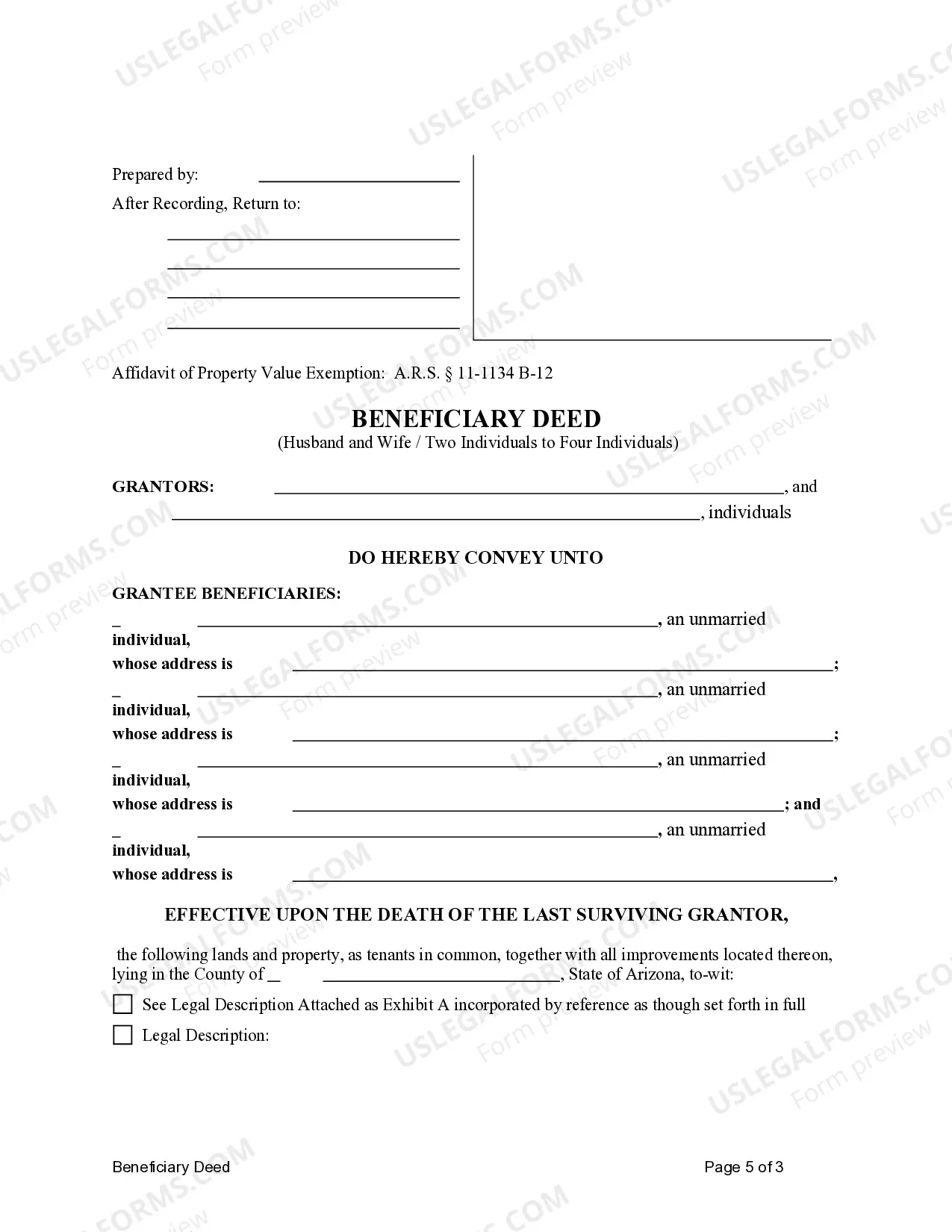

This form is a Transfer on Death Deed where the grantors are husband and wife and the grantees are four individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common . This deed complies with all state statutory laws.

Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals

Description

Key Concepts & Definitions

Transfer on Death Deed or TOD Beneficiary Deed: A legal document that allows property owners in the United States to pass their real estate directly to a beneficiary upon their death, bypassing the probate process. This deed is part of a broader estate planning strategy, aligning with tools like living trusts and financial planning to ensure a smooth transition of assets.

Step-by-Step Guide on Setting up a TOD Beneficiary Deed

- Choose a Beneficiary: Decide who you want to inherit the property. This can be a family member, friend, or organization.

- Contact a Law Firm: Seek legal advice to ensure compliance with your state's laws. A law firm specializing in estate planning can provide crucial guidance.

- Prepare the Deed: Your attorney will draft the Transfer on Death Deed, including all necessary legal descriptions of the property.

- Sign the Deed: You must sign the deed in the presence of a notary public to make it legally binding.

- Record the Deed: File the deed with the county recorders office where the property is located. This public recording formalizes the deed's effectiveness after your death.

Risk Analysis

- Credit Impact: Transferring property via a TOD does not typically affect your credit score directly. However, unresolved debts, including personal loans or bad credit, can complicate the beneficiary's ability to sell the property later.

