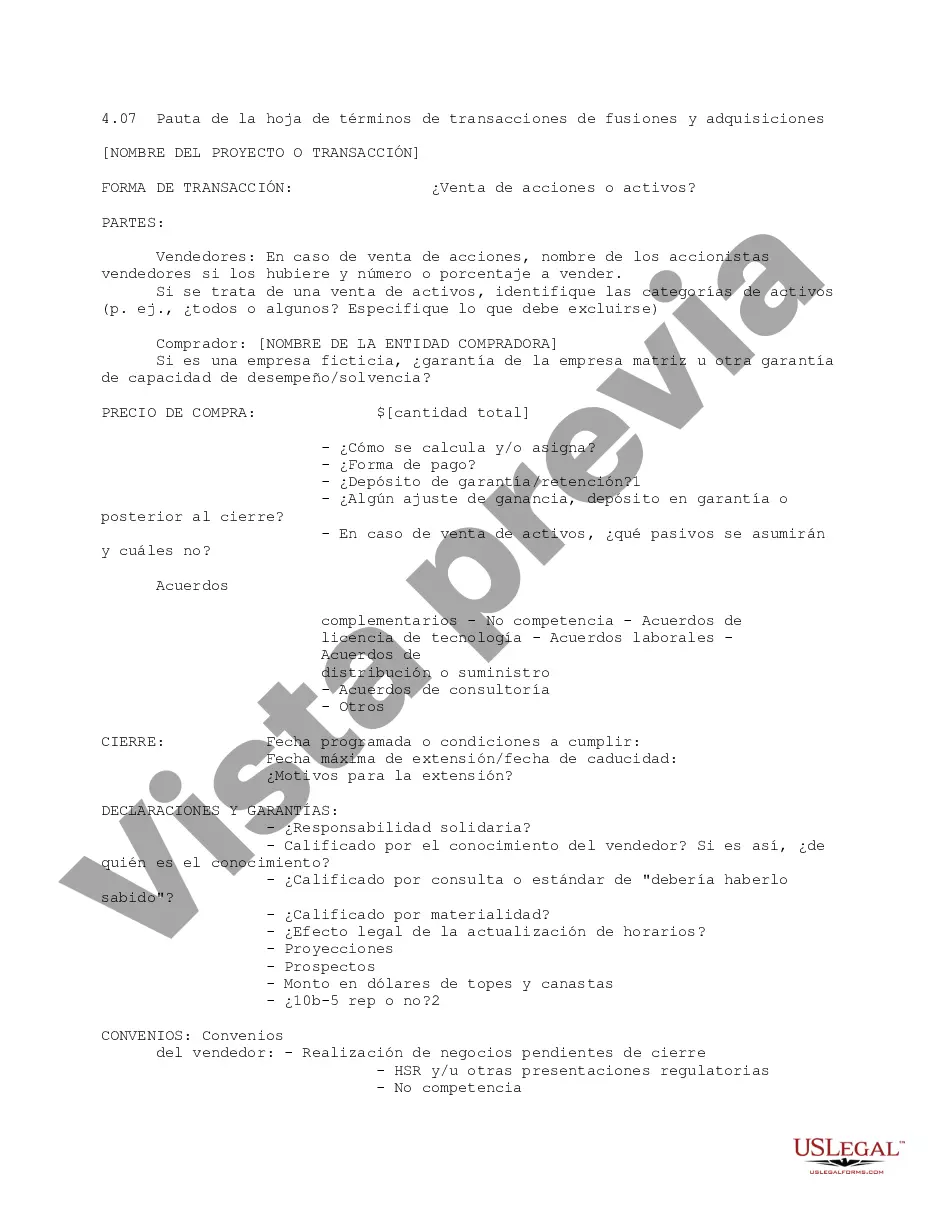

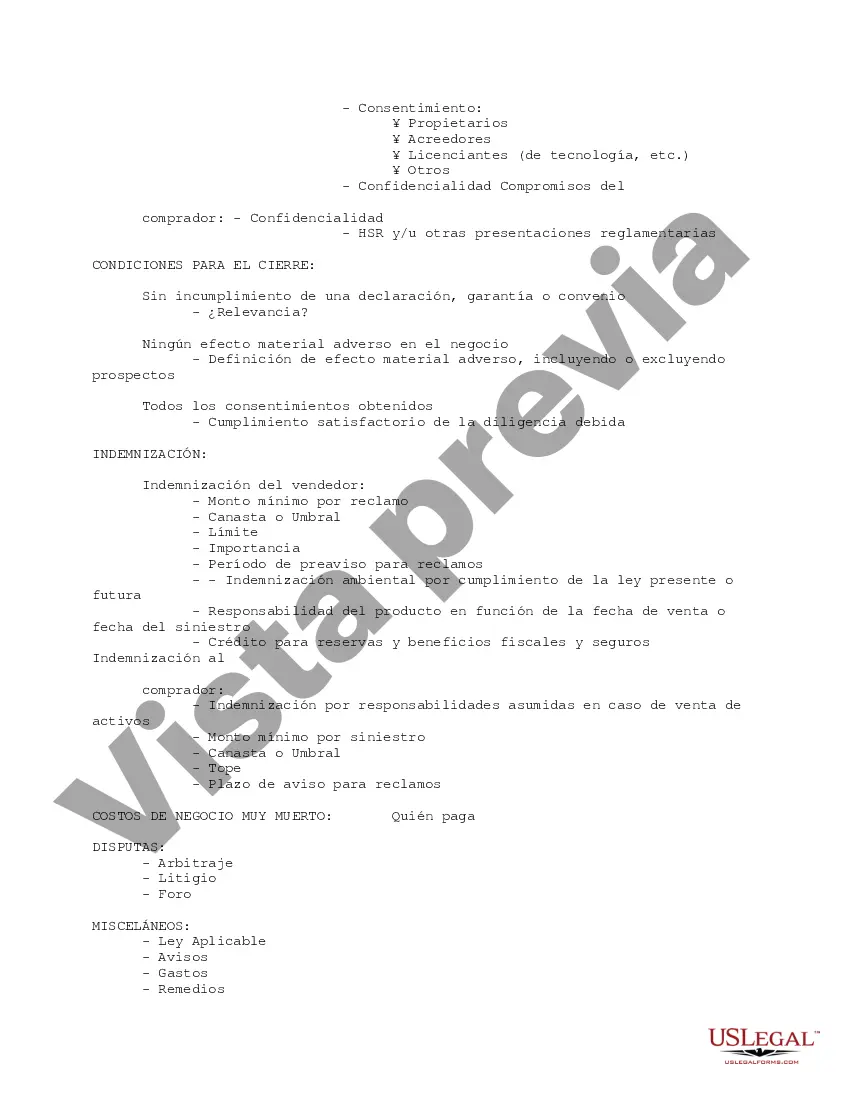

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

Arkansas M&A Transaction Term Sheet Guideline is a comprehensive document that outlines the terms and conditions of a merger or acquisition (M&A) deal specific to the state of Arkansas. This guideline serves as a framework to facilitate the negotiation and execution of M&A transactions in a structured manner, ensuring all parties involved understand and agree to the terms of the deal. The Arkansas M&A Transaction Term Sheet Guideline typically includes key provisions and details pertaining to the transaction, such as the parties involved, background information, transaction structure, purchase price and payment terms, representations and warranties, covenants, conditions precedent, closing conditions, and dispute resolution mechanisms. It is important to note that there can be different types of Arkansas M&A Transaction Term Sheet Guidelines depending on the nature of the deal or industry involved. For instance, there might be specific term sheets tailored for technology-related M&A transactions, healthcare M&A transactions, real estate M&A transactions, or any other sector-specific deals. Each type of Arkansas M&A Transaction Term Sheet Guideline may include industry-specific clauses that address unique considerations, regulatory requirements, and relevant legal frameworks. These guidelines aim to ensure compliance and clarity while accommodating the specific needs and nuances of different industries. By following the Arkansas M&A Transaction Term Sheet Guideline, parties involved in an M&A transaction can create a solid foundation for negotiation, due diligence, and subsequent agreement drafting. This guideline streamlines the deal-making process, minimizing potential disputes or misunderstandings by providing clear expectations and requirements from the outset. In summary, the Arkansas M&A Transaction Term Sheet Guideline is a crucial tool in facilitating successful M&A transactions in the state. Its purpose is to provide a standardized framework that covers essential aspects of the deal while allowing for customization based on industry-specific factors. By adhering to this guideline, buyers and sellers can navigate the complexities of M&A deals with confidence and transparency.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.