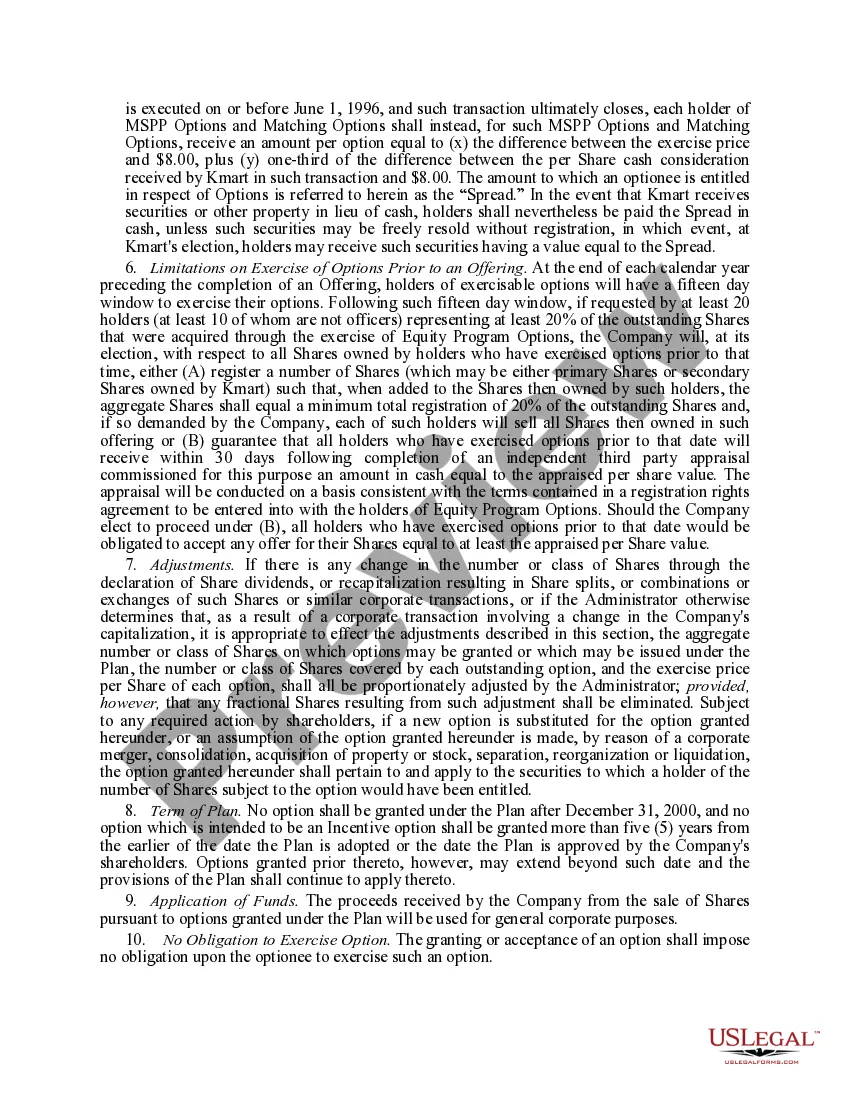

Arkansas Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options

Description

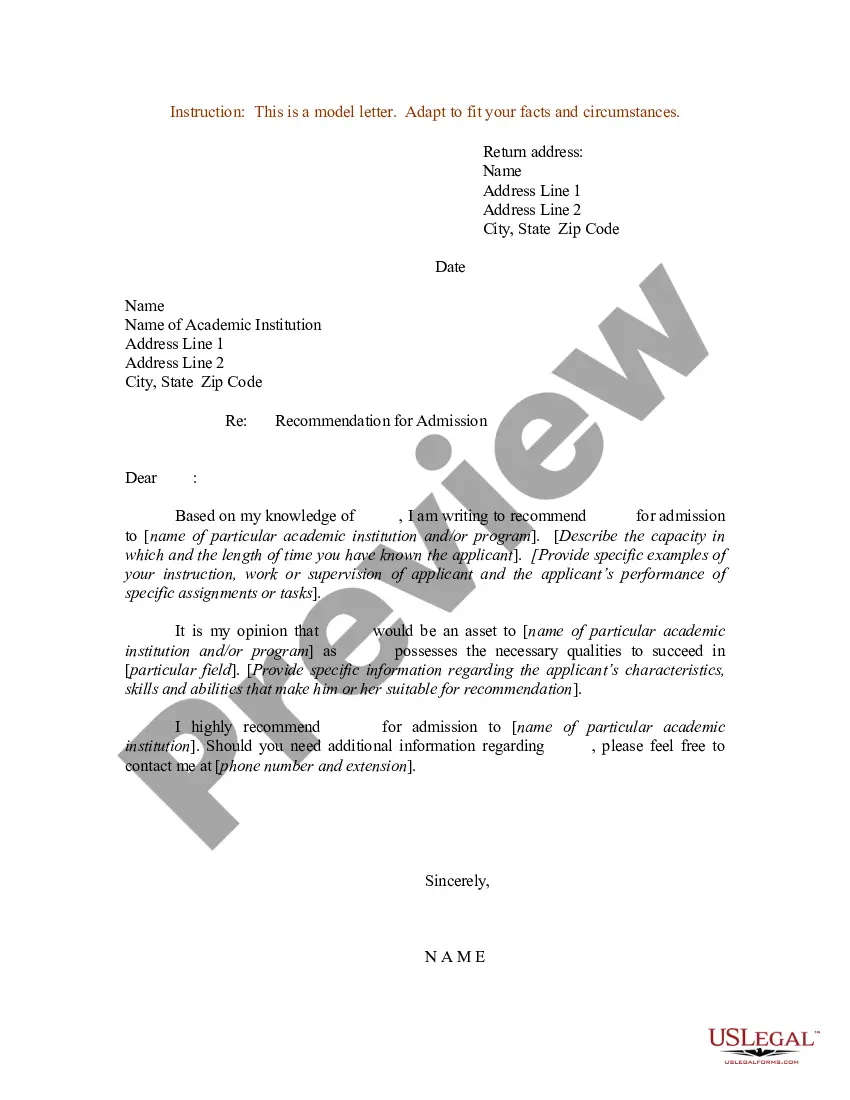

How to fill out Stock Option Plan Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options, And Exchange Options?

Discovering the right legitimate papers web template can be a battle. Obviously, there are plenty of themes available online, but how will you obtain the legitimate develop you require? Take advantage of the US Legal Forms web site. The services offers a huge number of themes, for example the Arkansas Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options, that you can use for business and personal demands. All the types are inspected by pros and meet up with state and federal needs.

In case you are currently authorized, log in to your profile and click on the Download key to find the Arkansas Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options. Make use of your profile to appear from the legitimate types you may have purchased in the past. Go to the My Forms tab of the profile and have an additional duplicate of the papers you require.

In case you are a whole new user of US Legal Forms, allow me to share simple instructions so that you can comply with:

- Initially, make certain you have selected the proper develop for your city/state. You may look through the form making use of the Review key and browse the form description to ensure this is the best for you.

- When the develop is not going to meet up with your expectations, take advantage of the Seach area to get the proper develop.

- When you are positive that the form is acceptable, click the Acquire now key to find the develop.

- Choose the pricing program you want and type in the essential information. Design your profile and pay for the transaction using your PayPal profile or charge card.

- Select the submit format and download the legitimate papers web template to your system.

