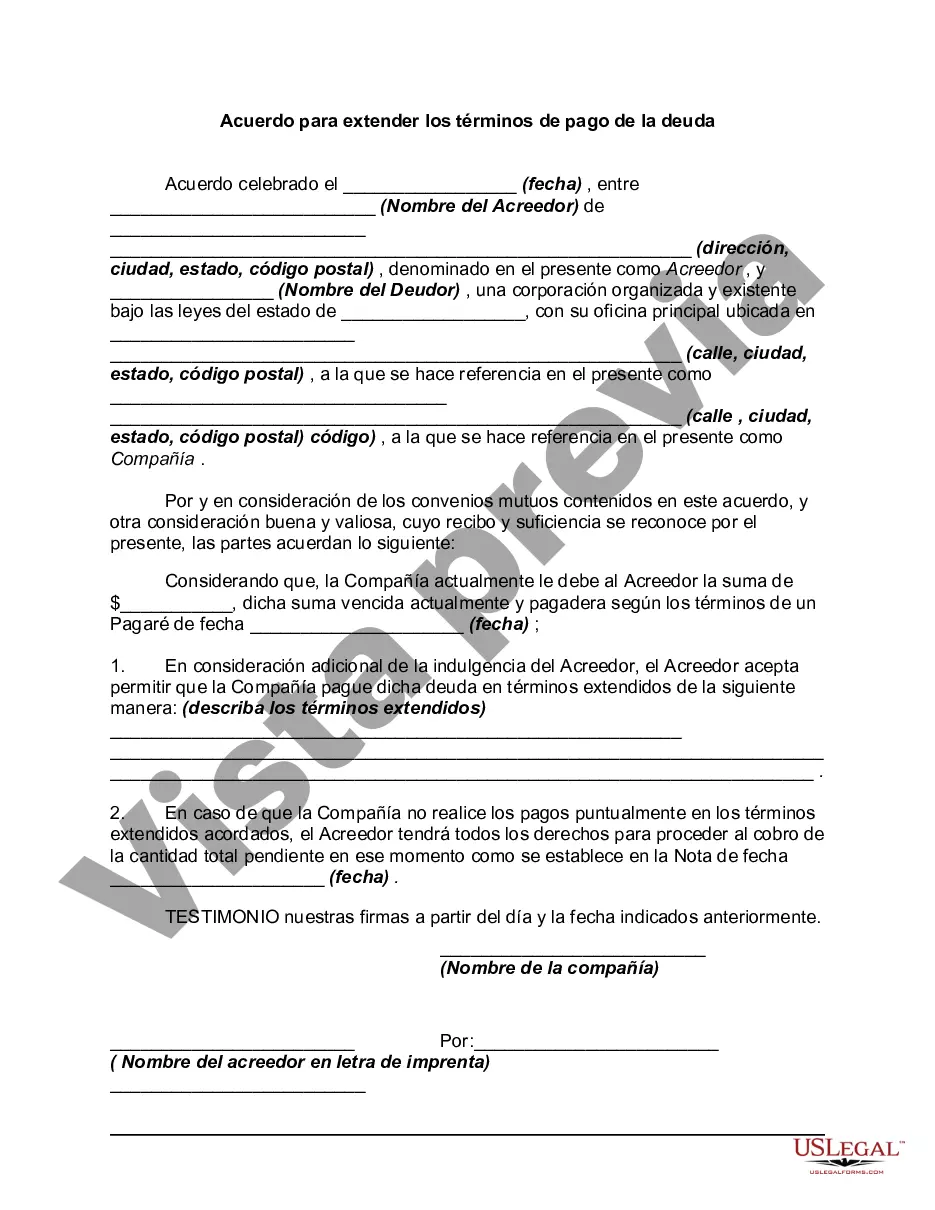

Arkansas Agreement to Extend Debt Payment Terms refers to a legal document that allows parties involved in a financial agreement to modify the existing payment terms and extend the timeline for repayment. It provides a structured solution for debtors who are facing difficulty in meeting their debt obligations within the original agreed-upon period. The Arkansas Agreement to Extend Debt Payment Terms is a legally binding contract that must be agreed upon by both parties involved: the debtor (individual or organization) and the creditor (individual, financial institution, or company). By signing this agreement, both parties outline the new terms and conditions which will govern the extended payment period. In Arkansas, there are various types of Agreement to Extend Debt Payment Terms designed to cater to different debt situations. Some of these types include: 1. Personal Loan Extension Agreement: This agreement is used when a debtor needs more time to repay a personal loan. It allows for the extension of the original loan term, providing the debtor with a new repayment schedule that takes into account their financial constraints. 2. Credit Card Debt Extension Agreement: This type of agreement is specifically tailored for individuals who have outstanding credit card debt and need to renegotiate the payment terms. It allows the debtor to extend the repayment timeline while potentially negotiating reduced interest rates or fees. 3. Business Debt Restructuring Agreement: This agreement is commonly used by businesses facing financial challenges, aiming to restructure their debt obligations and prevent bankruptcy. It enables the business to extend the repayment period, lower interest rates, adjust payment amounts, or other modifications to fit its financial capabilities. 4. Mortgage Loan Modification Agreement: When homeowners face difficulties in making mortgage payments, an Agreement to Extend Debt Payment Terms can be utilized to modify the mortgage loan terms. This may involve extending the loan term, adjusting interest rates, or revising payment amounts, providing financial relief to the borrower. It is important to note that an Arkansas Agreement to Extend Debt Payment Terms should clearly outline the terms of extension, including the new payment schedule, any changes in interest rates or fees, and any potential consequences for non-compliance. Additionally, it is advisable for both parties to seek legal advice or consult professionals experienced in debt negotiation to ensure the agreement is fair and protects their respective interests. In conclusion, the Arkansas Agreement to Extend Debt Payment Terms is a legal document that grants debtors an opportunity to modify the original payment terms, providing them with financial relief and flexibility. The various types of agreements cater to different situations, such as personal loans, credit card debts, business debts, and mortgage loans. It is crucial for both parties to understand and agree upon the terms outlined in the agreement, ensuring a mutually beneficial arrangement.Arkansas