Arkansas Sample Letter for Explanation of Bankruptcy

Description

How to fill out Sample Letter For Explanation Of Bankruptcy?

If you require to completely, download, or print authorized document templates, utilize US Legal Forms, the premier compilation of authorized forms, which is available online.

Utilize the site’s simple and convenient search function to locate the documents you need.

Various templates for business and personal use are categorized by types and states, or keywords.

Step 4. Once you have located the form you desire, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Employ US Legal Forms to locate the Arkansas Sample Letter for Explanation of Bankruptcy with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Purchase button to find the Arkansas Sample Letter for Explanation of Bankruptcy.

- You may also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure that you have selected the form for the correct state/region.

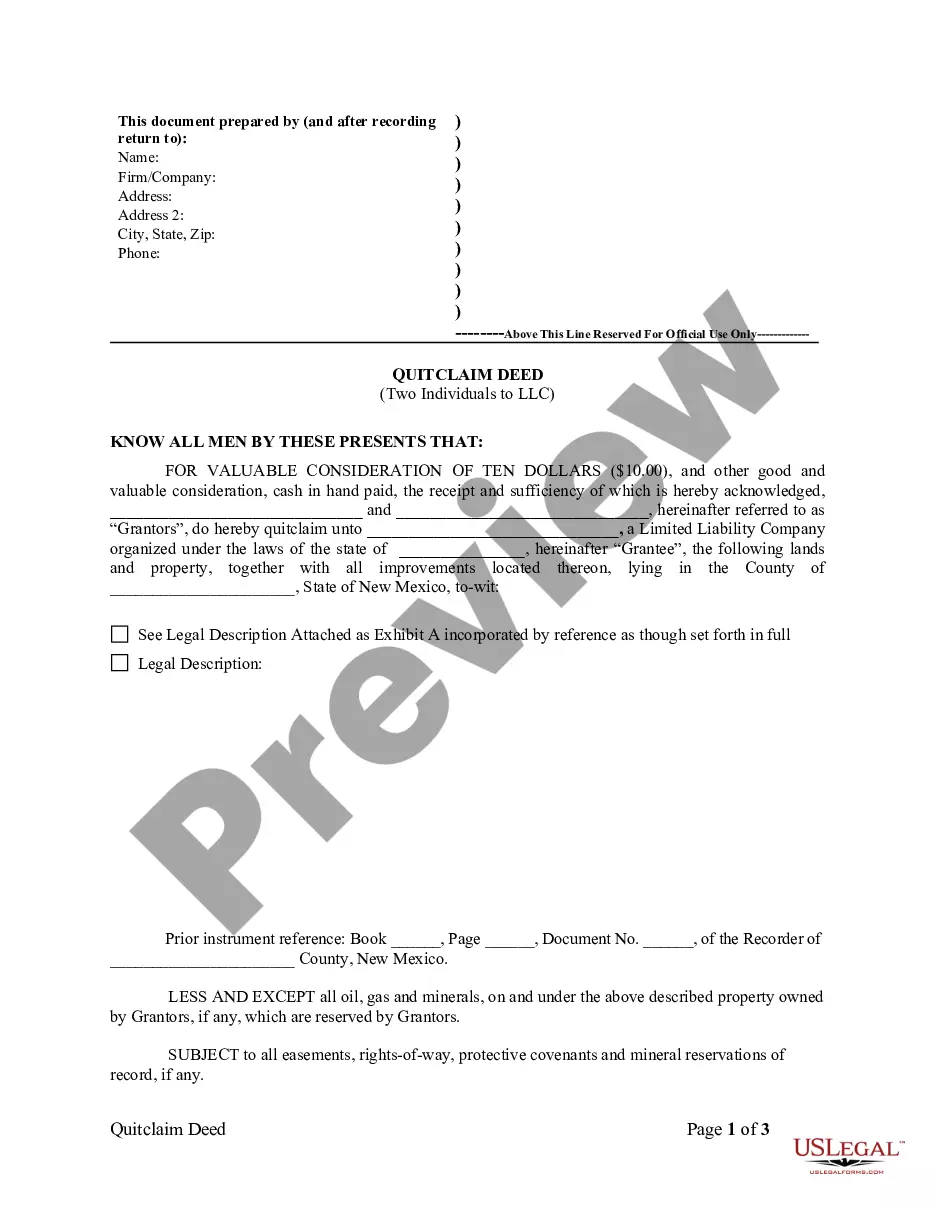

- Step 2. Use the Preview option to review the form’s content. Remember to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other variations of the legal form format.

Form popularity

FAQ

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

How to write a letter of explanationFacts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledgment. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.

If the court grants an objection to discharge, the debtor remains liable on every debt, as if the bankruptcy had not been filed. When an objection to dischargability is granted, only the particular debt at issue carries through after the bankruptcy as a personal liability of the debtor.

When drafting a Letter of Explanation for Bankruptcy, you need to state the reason you are submitting this explanation, record the type of bankruptcy you filed for, the timeline of the bankruptcy proceedings, and a brief description of the circumstances that led to the bankruptcy.

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased propertysuch as your car, boat, or homeor let it go back to the creditor.

Redemption is a tool available only in a Chapter 7 Bankruptcy. It allows you to pay off a loan by paying an amount equal to the value of the loan collateral. However, redemption may not be an option for all Chapter 7 debtors because it requires you to pay off the loan in a lump sum.

The reader should absolutely state his job loss as the reason for the bankruptcy. It will also help to provide any supporting documentation to prove his point. The worst explanation is that you got too deep in debt, couldn't pay your bills, and resorted to bankruptcy to get yourself out of trouble.

Retain: You tell the court you want to keep the property. You may have to pay some or all of the debt that goes with the property. If you want to retain the property, you must tell the court how you will pay the loan on it.

The disclosure statement is a document that must contain information concerning the assets, liabilities, and business affairs of the debtor sufficient to enable a creditor to make an informed judgment about the debtor's plan of reorganization. 11 U.S.C. § 1125.

Filing bankruptcy: The prosYou are granted an automatic stay.Relief from dealing with multiple creditors.A court-appointed representative.Prevention of further legal action.You may be able to keep some assets.Back taxes can be addressed.Can prevent foreclosure or car repossession.More items...?18-Jul-2018