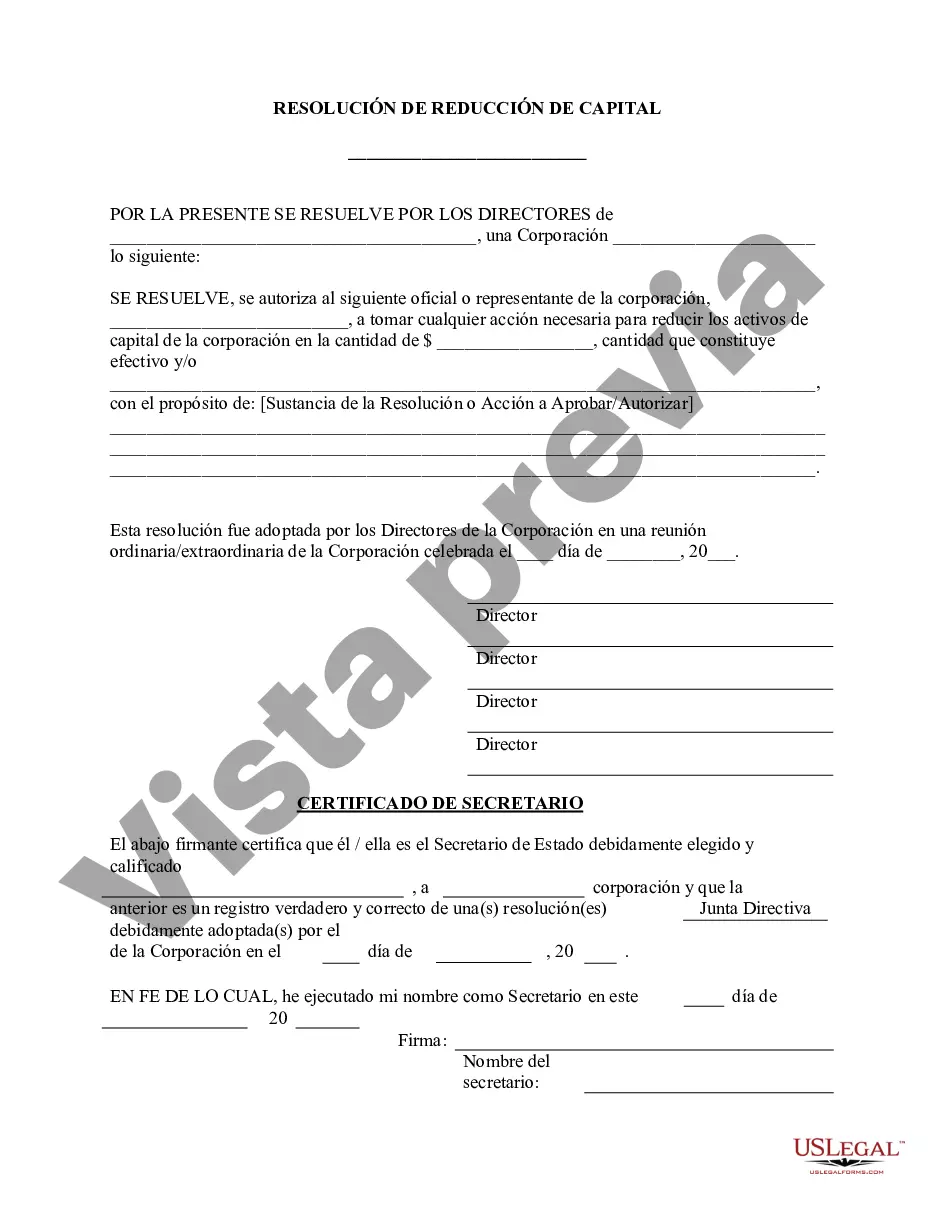

Arizona Reduce Capital- Resolution Form — Corporate Resolutions is a legal document used by corporations in Arizona to reduce the capital stock of the company. This form plays a crucial role in corporate decision-making and is required when an organization decides to decrease its stated capital. The primary purpose of this resolution form is to outline the details and justification for reducing the capital stock. It provides a roadmap for how the reduction will be implemented and communicates the intention to all stakeholders involved. The document is typically prepared by the board of directors, but it must be approved by shareholders through a formal voting process. The Arizona Reduce Capital — Resolution For— - Corporate Resolutions includes various sections to ensure all necessary information is included. Some key components of this document are: 1. Company Information: This section outlines the full legal name, address, and contact details of the corporation seeking to reduce its capital. It may also include the company's tax identification number and registration number. 2. Introduction: Here, the resolution form introduces the objective of reducing the capital stock. The reasons behind this decision may vary but commonly include consolidating capital, financial restructuring, returning excess capital to shareholders, or fulfilling legal requirements. 3. Statement of Resolution: This section articulates the specific resolution to reduce the capital, including the specific details such as the amount of reduction, whether it will be a decrease in the number of authorized shares or par value reduction, and any proposed changes to the company's articles of incorporation or bylaws. 4. Justification: The form requires a detailed explanation justifying the reduction of capital. This section highlights the rationale behind the decision, potential benefits, and impact on the company's financial position. It may also mention any legal or regulatory requirements that necessitate a decrease in capital. 5. Shareholder Approval: The resolution form includes provisions for obtaining shareholder approval, such as the date, time, and location of the meeting. It also outlines the quorum requirements and the majority needed for the resolution to pass. 6. Execution and Notarization: Lastly, the form includes spaces for the signatures of the board of directors or corporate officers involved in presenting the resolution. It may also require notarization to validate the authenticity of the document. It is important to note that there may be different types of Arizona Reduce Capital — Resolution Form— - Corporate Resolutions, depending on the specific circumstances and requirements of the corporation. Some of these variations may include: 1. Reduction in Authorized Capital: This type of resolution form focuses on decreasing the number of authorized shares available for issuance, thereby reducing the potential future equity capital. 