Agreement to Extend Debt Payment Terms refers to a legal document that allows parties involved in a financial agreement to modify the existing payment terms and extend the timeline for repayment. It provides a structured solution for debtors who are facing difficulty in meeting their debt obligations within the original agreed-upon period. The Arkansas Agreement to Extend Debt Payment Terms is a legally binding contract that must be agreed upon by both parties involved: the debtor (individual or organization) and the creditor (individual, financial institution, or company). By signing this agreement, both parties outline the new terms and conditions which will govern the extended payment period. In Arkansas, there are various types of Agreement to Extend Debt Payment Terms designed to cater to different debt situations. Some of these types include: 1. Personal Loan Extension Agreement: This agreement is used when a debtor needs more time to repay a personal loan. It allows for the extension of the original loan term, providing the debtor with a new repayment schedule that takes into account their financial constraints. 2. Credit Card Debt Extension Agreement: This type of agreement is specifically tailored for individuals who have outstanding credit card debt and need to renegotiate the payment terms. It allows the debtor to extend the repayment timeline while potentially negotiating reduced interest rates or fees. 3. Business Debt Restructuring Agreement: This agreement is commonly used by businesses facing financial challenges, aiming to restructure their debt obligations and prevent bankruptcy. It enables the business to extend the repayment period, lower interest rates, adjust payment amounts, or other modifications to fit its financial capabilities. 4. Mortgage Loan Modification Agreement: When homeowners face difficulties in making mortgage payments, an Agreement to Extend Debt Payment Terms can be utilized to modify the mortgage loan terms. This may involve extending the loan term, adjusting interest rates, or revising payment amounts, providing financial relief to the borrower. It is important to note that an Arkansas Agreement to Extend Debt Payment Terms should clearly outline the terms of extension, including the new payment schedule, any changes in interest rates or fees, and any potential consequences for non-compliance. Additionally, it is advisable for both parties to seek legal advice or consult professionals experienced in debt negotiation to ensure the agreement is fair and protects their respective interests. In conclusion, the Arkansas Agreement to Extend Debt Payment Terms is a legal document that grants debtors an opportunity to modify the original payment terms, providing them with financial relief and flexibility. The various types of agreements cater to different situations, such as personal loans, credit card debts, business debts, and mortgage loans. It is crucial for both parties to understand and agree upon the terms outlined in the agreement, ensuring a mutually beneficial arrangement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.