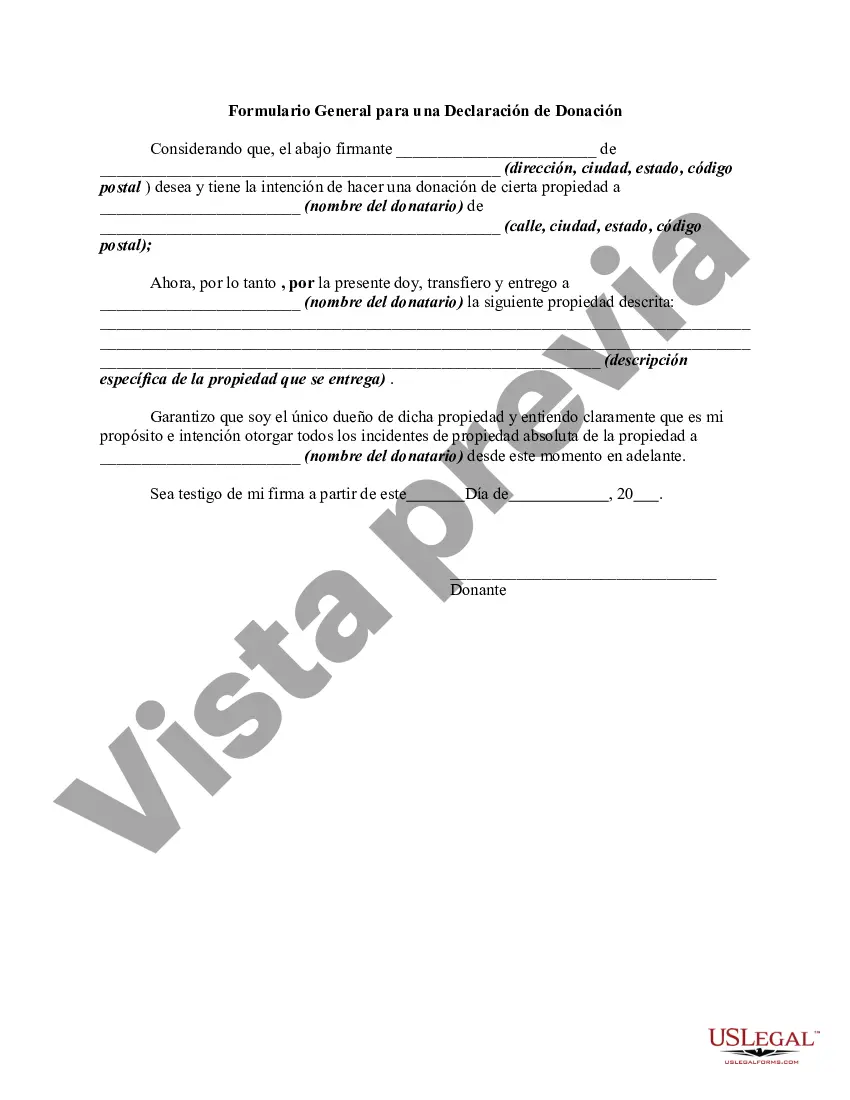

The following form is a general form for a declaration of a gift of property.

The Arizona Declaration of Gift is a legal document that enables individuals to make a voluntary and irrevocable transfer of their property or assets to another person or entity without receiving monetary compensation in return. This declaration is governed by Arizona's laws and regulations and serves as a means to allocate assets or property to beneficiaries or recipients. The Arizona Declaration of Gift holds immense significance in estate planning, wealth management, and gifting situations. It allows individuals to create a legal record of their intent to gift specific property or assets while alive. This document ensures clarity, minimizes disputes, and enables the smooth transfer of ownership to the intended recipient. There are different types of Arizona Declaration of Gift, each catering to specific circumstances and assets involved: 1. Real Estate and Personal Property Declaration of Gift: This type of declaration is commonly used when gifting real estate properties, vehicles, artwork, jewelry, or any tangible assets. It outlines the donor's intent to gift the mentioned property and provides a comprehensive description of the item(s) being gifted. 2. Financial Asset Declaration of Gift: This declaration is utilized when gifting financial assets such as stocks, bonds, mutual funds, or any other investment instruments. It specifies the donor's intention to gift the mentioned assets and may require additional documentation to transfer ownership officially. 3. Charitable Donation Declaration of Gift: This specific type of declaration is executed when individuals wish to donate their assets or money to charitable organizations or causes. It ensures that the donor's intentions are formally recorded, allowing the charity to acknowledge the donation and comply with legal requirements. 4. Gift of Intangible Property Declaration: This declaration deals with intangible assets like patents, copyrights, royalties, or intellectual property rights being gifted. It provides a legal framework for the transfer and establishes the ownership transition from the donor to the recipient. While the Arizona Declaration of Gift enables individuals to gift their assets without receiving payment, it is crucial to consult an attorney or legal professional familiar with Arizona's laws to ensure compliance, validity, and appropriate execution of the declaration.The Arizona Declaration of Gift is a legal document that enables individuals to make a voluntary and irrevocable transfer of their property or assets to another person or entity without receiving monetary compensation in return. This declaration is governed by Arizona's laws and regulations and serves as a means to allocate assets or property to beneficiaries or recipients. The Arizona Declaration of Gift holds immense significance in estate planning, wealth management, and gifting situations. It allows individuals to create a legal record of their intent to gift specific property or assets while alive. This document ensures clarity, minimizes disputes, and enables the smooth transfer of ownership to the intended recipient. There are different types of Arizona Declaration of Gift, each catering to specific circumstances and assets involved: 1. Real Estate and Personal Property Declaration of Gift: This type of declaration is commonly used when gifting real estate properties, vehicles, artwork, jewelry, or any tangible assets. It outlines the donor's intent to gift the mentioned property and provides a comprehensive description of the item(s) being gifted. 2. Financial Asset Declaration of Gift: This declaration is utilized when gifting financial assets such as stocks, bonds, mutual funds, or any other investment instruments. It specifies the donor's intention to gift the mentioned assets and may require additional documentation to transfer ownership officially. 3. Charitable Donation Declaration of Gift: This specific type of declaration is executed when individuals wish to donate their assets or money to charitable organizations or causes. It ensures that the donor's intentions are formally recorded, allowing the charity to acknowledge the donation and comply with legal requirements. 4. Gift of Intangible Property Declaration: This declaration deals with intangible assets like patents, copyrights, royalties, or intellectual property rights being gifted. It provides a legal framework for the transfer and establishes the ownership transition from the donor to the recipient. While the Arizona Declaration of Gift enables individuals to gift their assets without receiving payment, it is crucial to consult an attorney or legal professional familiar with Arizona's laws to ensure compliance, validity, and appropriate execution of the declaration.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.