2. Par Value Reduction: In some cases, the resolution form may propose a decrease in the par value assigned to each share, resulting in a proportionate decrease in the value of existing shares. 3. Capital Stock Consolidation: This type of resolution form outlines the consolidation of shares, combining multiple shares into one, reducing the total number of outstanding shares. Each type of resolution form will have its own specific provisions and requirements, tailored to the nature and purpose of the proposed capital reduction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Reducir Capital - Formulario de Resolución - Resoluciones Societarias - Reduce Capital - Resolution Form - Corporate Resolutions

Description

How to fill out Arizona Reducir Capital - Formulario De Resolución - Resoluciones Societarias?

Finding the right legal file format can be a have difficulties. Obviously, there are plenty of layouts available online, but how can you find the legal kind you need? Use the US Legal Forms internet site. The support delivers a large number of layouts, for example the Arizona Reduce Capital - Resolution Form - Corporate Resolutions, which you can use for organization and private requirements. Every one of the kinds are inspected by pros and satisfy federal and state demands.

If you are previously listed, log in to your account and click on the Obtain key to obtain the Arizona Reduce Capital - Resolution Form - Corporate Resolutions. Utilize your account to appear throughout the legal kinds you possess ordered earlier. Proceed to the My Forms tab of your own account and obtain an additional backup of your file you need.

If you are a new end user of US Legal Forms, allow me to share simple recommendations for you to follow:

- First, ensure you have chosen the proper kind for your town/area. You may look through the shape making use of the Review key and read the shape information to make sure it will be the best for you.

- If the kind fails to satisfy your needs, take advantage of the Seach area to find the appropriate kind.

- When you are sure that the shape is acceptable, click on the Get now key to obtain the kind.

- Select the rates prepare you desire and enter in the necessary information and facts. Build your account and pay money for an order using your PayPal account or credit card.

- Opt for the submit file format and download the legal file format to your product.

- Comprehensive, modify and produce and indicator the acquired Arizona Reduce Capital - Resolution Form - Corporate Resolutions.

US Legal Forms may be the biggest collection of legal kinds where you can see different file layouts. Use the service to download skillfully-manufactured papers that follow condition demands.