Arkansas Checklist - Health and Disability Insurance

Description

How to fill out Checklist - Health And Disability Insurance?

If you need to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and efficient search to acquire the documents you require.

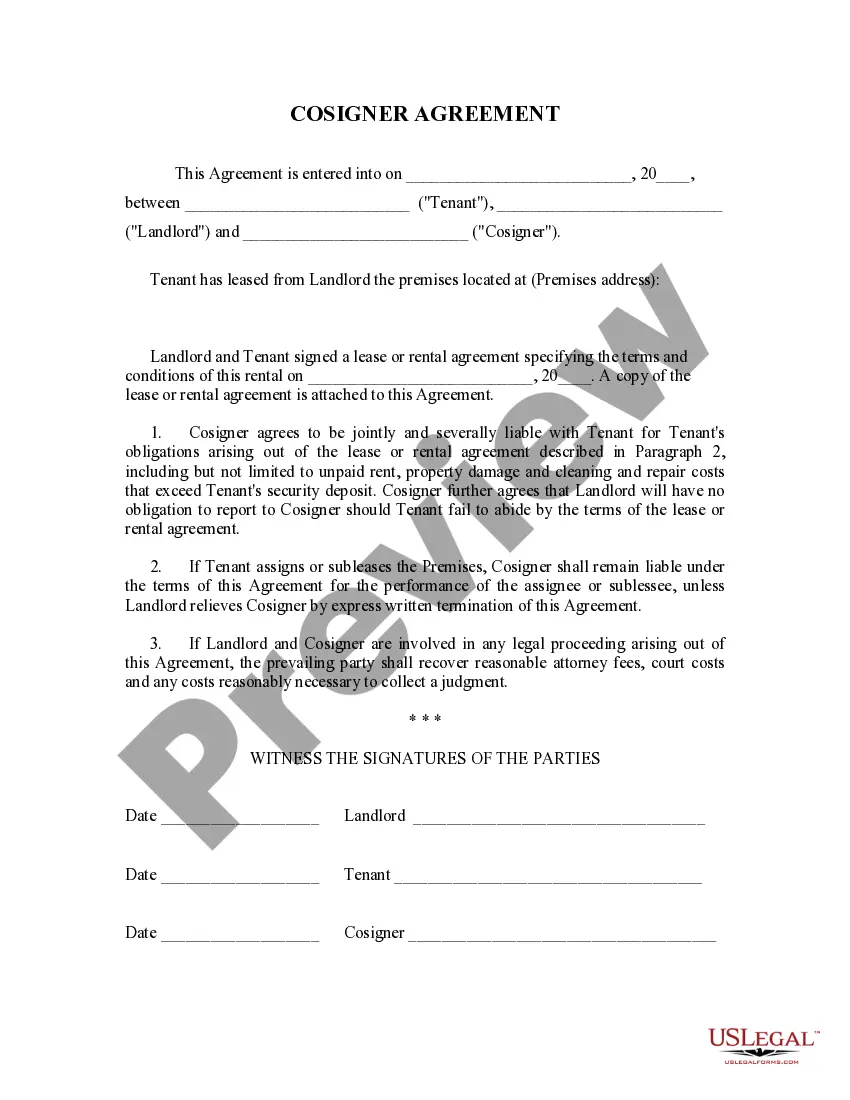

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you obtain is yours permanently. You will have access to each form you downloaded through your account. Navigate to the My documents section and select a form to print or download again.

Compete and download, and print the Arkansas Checklist - Health and Disability Insurance with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

