Computer programs are instructions for a computer. Usually, computer programs are in the form of a human-readable, computer programming language called source code. 17 USCS § 101 defines "computer program" as a set of statements or instructions to be used directly or indirectly in a computer in order to bring about a certain result. A software package is used in object-oriented programming to name a group of related classes of a program. Packages are useful to measure and control the inherent coupling of a program. They contain written programs or procedures or rules and associated documentation pertaining to the operation of a computer system and that are stored in read/write memory.

Arkansas Sale of Computer Programming Package

Description

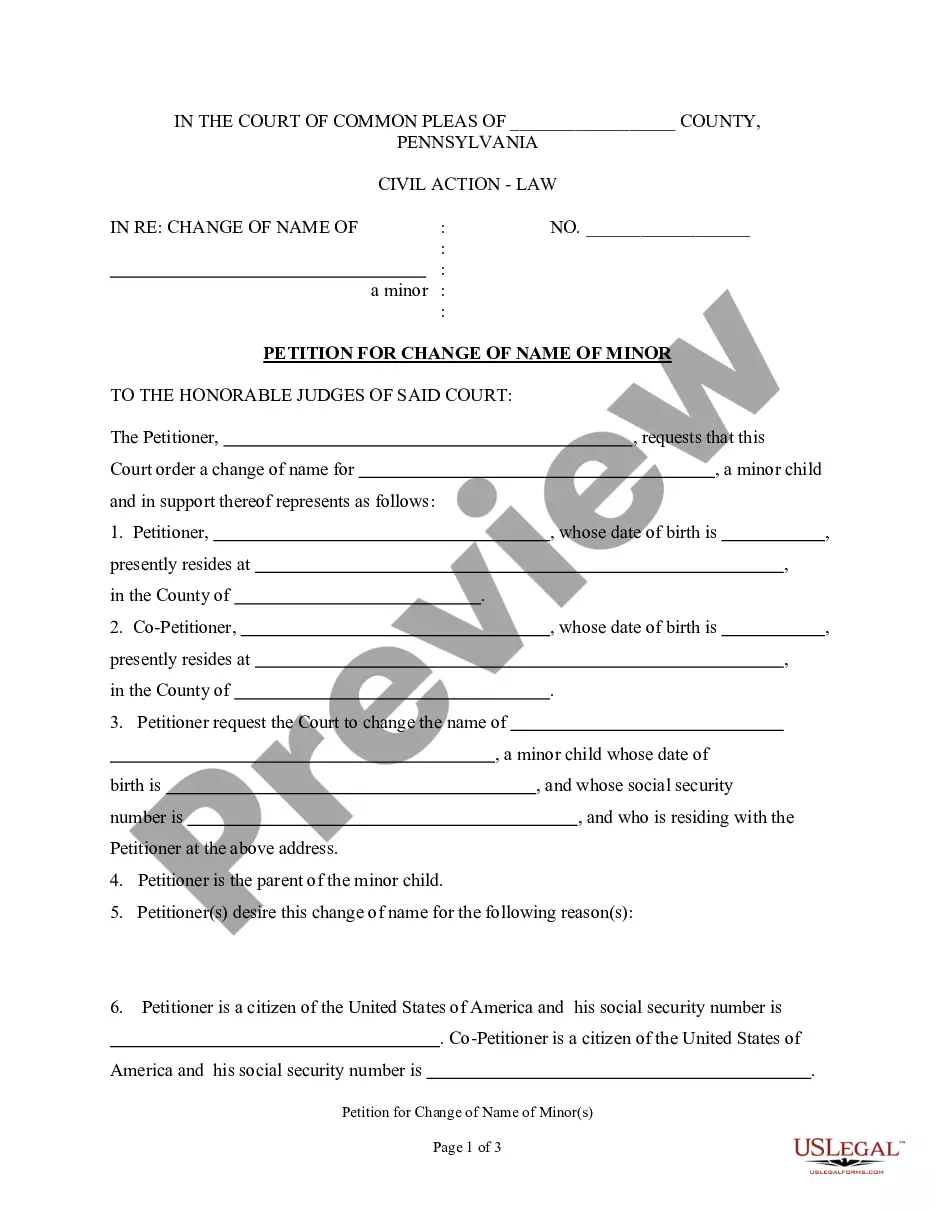

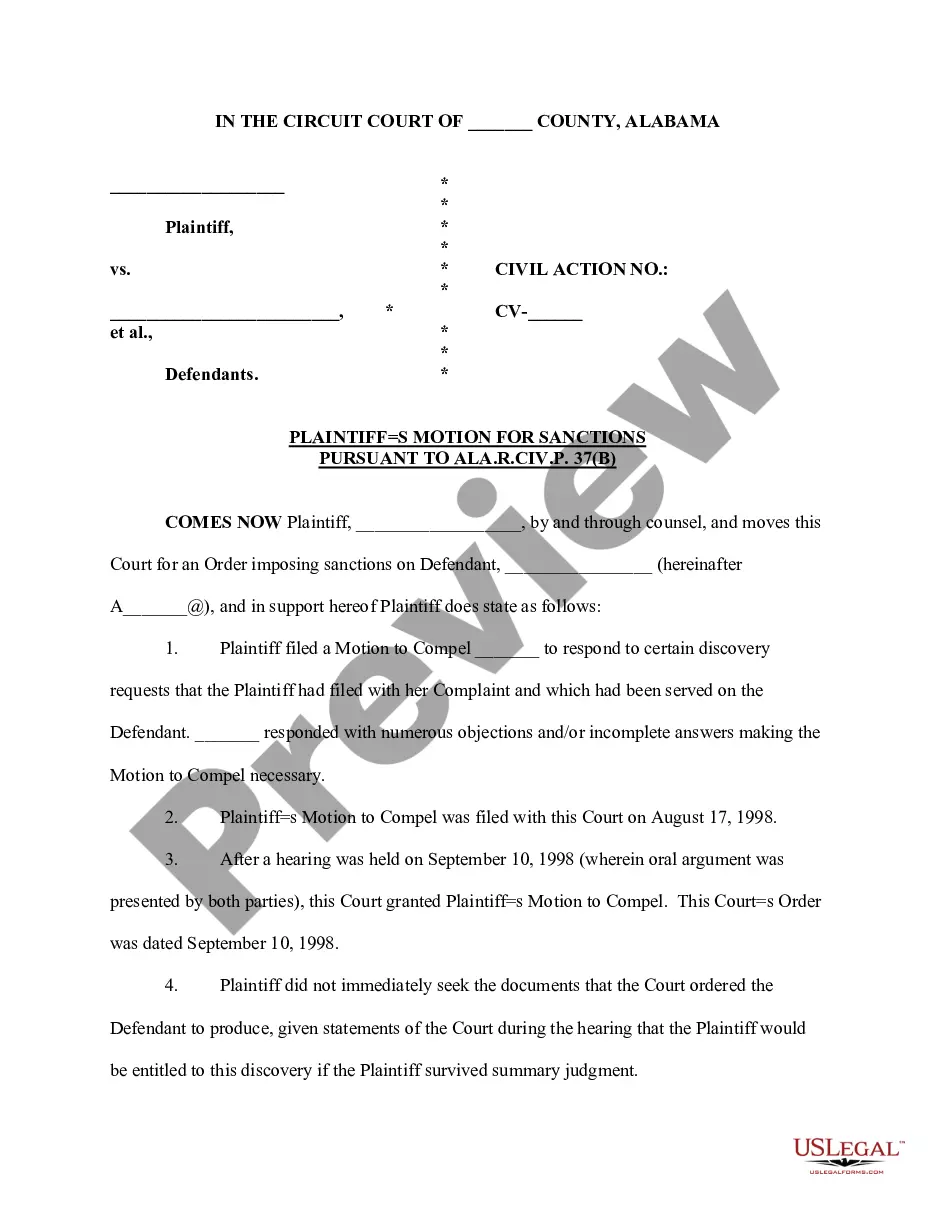

How to fill out Sale Of Computer Programming Package?

If you desire to obtain thorough, download, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available on the internet.

Utilize the site's straightforward and user-friendly search to locate the documents you require.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Arkansas Sale of Computer Programming Package. Every legal document format you acquire is your property indefinitely. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again. Be proactive and download and print the Arkansas Sale of Computer Programming Package with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to acquire the Arkansas Sale of Computer Programming Package with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Buy option to locate the Arkansas Sale of Computer Programming Package.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Preview option to review the form's details. Don't forget to read through the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you’ve found the form you need, click the Purchase now option. Select the pricing plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

Physical nexus is created when a business has a tangible connection to a state, typically through a physical location, employees, or inventory. For example, storing goods or conducting in-person transactions in Arkansas would establish physical nexus. If your business sells the Arkansas Sale of Computer Programming Package and has such a presence, it is essential to comply with state tax requirements.

In Arkansas, nexus is created through various means such as having a physical presence, employees, and making a substantial number of sales. Companies that market products like the Arkansas Sale of Computer Programming Package should be aware that engaging in these activities establishes the requirement to collect and remit taxes. Being proactive in understanding these rules helps maintain compliance and avoid penalties.

