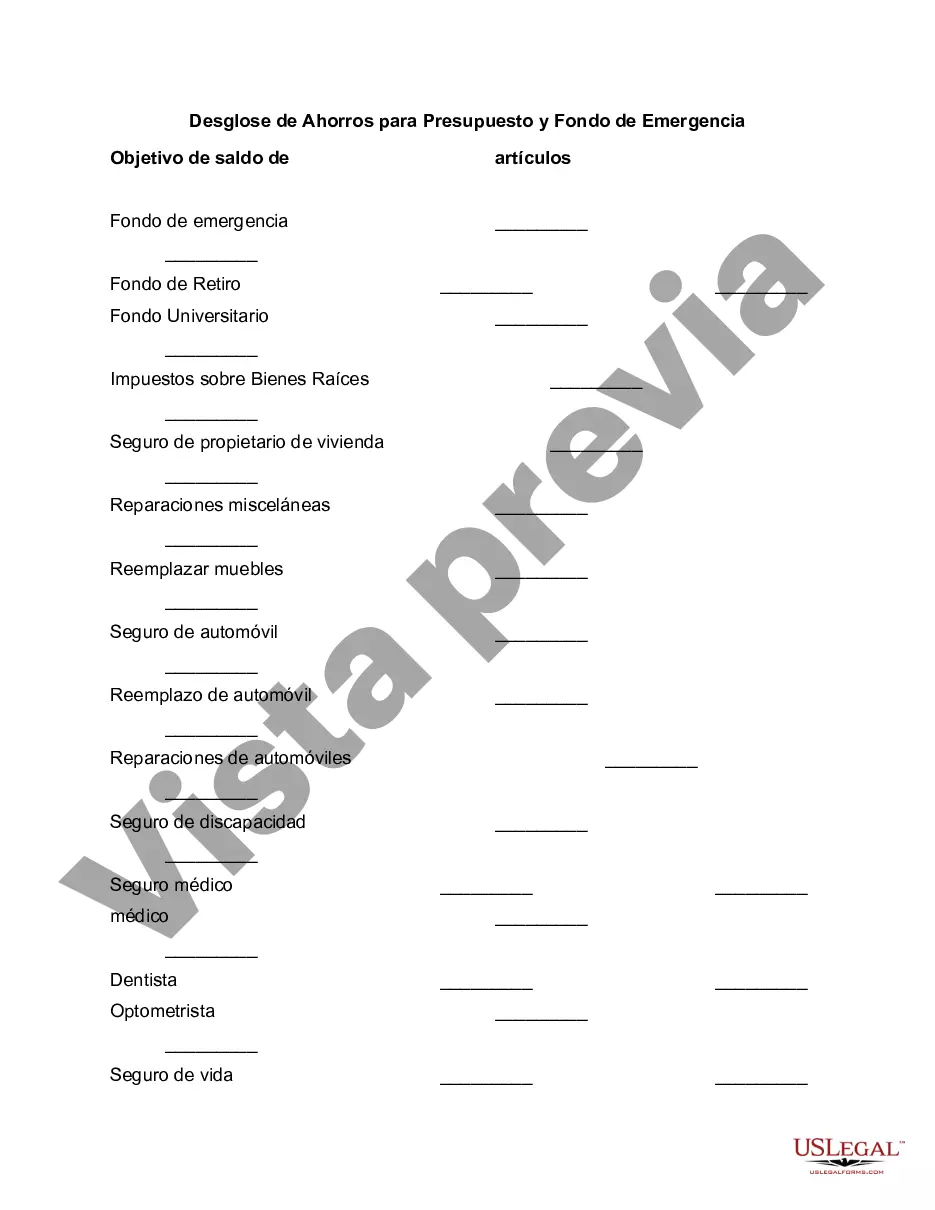

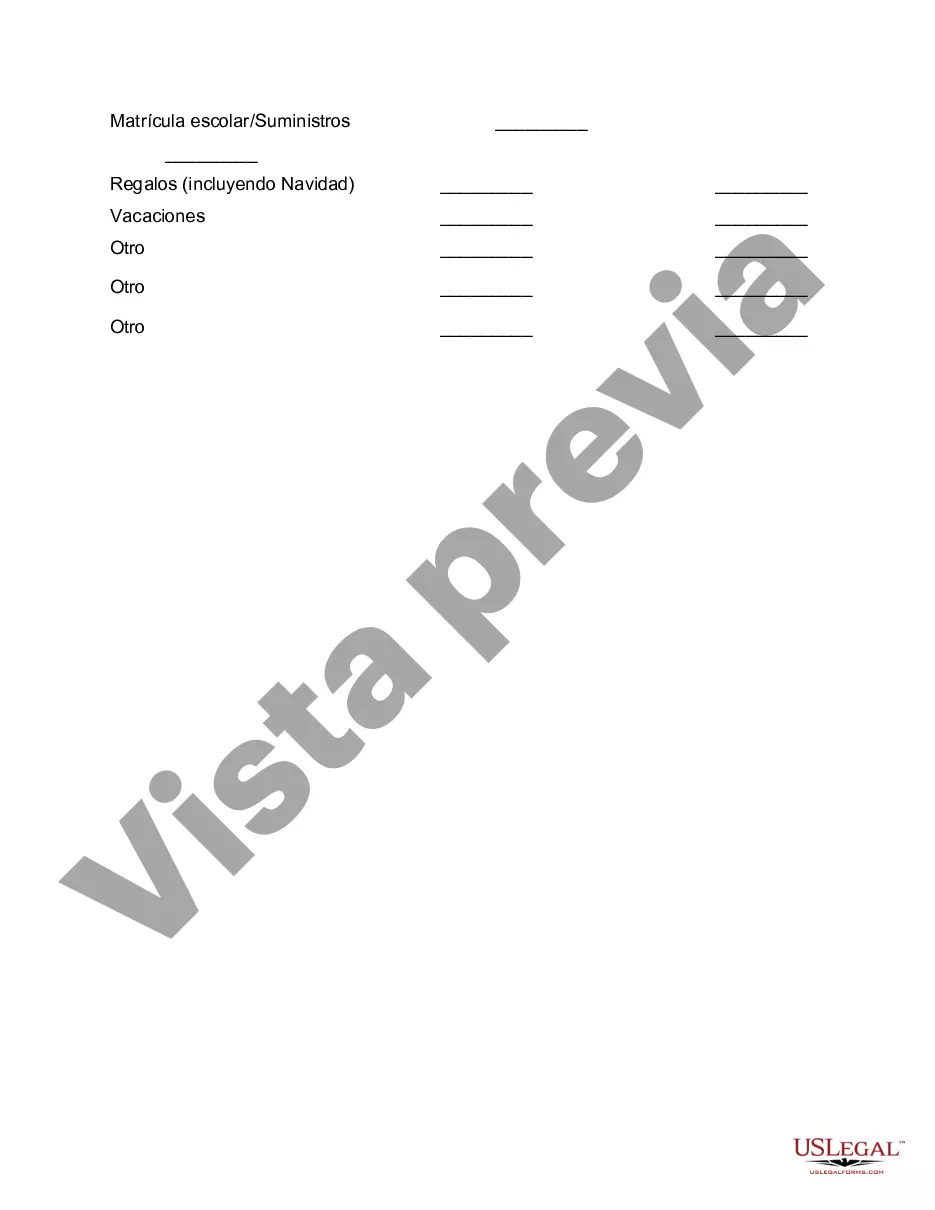

Arkansas Breakdown of Savings for Budget and Emergency Fund: In Arkansas, understanding the importance of financial planning and building a robust savings strategy is crucial. One integral aspect of financial planning is creating a breakdown of savings for both budgeting and emergency fund purposes. By allocating specific amounts to different categories, individuals and families in Arkansas can ensure they are prepared for unexpected expenses while also staying on track with their monthly budget. The breakdown of savings typically includes various categories to cover a range of financial needs. These categories may differ based on individual circumstances, but some common ones include: 1. Emergency Fund: An emergency fund serves as a safety net for unforeseen circumstances such as medical emergencies, car repairs, or sudden unemployment. Experts recommend setting aside three to six months' worth of living expenses in this fund. This ensures that Arkansas residents can handle unexpected events without resorting to high-interest loans or credit card debt. 2. Monthly Living Expenses: Another important category is allocating savings for monthly living expenses. This includes budgeting for groceries, utilities, rent or mortgage payments, transportation costs, and any other recurring bills. By having a separate savings account dedicated to covering these expenses, Arkansans can avoid dipping into their emergency fund unnecessarily. 3. Long-Term Goals: Savings for long-term goals is crucial to achieving financial stability. This may include saving for a down payment on a house, education expenses, retirement, or any other significant expenses. Setting aside a portion of the overall savings to invest in future plans can greatly benefit individuals and families in Arkansas. 4. Debt Repayment: For those dealing with existing debts, it's important to allocate a portion of savings to debt repayment. This could include credit card debt, student loans, or any other outstanding balances. Prioritizing debt repayment through savings can help improve credit scores and free up more funds for future financial goals. 5. Fun and Leisure: It is equally important to set aside a portion of savings for leisure activities or unexpected expenses that bring joy and relaxation to Arkansans. This category can be tailored to personal preferences and may include activities like vacations, hobbies, or dining out. By breaking down savings into these different categories, Arkansas residents can create a more comprehensive and manageable financial plan. It ensures they are prepared for emergencies while also actively working towards their long-term financial goals. It is important to review and adjust this breakdown periodically to adapt to changing circumstances and financial needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arkansas Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Arkansas Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

Choosing the best legitimate record design can be quite a have a problem. Of course, there are a lot of web templates available on the Internet, but how do you obtain the legitimate develop you want? Make use of the US Legal Forms site. The service offers a large number of web templates, including the Arkansas Breakdown of Savings for Budget and Emergency Fund, which you can use for business and personal requires. Each of the types are checked out by professionals and meet state and federal demands.

In case you are currently listed, log in for your accounts and then click the Obtain key to get the Arkansas Breakdown of Savings for Budget and Emergency Fund. Utilize your accounts to check from the legitimate types you possess purchased formerly. Proceed to the My Forms tab of the accounts and have yet another copy of the record you want.

In case you are a fresh customer of US Legal Forms, allow me to share simple directions that you can follow:

- Initial, ensure you have selected the right develop to your area/county. It is possible to check out the form making use of the Preview key and study the form description to make certain it is the right one for you.

- In case the develop will not meet your preferences, use the Seach industry to get the right develop.

- When you are certain that the form is acceptable, click the Acquire now key to get the develop.

- Opt for the pricing program you want and enter the needed information. Create your accounts and buy your order utilizing your PayPal accounts or charge card.

- Opt for the submit format and obtain the legitimate record design for your product.

- Full, edit and produce and sign the acquired Arkansas Breakdown of Savings for Budget and Emergency Fund.

US Legal Forms is the largest catalogue of legitimate types where you can find a variety of record web templates. Make use of the service to obtain professionally-created files that follow express demands.