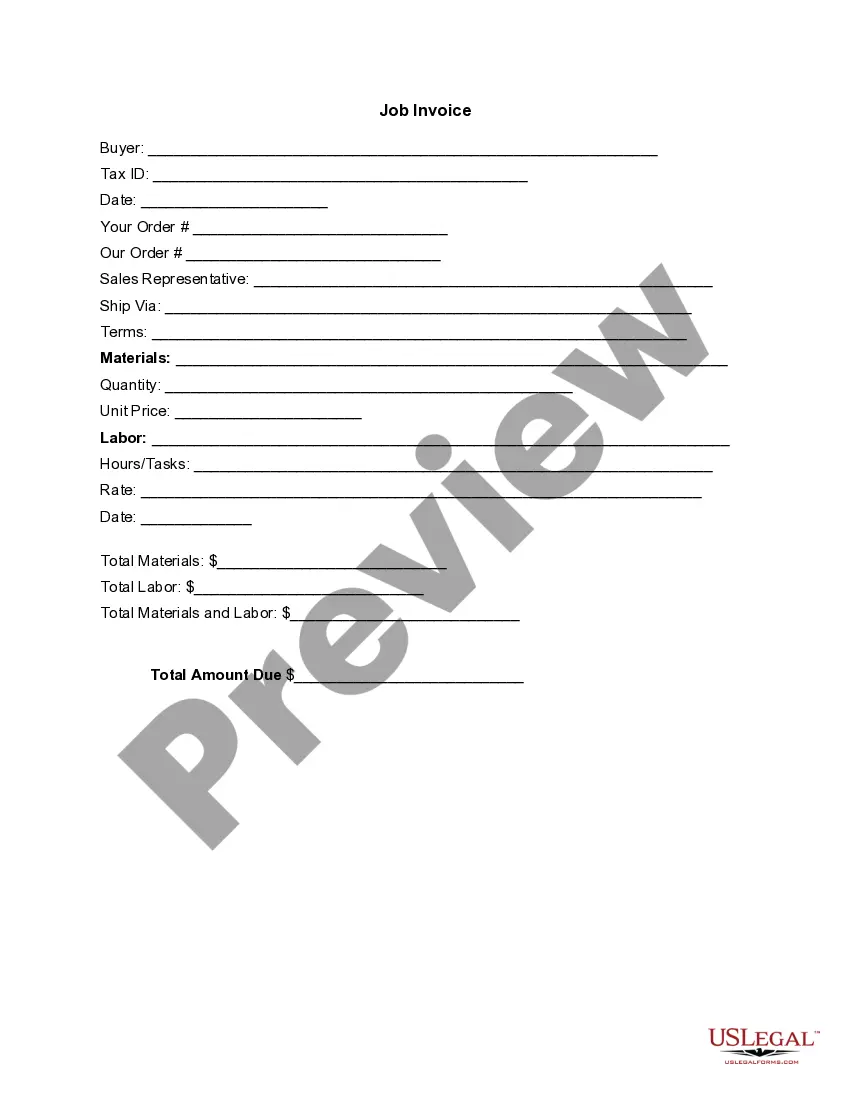

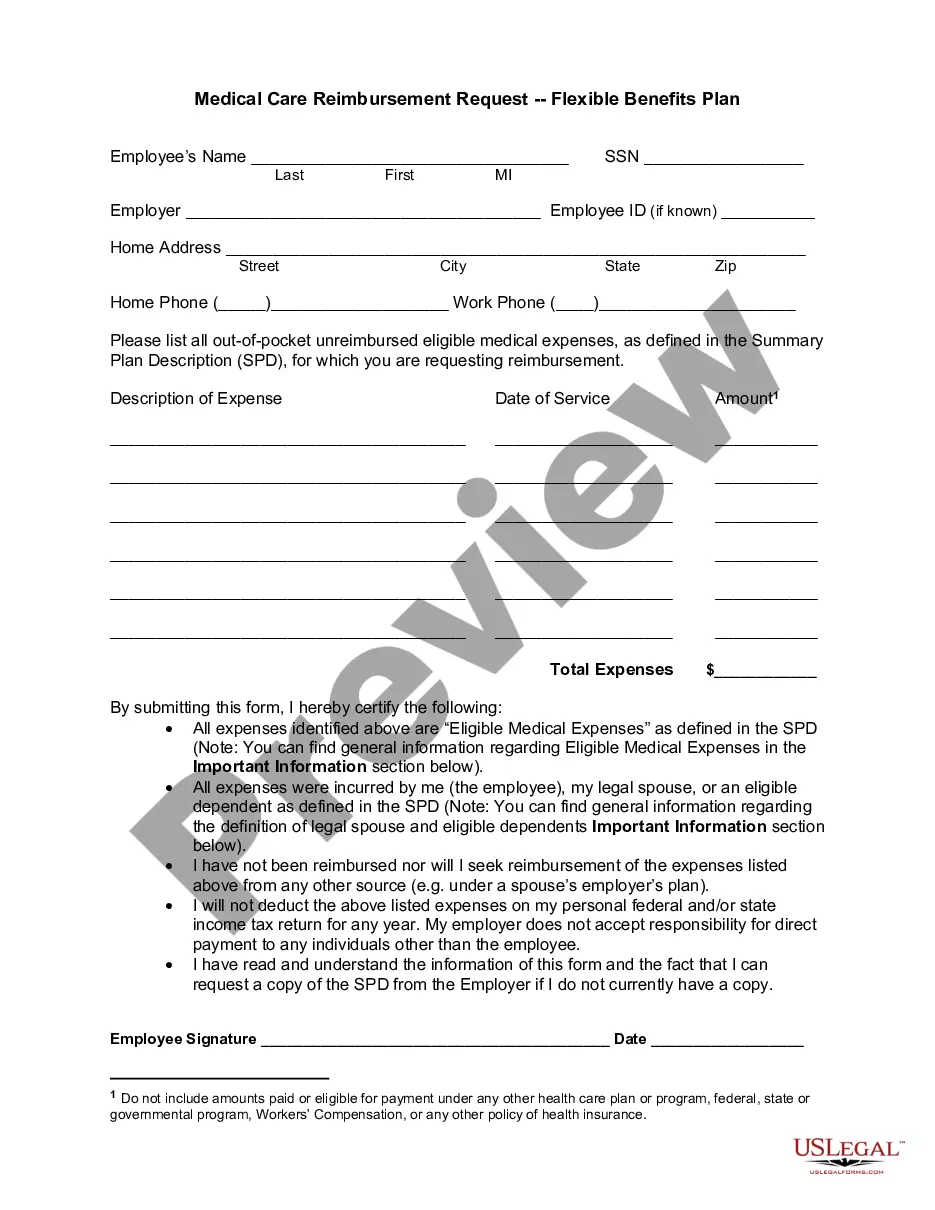

- Step 1: Confirm you have chosen the form for the correct city/state.

- Step 2: Use the Review option to examine the form's details. Don't forget to read the summary.

- Step 3: If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4: Once you have located the form you need, click on the Acquire now button. Select the payment plan you prefer and input your credentials to create an account.

- Step 5: Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6: Choose the format of the legal form and download it to your device.

- Step 7: Complete, modify, and print or sign the Arkansas Checklist - Health and Disability Insurance.

Form popularity

FAQ

Question 10 on the disability function report typically asks you to explain how your disability impacts your daily activities. It is crucial to provide detailed responses that reflect your circumstances accurately. Referencing the Arkansas Checklist - Health and Disability Insurance can enhance your answer, ensuring you include all significant limitations.

When applying for disability, you typically need substantial medical evidence, such as detailed reports from healthcare providers, medical records, and diagnosis details. Financial information, including income statements, may also be necessary to verify eligibility. Referring to the Arkansas Checklist - Health and Disability Insurance will help you gather the appropriate documents and streamline the application process.

To qualify for disability in Arkansas, one must demonstrate a severe medical condition that significantly limits daily activities and the ability to work. This includes meeting specific criteria related to age, work history, and medical documentation. The Arkansas Checklist - Health and Disability Insurance can help guide you through these requirements and ensure you submit a strong application.

