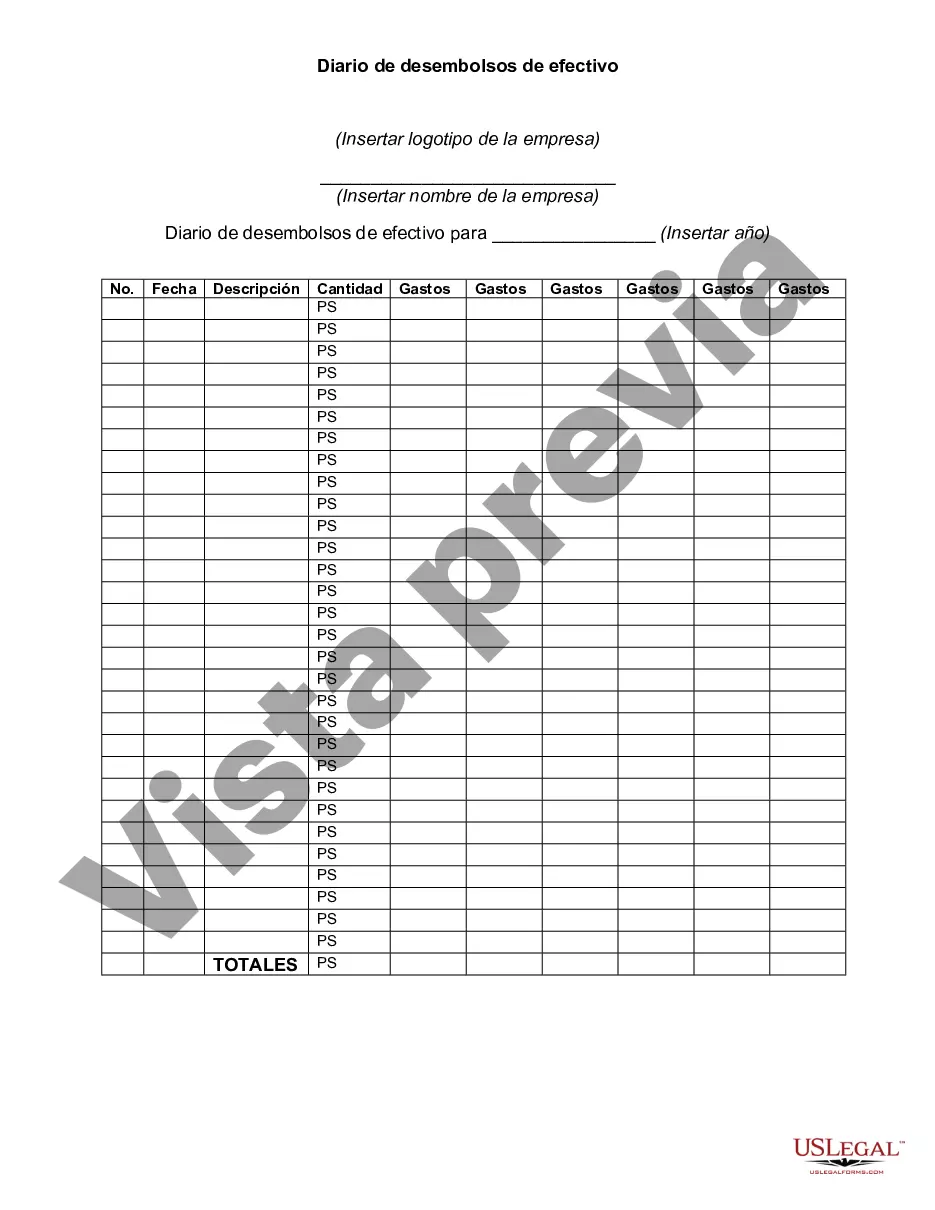

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

The Arkansas Check Disbursements Journal is a financial document used by organizations and businesses in Arkansas to record and track the disbursement of checks. This journal provides a detailed account of all outgoing payments made by an entity, including the check number, date, amount, and recipient. Organizations and businesses utilize the Arkansas Check Disbursements Journal to ensure accurate financial record-keeping and facilitate efficient tracking of expenses. By maintaining a comprehensive account of check disbursements, businesses can easily monitor their cash flow, identify discrepancies, and fulfill their reporting obligations. The Arkansas Check Disbursements Journal plays a crucial role in ensuring transparency and accountability in financial operations. It helps prevent fraudulent activities and provides a systematic record that can be easily referenced during audits or financial inspections. Additionally, this journal assists in reconciling bank statements and serves as a valuable tool for budgeting and financial planning purposes. There are various types of Arkansas Check Disbursements Journals, each serving a distinct purpose within an organization's financial management system. Some common types include: 1. General Check Disbursements Journal: This type of journal records all check disbursements made by an organization, covering a wide range of expenses such as utilities, suppliers, payroll, and other operating costs. 2. Accounts Payable Check Disbursements Journal: Specifically dedicated to tracking payments made to suppliers, vendors, and other creditors, this journal helps manage accounts payable and maintains accurate records of outstanding liabilities. 3. Payroll Check Disbursements Journal: Used exclusively for recording salary and wage payments to employees, this journal ensures that wages are properly disbursed and provides a breakdown of individual employee payments. 4. Expense Reimbursement Check Disbursements Journal: This journal is utilized to record and track reimbursements made to employees for business-related expenses they have paid out-of-pocket, such as travel expenses, client entertainment, or office supplies. Overall, the Arkansas Check Disbursements Journal is an indispensable financial management tool used by businesses and organizations to maintain accurate records of all check disbursements, ensuring financial transparency, and aiding in the smooth operation of day-to-day business activities.The Arkansas Check Disbursements Journal is a financial document used by organizations and businesses in Arkansas to record and track the disbursement of checks. This journal provides a detailed account of all outgoing payments made by an entity, including the check number, date, amount, and recipient. Organizations and businesses utilize the Arkansas Check Disbursements Journal to ensure accurate financial record-keeping and facilitate efficient tracking of expenses. By maintaining a comprehensive account of check disbursements, businesses can easily monitor their cash flow, identify discrepancies, and fulfill their reporting obligations. The Arkansas Check Disbursements Journal plays a crucial role in ensuring transparency and accountability in financial operations. It helps prevent fraudulent activities and provides a systematic record that can be easily referenced during audits or financial inspections. Additionally, this journal assists in reconciling bank statements and serves as a valuable tool for budgeting and financial planning purposes. There are various types of Arkansas Check Disbursements Journals, each serving a distinct purpose within an organization's financial management system. Some common types include: 1. General Check Disbursements Journal: This type of journal records all check disbursements made by an organization, covering a wide range of expenses such as utilities, suppliers, payroll, and other operating costs. 2. Accounts Payable Check Disbursements Journal: Specifically dedicated to tracking payments made to suppliers, vendors, and other creditors, this journal helps manage accounts payable and maintains accurate records of outstanding liabilities. 3. Payroll Check Disbursements Journal: Used exclusively for recording salary and wage payments to employees, this journal ensures that wages are properly disbursed and provides a breakdown of individual employee payments. 4. Expense Reimbursement Check Disbursements Journal: This journal is utilized to record and track reimbursements made to employees for business-related expenses they have paid out-of-pocket, such as travel expenses, client entertainment, or office supplies. Overall, the Arkansas Check Disbursements Journal is an indispensable financial management tool used by businesses and organizations to maintain accurate records of all check disbursements, ensuring financial transparency, and aiding in the smooth operation of day-to-day business activities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.