Arkansas has specific nexus rules that emphasize physical presence and economic activity. A seller is considered to have nexus if they have a physical location, employees, or make significant sales in the state. The Arkansas Sale of Computer Programming Package would fall under these regulations, necessitating compliance when selling software to Arkansas residents.

Nexus can be triggered by various factors, including physical presence, sales volume, or economic ties to a state. For example, having an office, employees, or inventory can establish physical nexus. In states like Arkansas, engaging in remote sales of products such as the Arkansas Sale of Computer Programming Package may create economic nexus, subjecting you to state tax laws.

Income tax nexus refers to the connection between a business and a state that allows the state to impose tax obligations. Generally, having a physical presence in the state, such as an office or employees, establishes this connection. In relation to the Arkansas Sale of Computer Programming Package, selling or delivering products within the state also creates nexus, requiring compliance with local tax laws.

To obtain a seller's permit in Arkansas, you need to apply through the Arkansas Department of Finance and Administration. First, gather the required information, including your business details and identification. Submit your application online or by mail. Once approved, your seller's permit allows for the Arkansas Sale of Computer Programming Package and ensures compliance with state sales tax regulations.

The taxation of programming services can vary in Arkansas, but typically, the sale of a computer programming package is subject to sales tax. If you sell a complete programming solution or related products, understand that these transactions may incur tax liabilities. To gain insight into what qualifies as taxable, reviewing state regulations or consulting with uslegalforms may be beneficial.

In Arkansas, software as a service (SaaS) is generally considered taxable under the Arkansas Sale of Computer Programming Package. This means that if you are purchasing access to software hosted online, you may be responsible for paying sales tax. It's essential to understand the specific regulations, as they can impact your total costs. For additional guidance, you can explore resources such as uslegalforms.

Arkansas Code 26-52-304 outlines specific sales tax regulations, including exemptions and taxable categories. Understanding this code can be particularly useful when considering an Arkansas Sale of Computer Programming Package. It is advisable to consult legal resources or platforms like uslegalforms for detailed explanations and implications.

Sales tax on software as a service (SaaS) varies by state, and some states do require it. For example, states like New York and Texas impose sales tax on SaaS, while others may not. If you're considering an Arkansas Sale of Computer Programming Package, it's beneficial to research state-specific regulations to avoid unexpected tax liabilities.