A person can remain on social security disability as long as they continue to meet the criteria for their condition and do not exceed the income limits. Typically, benefits can last for many years, and some individuals may qualify for life. Utilizing the Arkansas Checklist - Health and Disability Insurance can provide crucial support in maintaining eligibility and understanding any transitions you may encounter.

The Social Security 5 year rule works by assessing your work history to determine your eligibility for disability benefits. To qualify, you need to have earned sufficient work credits over five years, which is based on your income and contributions to Social Security. It is important to review the Arkansas Checklist - Health and Disability Insurance to ensure all necessary criteria are met before applying.

SSA-623: Representative Payee Report (Adult Beneficiaries)

Questions You Should Expect To Be Asked During A Social Security Disability HearingWhat is your formal education?Do you have any vocational training?Are you currently working?What was your last job and what were your job responsibilities?Have you tried working since you became disabled?More items...

If you are under 18 and a representative payee, you must complete the paper Representative Payee Report form you received in the mail and return it to the address shown on the form. You will need to have the report that you received in the mail to access your beneficiary's records.

1. Why You Received. This Form. We must regularly review how representative payees used the benefits they received on behalf of the Social Security and/or Supplemental Security Income (SSI) beneficiaries.

Are age 18 or older; Are not currently receiving benefits on your own Social Security record; Are unable to work because of a medical condition that is expected to last at least 12 months or result in death: and. Have not been denied disability benefits in the last 60 days.