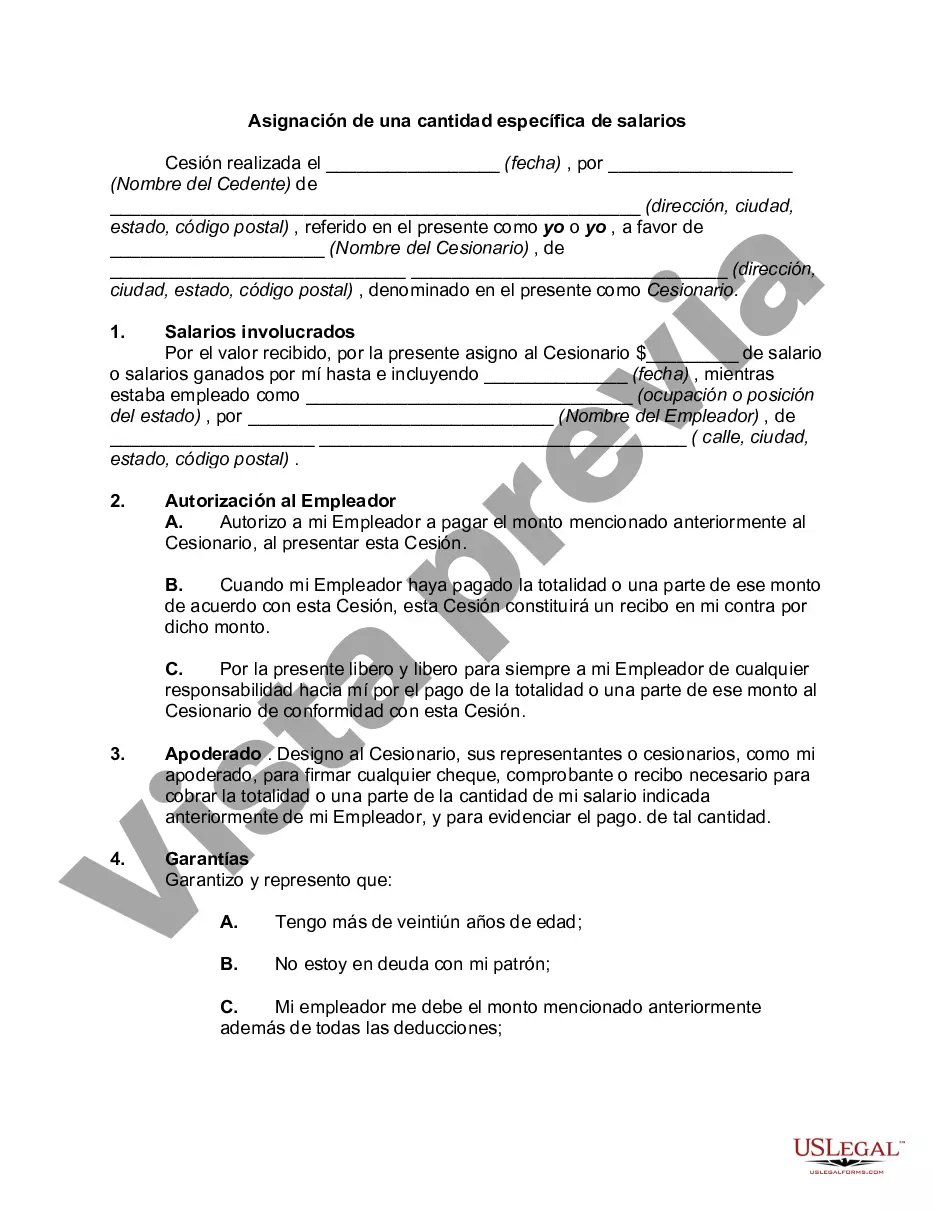

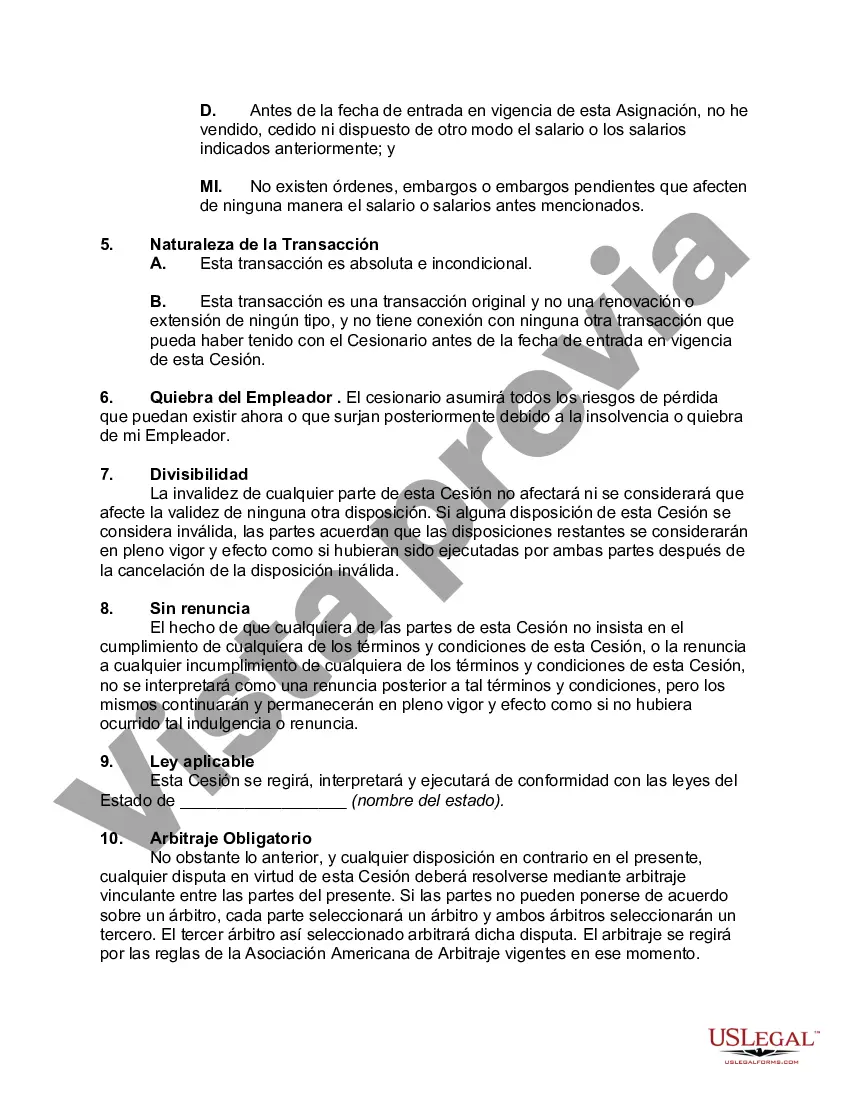

An assignment of wages should be contained in a separate written instrument, signed by the person who has earned or will earn the wages or salary. The assignment should include statements identifying the transaction to which the assignment relates, the personal status of the assignor, and a recital, where appropriate, that no other assignment or order exists in connection with the same transaction.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas Assignment of a Specified Amount of Wages refers to a legal provision that allows employees to assign a specific portion of their wages to a creditor or third party in order to repay a debt. This arrangement ensures that the creditor receives a consistent payment directly from the employee's wages until the debt is settled. Under Arkansas law, there are two types of Assignment of a Specified Amount of Wages — voluntary and involuntary. 1. Voluntary Assignment of a Specified Amount of Wages: This occurs when an employee willingly agrees to assign a portion of their wages to a creditor. It is typically done as part of a debt repayment plan and requires the employee's written consent. The employee and creditor mutually enter into a voluntary agreement outlining the terms of the wage assignment, including the specified amount or percentage that will be deducted from the employee's wages. 2. Involuntary Assignment of a Specified Amount of Wages: In contrast to the voluntary assignment, an involuntary assignment may occur when a court order or legal authority mandates the deduction of a specific amount from an employee's wages. This is usually a result of a judgment or court-ordered debt, such as unpaid taxes, child support, or other outstanding legal obligations. The employer is legally obligated to comply with the court order and deduct the specified amount from the employee's wages until the debt is satisfied. It is important to note that under Arkansas law, an employer is prohibited from making a voluntary wage assignment mandatory as a condition of employment unless it is for the repayment of a loan made by the employer. Additionally, the total amount deducted from an employee's wages cannot exceed 25% of their disposable earnings unless the assignment is for child support or federal tax obligations. In summary, the Arkansas Assignment of a Specified Amount of Wages allows employees to assign a specific portion of their earnings to repay a debt. Whether voluntary or involuntary, this legal provision ensures consistent payments directly from an employee's wages until the debt is fully settled. Compliance with the state laws is crucial for both employers and employees to avoid any violations or unjust practices.

