The Arkansas Pledge of Personal Property as Collateral Security is a legal instrument used to secure loans or obligations by providing personal property as collateral. This pledge is governed by the Arkansas Uniform Commercial Code (UCC) Article 9. Personal property can include a wide range of items such as vehicles, machinery, inventory, accounts receivable, and equipment. By pledging personal property as collateral, borrowers can obtain financing for various purposes, including business expansion, capital investment, or debt consolidation. The Arkansas Pledge of Personal Property as Collateral Security allows lenders to have a claim on the pledged assets in case the borrower defaults on their loan or otherwise fails to fulfill their obligations. This collateral provides lenders with a level of protection and helps lower the risk associated with lending money. In Arkansas, there are different types or variations of the Pledge of Personal Property as Collateral Security, including: 1. Secured Term Loan: This type involves the borrower pledging personal property as collateral for a specific loan amount. The collateral can be repossessed or sold to recover the outstanding debt in case of default. 2. Accounts Receivable Financing: A borrower can pledge their accounts receivable as collateral to secure a revolving line of credit. This type of pledge allows businesses to access immediate funds based on their outstanding invoices while the lender assumes the risk of collecting those invoices. 3. Equipment Financing: Individuals or businesses can pledge specific equipment or machinery as collateral to obtain financing for the purchase or lease of additional equipment. This type of pledge enables borrowers to secure funds based on the value of their existing equipment. 4. Inventory Financing: Borrowers can pledge their inventory as collateral to secure a loan or line of credit. This financing option is commonly used by businesses that need working capital to purchase inventory or manage cash flow. It is important for borrowers to understand the terms and conditions of the Arkansas Pledge of Personal Property as Collateral Security, including the rights and responsibilities of both parties involved. Seeking legal advice or consulting with a financial professional is recommended before entering into any pledge agreement. In conclusion, the Arkansas Pledge of Personal Property as Collateral Security is a legal mechanism that allows borrowers to secure loans or obligations by offering personal property as collateral. The different types of pledges include secured term loans, accounts receivable financing, equipment financing, and inventory financing. It is imperative to fully comprehend the terms and seek appropriate guidance to ensure a smooth and legally compliant borrowing process.

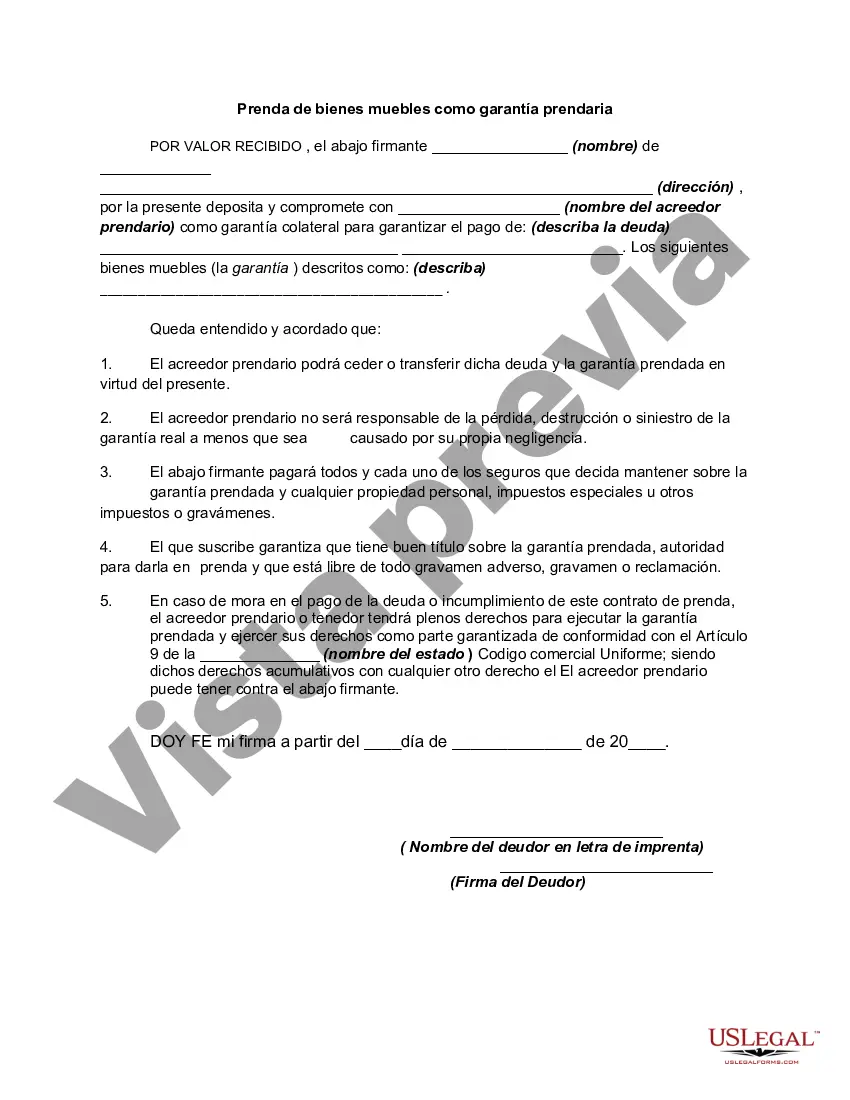

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arkansas Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Arkansas Prenda De Bienes Muebles Como Garantía Prendaria?

Are you currently in the place in which you will need files for possibly enterprise or specific purposes virtually every day? There are plenty of authorized papers layouts available on the net, but getting types you can depend on isn`t simple. US Legal Forms provides thousands of form layouts, like the Arkansas Pledge of Personal Property as Collateral Security, that happen to be published to meet state and federal needs.

In case you are presently informed about US Legal Forms website and also have your account, basically log in. Next, you may acquire the Arkansas Pledge of Personal Property as Collateral Security design.

Should you not offer an profile and want to begin to use US Legal Forms, adopt these measures:

- Find the form you want and make sure it is for the appropriate town/state.

- Use the Preview key to examine the form.

- Browse the explanation to actually have chosen the proper form.

- In case the form isn`t what you`re looking for, make use of the Search field to discover the form that fits your needs and needs.

- When you find the appropriate form, click on Purchase now.

- Opt for the prices prepare you desire, submit the specified info to produce your money, and purchase your order making use of your PayPal or credit card.

- Decide on a handy document structure and acquire your duplicate.

Locate every one of the papers layouts you have bought in the My Forms food list. You may get a further duplicate of Arkansas Pledge of Personal Property as Collateral Security whenever, if required. Just go through the essential form to acquire or print out the papers design.

Use US Legal Forms, by far the most substantial assortment of authorized kinds, in order to save efforts and avoid errors. The assistance provides expertly created authorized papers layouts which you can use for a selection of purposes. Create your account on US Legal Forms and commence making your life easier.