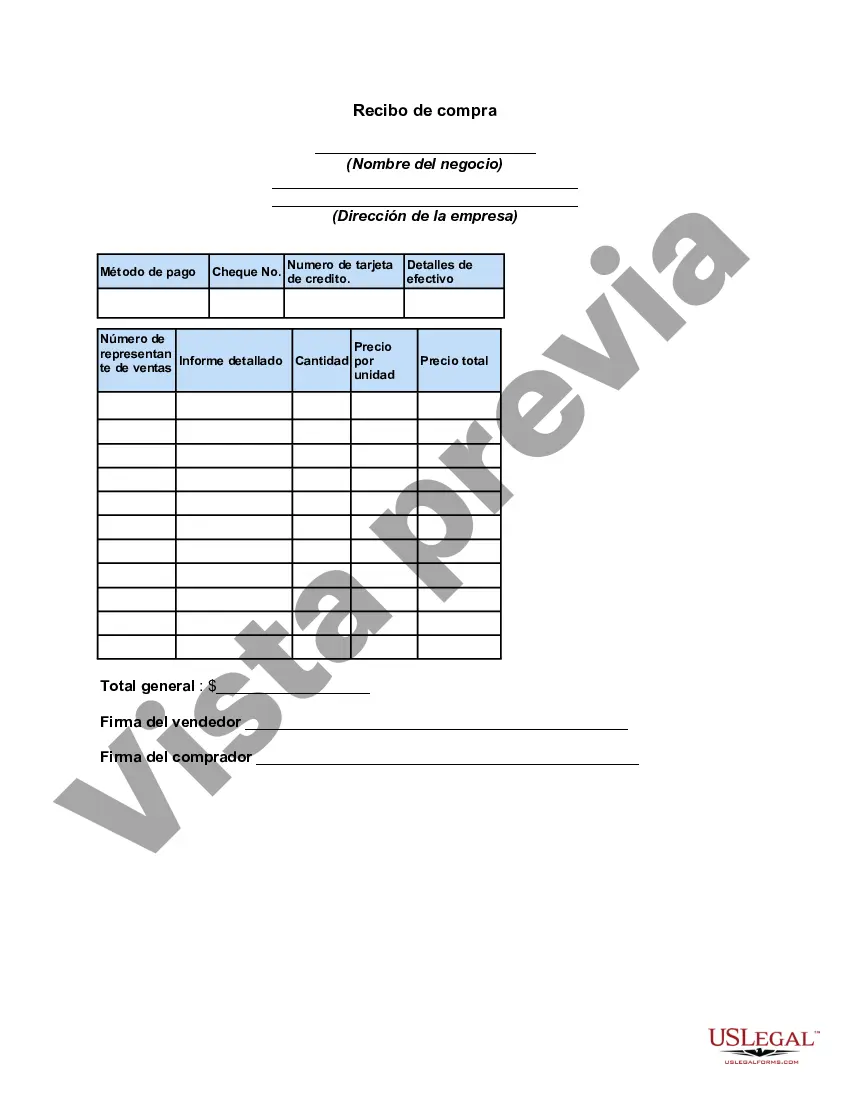

Arkansas Sales Receipt: A Comprehensive Overview Keywords: Arkansas, sales receipt, types A sales receipt in Arkansas is a legal document that serves as proof of purchase for goods or services exchanged between a buyer and a seller. It provides valuable information about the transaction, including the date, amount paid, items or services purchased, and relevant details of the buyer and seller. In Arkansas, there are various types of sales receipts, each serving a specific purpose. Understanding these different types is crucial for businesses and consumers alike. Let's explore some of the most common types of sales receipts in Arkansas: 1. Point of Sale (POS) Receipts: POS receipts are perhaps the most familiar type of sales receipt. They are generated at the time of purchase in brick-and-mortar stores, restaurants, and other retail establishments. POS receipts typically include details like the store's name, address, contact information, itemized list of purchased products or services, rates, taxes, and the total amount paid. 2. E-commerce Receipts: With the rapid growth of online shopping, e-commerce receipts have become increasingly prevalent. These receipts are typically sent via email or displayed on the website after an online transaction is completed. They contain similar information to POS receipts, including the seller's details, purchased items, prices, applicable discounts, taxes, shipping details, and the total payment. 3. Wholesale or B2B Receipts: Wholesale or business-to-business receipts are used when one business sells goods or services to another business. These transactions often involve larger quantities and are characterized by different pricing structures, such as wholesale or bulk pricing. B2B receipts in Arkansas generally contain the buyer's and seller's business names, addresses, contact details, purchase order information, quantity purchased, unit price, total price, and any applicable discounts or taxes. 4. Mobile Payment Receipts: With the availability of mobile payment options such as digital wallets and payment apps, mobile receipts have gained popularity. These receipts are often received electronically on mobile devices in real-time after completing a transaction. They typically include essential details such as the vendor's name, transaction ID, date and time of purchase, itemized goods or services, amounts, and payment confirmation. 5. Charitable Donation Receipts: When individuals or businesses make charitable contributions in Arkansas, they often receive donation receipts. These receipts serve as proof of donation for tax purposes and include various details such as the name and contact information of the charitable organization, the donor's details, donation amount, date, and any additional details required by the IRS or taxation authorities. It is worth noting that sales receipts play an essential role in record-keeping, financial management, and tax compliance for both businesses and individuals in Arkansas. Additionally, they provide crucial evidence of purchase and warranty information, helping consumers in case of returns, exchanges, or disputes. In conclusion, sales receipts in Arkansas are vital legal documents that provide comprehensive information about transactions between buyers and sellers. They come in various forms, including POS receipts, e-commerce receipts, wholesale receipts, mobile payment receipts, and charitable donation receipts — each serving a unique purpose. Understanding the different types of sales receipts will enable businesses and consumers to maintain accurate records and ensure smooth financial operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arkansas Recibo de compra - Sales Receipt

Description

How to fill out Arkansas Recibo De Compra?

Are you in the place in which you need to have files for sometimes enterprise or personal uses virtually every time? There are plenty of authorized file themes available on the net, but discovering types you can rely isn`t simple. US Legal Forms delivers a huge number of develop themes, like the Arkansas Sales Receipt, that happen to be published to meet federal and state requirements.

Should you be already acquainted with US Legal Forms site and also have your account, just log in. Afterward, you may acquire the Arkansas Sales Receipt design.

If you do not come with an profile and need to begin to use US Legal Forms, adopt these measures:

- Find the develop you need and ensure it is for the proper area/area.

- Use the Preview key to analyze the shape.

- Browse the description to actually have selected the right develop.

- When the develop isn`t what you`re trying to find, use the Research discipline to get the develop that meets your requirements and requirements.

- When you discover the proper develop, click Purchase now.

- Pick the rates strategy you want, submit the desired info to generate your money, and pay for the transaction with your PayPal or bank card.

- Choose a convenient document file format and acquire your duplicate.

Find all of the file themes you have bought in the My Forms menu. You can obtain a extra duplicate of Arkansas Sales Receipt anytime, if possible. Just click the required develop to acquire or print out the file design.

Use US Legal Forms, the most substantial selection of authorized types, to save lots of time as well as prevent errors. The services delivers expertly made authorized file themes which you can use for a variety of uses. Generate your account on US Legal Forms and commence making your daily life easier.