Arkansas Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can get the most recent versions of forms like the Arkansas Promissory Note with Payments Amortized for a Certain Number of Years in seconds.

If you already have a subscription, Log In and download the Arkansas Promissory Note with Payments Amortized for a Certain Number of Years from the US Legal Forms collection. The Download button will appear on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

Make modifications. Fill out, amend, print, and sign the acquired Arkansas Promissory Note with Payments Amortized for a Certain Number of Years.

Each template added to your account has no expiration date and is yours permanently. Therefore, to obtain or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Arkansas Promissory Note with Payments Amortized for a Certain Number of Years with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are simple instructions to get you started.

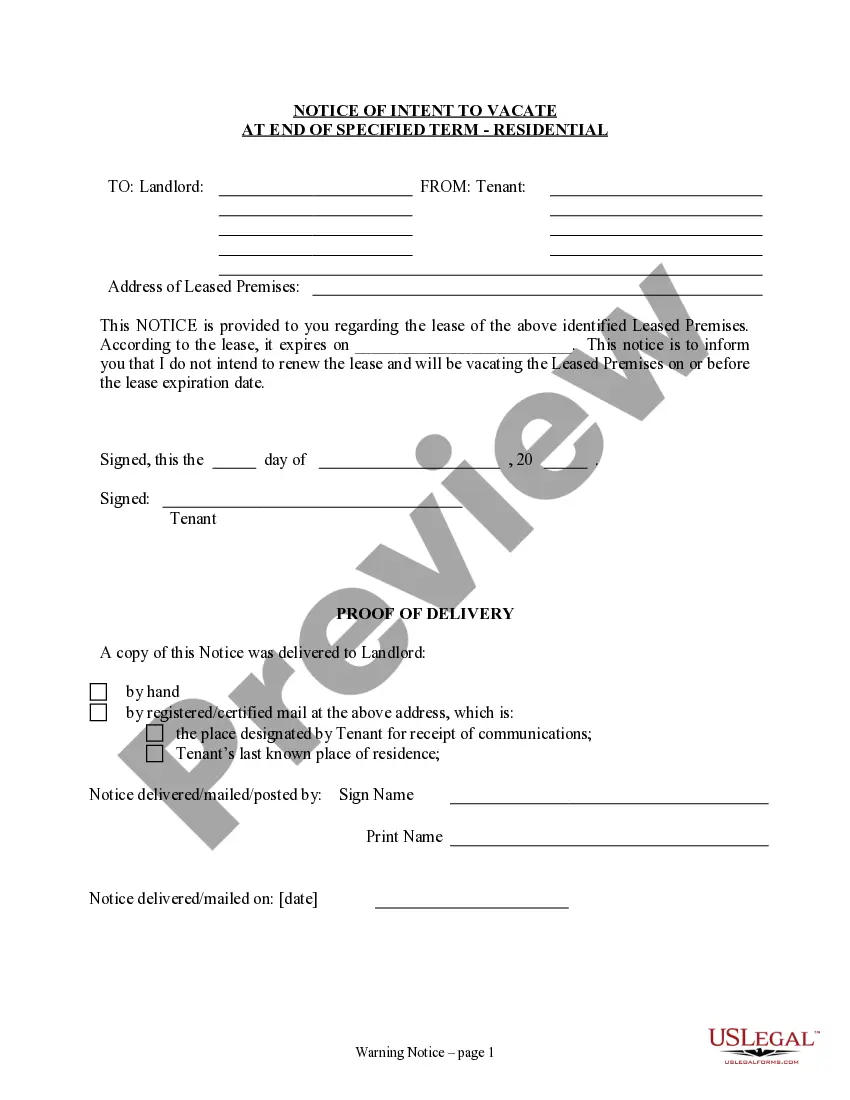

- Ensure that you have selected the correct form for the city/state. Click the Review button to inspect the form's content. Check the form outline to confirm that you have selected the appropriate form.

- If the form does not suit your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, validate your choice by clicking on the Purchase now button. Then, choose the pricing plan you prefer and provide your credentials to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

The payment for amortization refers to the regular installment you make to repay the principal and interest over a specified period. In the context of an Arkansas Promissory Note with Payments Amortized for a Certain Number of Years, these payments ensure you clear the debt by the end of the term. Understanding this payment structure is essential for effective financial planning.

Writing a simple promissory note involves some straightforward steps. Start by including the names of the lender and borrower, the amount being borrowed, and the interest rate. Next, specify the repayment schedule, especially if you are drafting an Arkansas Promissory Note with Payments Amortized for a Certain Number of Years, detailing how and when payments will be made. Finally, sign and date the document to make it legally binding—keeping a copy for your records is also a smart move.

Various types of promissory notes exist, catering to different financial needs. For instance, an Arkansas Promissory Note with Payments Amortized for a Certain Number of Years typically applies in personal loans, real estate transactions, or business financing. Other examples include student loans or car loans, where the borrower commits to repaying the amount over a specified period. Having clear examples helps in drafting your own note with confidence.

The length of a promissory note can vary depending on the agreement between the parties involved. Typically, an Arkansas Promissory Note with Payments Amortized for a Certain Number of Years lasts anywhere from a few months up to several decades. It's essential to specify the term in the note, as it will influence repayment schedules and interest rates. Clear terms not only help in understanding obligations but also protect both parties.

Promissory Notes in Ontario A lender has two years to collect repayment or commence legal proceedings for repayment after the maturity date of the loan or after the date where the lender demanded repayment. After the two years, the agreement is statute-barred and unenforceable.

Commercial Here, the note is made when dealing with commercial lenders such as banks. Most of the commercial promissory agreement is similar to personal notes. Real Estate This is similar to commercial notes in terms of nonpayment consequences.

Promissory note are a valid instrument in the court of law to claim your amount. payable at a certain time after date. So if in your promissory note is it stated that your friend will pay you the amount after a certain date then the instruments date is not very essential.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

Types of Promissory NotesPersonal Promissory Notes This is a particular loan taken from family or friends.Commercial Here, the note is made when dealing with commercial lenders such as banks.Real Estate This is similar to commercial notes in terms of nonpayment consequences.More items...