- Full, change and produce and indicator the acquired Arkansas Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options.

US Legal Forms may be the greatest local library of legitimate types where you will find a variety of papers themes. Take advantage of the service to download expertly-created files that comply with status needs.

Form popularity

FAQ

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

There are two types of stock options: Options granted under an employee stock purchase plan or an incentive stock option (ISO) plan are statutory stock options. Stock options that are granted neither under an employee stock purchase plan nor an ISO plan are nonstatutory stock options.

Statutory stock options are usually not taxed until the taxpayer disposes of the options and any gains on the disposition are taxed as capital gains. In contrast, nonstatutory stock options, governed by the rules of IRC § 83, are not given favorable tax treatment.

Incentive Stock Options (ISO) are one example of a qualified stock option plan. With ISO plans, there is no tax due at the time the option is granted and no tax due at the time the option is exercised. Instead, the tax on the option is deferred until the time you sell the stock.

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment. ISOs are often awarded as part of an employee's hiring or promotion package.

Non-statutory stock options (NSOs) Give you the ability (or option) to buy company stock at the exercise price, which is hopefully a discount from the stock's current market price. Offered to company employees or non-employees like contractors and vendors.

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

Statutory stock options are a type of compensation offered by employers to their employees. These plans must come with a document denoting how many options are allotted to which employees. Statutory stock options provide an additional tax advantage not offered by unqualified or nonstatutory stock options.