Arkansas Assignment of a Specified Amount of Wages refers to a legal provision that allows employees to assign a specific portion of their wages to a creditor or third party in order to repay a debt. This arrangement ensures that the creditor receives a consistent payment directly from the employee's wages until the debt is settled. Under Arkansas law, there are two types of Assignment of a Specified Amount of Wages — voluntary and involuntary. 1. Voluntary Assignment of a Specified Amount of Wages: This occurs when an employee willingly agrees to assign a portion of their wages to a creditor. It is typically done as part of a debt repayment plan and requires the employee's written consent. The employee and creditor mutually enter into a voluntary agreement outlining the terms of the wage assignment, including the specified amount or percentage that will be deducted from the employee's wages. 2. Involuntary Assignment of a Specified Amount of Wages: In contrast to the voluntary assignment, an involuntary assignment may occur when a court order or legal authority mandates the deduction of a specific amount from an employee's wages. This is usually a result of a judgment or court-ordered debt, such as unpaid taxes, child support, or other outstanding legal obligations. The employer is legally obligated to comply with the court order and deduct the specified amount from the employee's wages until the debt is satisfied. It is important to note that under Arkansas law, an employer is prohibited from making a voluntary wage assignment mandatory as a condition of employment unless it is for the repayment of a loan made by the employer. Additionally, the total amount deducted from an employee's wages cannot exceed 25% of their disposable earnings unless the assignment is for child support or federal tax obligations. In summary, the Arkansas Assignment of a Specified Amount of Wages allows employees to assign a specific portion of their earnings to repay a debt. Whether voluntary or involuntary, this legal provision ensures consistent payments directly from an employee's wages until the debt is fully settled. Compliance with the state laws is crucial for both employers and employees to avoid any violations or unjust practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.