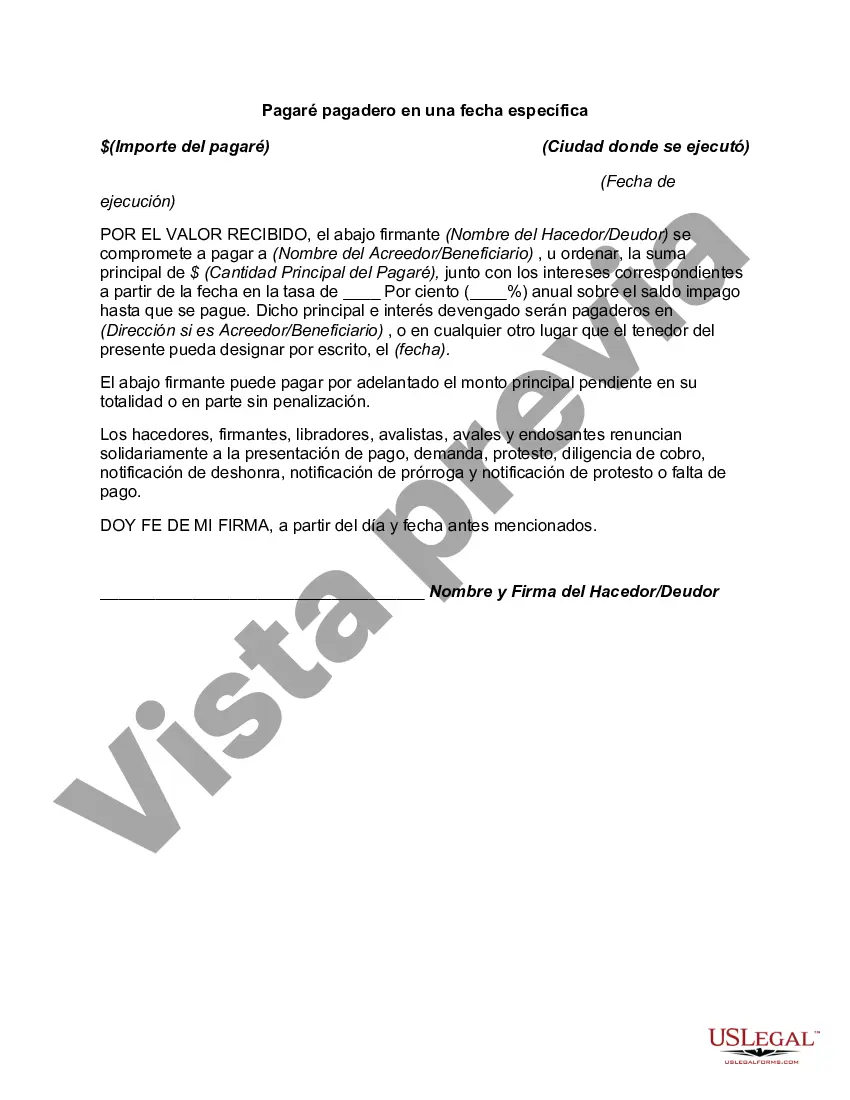

A promissory note is a legal document that outlines the terms of a loan agreement between a borrower and a lender. In Arkansas, a specific type of promissory note is known as the Arkansas Promissory Note Payable on a Specific Date. This type of promissory note is commonly used when a borrower needs to borrow a specific amount of money for a fixed period of time, with the intention of repaying the lender on a specific date. By including a specific payable date, both parties can have a clear understanding and expectation of when repayment is due. The Arkansas Promissory Note Payable on a Specific Date typically contains the following key elements: 1. Parties Involved: The note identifies the borrower, who is receiving the loan, and the lender, who is providing the funds. 2. Loan Amount: The note specifies the exact amount of money that is being borrowed by the borrower. This helps ensure there is no confusion regarding the loan amount. 3. Interest Rate: If applicable, the note outlines the interest rate that will be charged on the loan. This rate could be fixed or variable, depending on the terms agreed upon by both parties. 4. Repayment Terms: The note specifies the specific date on which the loan is due. It may also include information on the frequency of payments, such as monthly or quarterly, and the method of repayment, such as check, bank transfer, or automated debit. 5. Default and Remedies: The note usually includes provisions outlining what happens if the borrower fails to repay the loan on the specified date. This may include late payment penalties, default interest rates, or even legal consequences. Apart from the Arkansas Promissory Note Payable on a Specific Date, there are other types of promissory notes that can be found in Arkansas, including: 1. Arkansas Promissory Note Payable on Demand: This type of promissory note allows the lender to demand repayment at any time they choose, without specifying a fixed repayment date. 2. Arkansas Revolving Promissory Note: This note allows the borrower to borrow funds up to a predetermined credit limit and pay it back over time. The borrower has the flexibility to borrow and repay repeatedly within the credit limit. 3. Arkansas Secured Promissory Note: This note involves the borrower pledging specific collateral as security for the loan. If the borrower defaults, the lender can seize the collateral to repay the debt. In conclusion, the Arkansas Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions of a loan with a fixed repayment date. It provides clarity and protects the rights of both the borrower and the lender.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arkansas Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out Arkansas Pagaré Pagadero En Una Fecha Específica?

Have you been in the placement in which you require files for both company or person uses nearly every time? There are plenty of legal document web templates available online, but finding ones you can depend on is not simple. US Legal Forms offers a huge number of kind web templates, just like the Arkansas Promissory Note Payable on a Specific Date, that are created to satisfy federal and state specifications.

In case you are already informed about US Legal Forms web site and get an account, basically log in. After that, you may down load the Arkansas Promissory Note Payable on a Specific Date web template.

Unless you offer an bank account and need to begin to use US Legal Forms, follow these steps:

- Get the kind you require and make sure it is for your correct area/region.

- Take advantage of the Preview switch to examine the shape.

- Read the outline to actually have selected the right kind.

- If the kind is not what you are trying to find, take advantage of the Search area to obtain the kind that meets your requirements and specifications.

- Once you obtain the correct kind, just click Buy now.

- Select the prices prepare you would like, complete the desired information to produce your money, and pay for the order making use of your PayPal or charge card.

- Choose a hassle-free paper formatting and down load your copy.

Find all of the document web templates you possess purchased in the My Forms menu. You can get a further copy of Arkansas Promissory Note Payable on a Specific Date at any time, if required. Just select the essential kind to down load or printing the document web template.

Use US Legal Forms, probably the most extensive selection of legal kinds, to save lots of efforts and steer clear of mistakes. The assistance offers professionally made legal document web templates that can be used for a variety of uses. Generate an account on US Legal Forms and initiate generating your life a little easier.