- Legal Challenges: TOD deeds can be contested in court, typically by family members who were not named beneficiaries but who might claim an interest in the estate.

- Mismanagement: If the beneficiary lacks financial acumen, they might not manage the property effectively, potentially leading to financial loss or decreased property value.

Pros & Cons of Transfer on Death Deed

Pros:- Helps avoid the costly and time-consuming probate process.

- Can be revoked or modified during the property owner's lifetime.

- Immediate transfer of property upon death, allowing beneficiaries quick access to assets.

- May lead to family disputes if not all parties agree with the designation.

- Does not provide the same level of protection against creditors as some other estate planning methods like living trusts.

- Only affects real estate, so other parts of the estate will still require proper estate planning.

Best Practices

- Consult with Professionals: Always work with a legal professional familiar with estate laws in your state to draft and execute a TOD deed.

- Clear Communication: Discuss your estate planning decisions with all potential stakeholders to prevent misunderstandings and disputes after your death.

- Regular Updates: Review and update your TOD deed and other estate planning documents regularly, especially after major life events like marriages, divorces, or the birth of children.

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Four Individuals?

If you're looking for precise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Married Couples to Four Persons samples, US Legal Forms is what you require; obtain documents created and reviewed by state-licensed attorneys.

Using US Legal Forms not only saves you from issues regarding legal forms; furthermore, you save time, effort, and money! Downloading, printing, and completing a professional template is significantly less costly than hiring legal counsel to do it for you.

And that's it. With just a few simple steps, you have an editable Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Married Couples to Four Persons. Once you set up an account, all subsequent purchases will be processed even more smoothly. If you have a US Legal Forms subscription, just Log Into your profile and then hit the Download button found on the form's page. Subsequently, whenever you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time and energy comparing numerous forms across various websites. Obtain accurate copies from one secure service!

- To start, complete your registration process by entering your email and setting a secure password.

- Follow the outlined steps below to establish an account and locate the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Married Couples to Four Persons sample to address your needs.

- Utilize the Preview feature or review the document details (if available) to confirm that the template is suitable for your requirements.

- Verify its applicability in your residing state.

- Click on Buy Now to place an order.

- Choose an appropriate pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select a preferred format and download the document.

Form popularity

FAQ

Setting up a beneficiary deed in Arizona involves creating and signing a deed that designates beneficiaries who will inherit the property upon your passing. You must ensure that the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals is properly drafted and executed according to the state's requirements. After completing the deed, file it with the county recorder's office to ensure the beneficiaries' names are officially recorded.

In Arizona, when a spouse dies, the surviving spouse typically inherits the house if it was held in joint tenancy. If there is a valid Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals, the property will transfer directly to the specified beneficiaries without going through probate. The distribution also depends on whether the couple had a will or if the property was part of a trust.

To remove a deceased spouse from a property deed in Arizona, you'll need to first obtain a copy of the death certificate. If the property was held as joint tenants with rights of survivorship, the deed may automatically transfer to the surviving spouse. You must then file a new Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals to update the title and reflect current ownership.

To transfer a property deed from a deceased relative in Arizona, you will need to obtain the original deed and a certified copy of the death certificate. If the deceased had an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals, the property can be transferred to the designated beneficiaries without probate. You should file the new deed with the county recorder's office to complete the process fully.

Transfer on Death means that an asset, typically real estate, is transferred to named beneficiaries upon the owner's death. This process bypasses probate, allowing for a more efficient transfer of ownership. It's an integral aspect of the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals, ensuring your wishes are honored without lengthy legal procedures.

To file a Transfer on Death deed in Arizona, you will need to complete a specific form that outlines the details of the property and the designated beneficiaries. After filling out the form, it must be signed, notarized, and recorded with the county recorder's office in the county where the property is located. For a smooth process, consider using the resources available through uslegalforms, which can guide you in preparing your Arizona Transfer on Death Deed efficiently.

While an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals offers significant advantages, it also has some drawbacks. One disadvantage includes the potential for challenges from heirs who may feel overlooked. Additionally, property transferred through a TOD deed is not protected from creditors, which could impact the beneficiaries if debts exist at the time of death.

A Payable on Death (POD) account is similar to having a beneficiary, but they are not the same. A POD account is specifically for bank accounts, allowing the balance to be transferred to designated individuals upon the account holder's death. Conversely, a beneficiary deed pertains to real estate transactions and is critical to the planning process for property ownership in Arizona.

The terms 'beneficiary' and 'transfer on death' refer to different aspects of estate planning. A beneficiary is an individual designated to receive property after the owner’s death, while a transfer on death deed is the legal document that enables this transfer. Understanding this distinction is vital for effectively utilizing an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals.

Yes, a beneficiary deed can be contested in Arizona under certain circumstances. If there is evidence of undue influence, lack of capacity, or improper execution of the deed, interested parties may challenge its validity. This potential for contestation emphasizes the importance of proper legal guidance when drafting an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals.