Arkansas Annuity as Consideration for Transfer of Securities refers to a financial transaction in which an Arkansas resident transfers their securities holdings to an annuity provider in exchange for an annuity product. This arrangement allows individuals to convert their securities into a steady income stream over a specified period or for the rest of their life, providing financial security and stability. There are various types of Arkansas Annuities as Consideration for Transfer of Securities available, including: 1. Fixed Annuities: These annuities guarantee a fixed interest rate for a predetermined period, offering stable and predictable income. They are popular among conservative investors seeking a reliable income source. 2. Variable Annuities: Unlike fixed annuities, variable annuities offer the potential for higher returns through investment in various securities such as stocks, bonds, and mutual funds. The income generated fluctuates depending on the performance of the underlying investments. 3. Indexed Annuities: Indexed annuities tie their returns to a specific market index, such as the S&P 500. These products offer a guaranteed minimum return while participating in potential market gains, providing a balance between security and growth. 4. Immediate Annuities: Immediate annuities start providing regular income payments shortly after the transfer of securities. This type of annuity is suitable for those looking for immediate cash flow. 5. Deferred Annuities: Deferred annuities are designed to accumulate funds over a specific period, providing individuals with a future income stream. They are often chosen by individuals looking to supplement their retirement income. Arkansas' residents looking to diversify their investment portfolio, benefit from tax-deferred growth, and secure a reliable income for retirement can consider Arkansas Annuity as Consideration for Transfer of Securities. It is crucial for individuals to consult with financial advisors or annuity specialists to understand the pros and cons of each annuity type, assess their individual financial goals, and align their investment strategy accordingly.

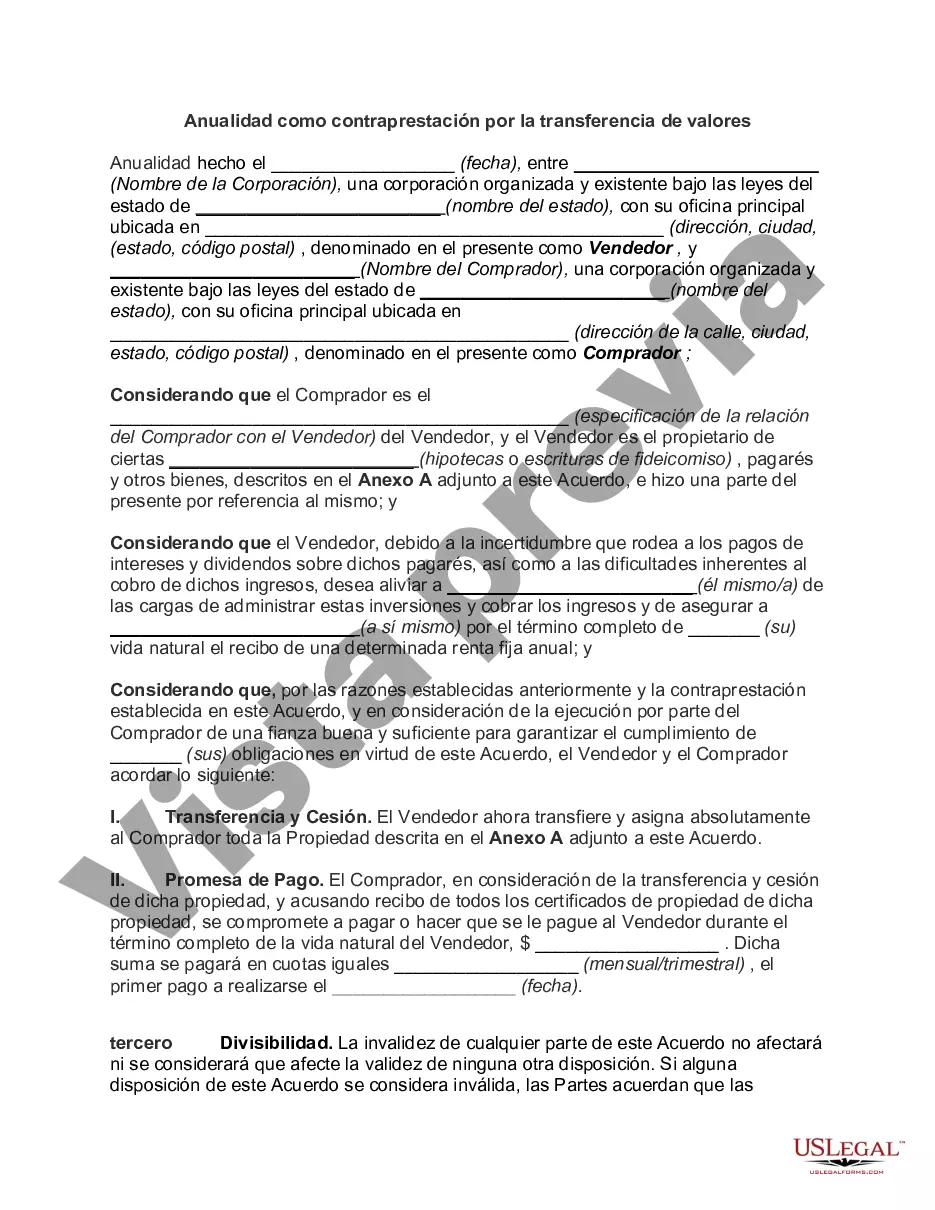

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arkansas Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out Arkansas Anualidad Como Contraprestación Por La Transferencia De Valores?

If you want to comprehensive, down load, or print out lawful document templates, use US Legal Forms, the greatest variety of lawful types, that can be found on-line. Take advantage of the site`s basic and hassle-free research to discover the paperwork you need. Different templates for company and individual purposes are sorted by types and says, or keywords. Use US Legal Forms to discover the Arkansas Annuity as Consideration for Transfer of Securities within a few mouse clicks.

In case you are currently a US Legal Forms client, log in to your bank account and click the Obtain key to find the Arkansas Annuity as Consideration for Transfer of Securities. You can also gain access to types you previously saved inside the My Forms tab of your bank account.

If you work with US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape for your right area/nation.

- Step 2. Use the Review method to look through the form`s content. Do not neglect to read the information.

- Step 3. In case you are not happy together with the kind, take advantage of the Research industry near the top of the monitor to get other versions from the lawful kind web template.

- Step 4. When you have discovered the shape you need, click the Acquire now key. Choose the rates prepare you like and include your qualifications to register for the bank account.

- Step 5. Process the deal. You can use your charge card or PayPal bank account to complete the deal.

- Step 6. Select the structure from the lawful kind and down load it on your device.

- Step 7. Total, edit and print out or sign the Arkansas Annuity as Consideration for Transfer of Securities.

Every single lawful document web template you acquire is your own property forever. You might have acces to every single kind you saved within your acccount. Go through the My Forms area and select a kind to print out or down load again.

Compete and down load, and print out the Arkansas Annuity as Consideration for Transfer of Securities with US Legal Forms. There are thousands of specialist and status-certain types you can use for your company or individual requires.