The Arizona Bill of Transfer to a Trust is a legal document that allows an individual or entity to transfer their assets into a trust. A trust is a legal arrangement where a trustee is appointed to manage and distribute assets for the benefit of one or more beneficiaries. The purpose of the Arizona Bill of Transfer to a Trust is to ensure a smooth and efficient transfer of assets into a trust, while also protecting the rights and interests of the trust creator (also known as the granter) and the beneficiaries. There are several types of Arizona Bill of Transfer to a Trust, depending on the specific circumstances and preferences of the granter. These types may include: 1. Revocable Trust Transfer: In this type of transfer, the granter retains the right to revoke or amend the trust document at any time during their lifetime. This provides flexibility and control for the granter, allowing them to make changes as circumstances change. 2. Irrevocable Trust Transfer: With an irrevocable trust transfer, the granter permanently gives up their rights to the assets transferred into the trust. Once the transfer is made, the granter cannot alter or revoke the trust without the consent of the beneficiaries or court approval. 3. Testamentary Trust Transfer: This type of transfer takes place upon the death of the granter, as outlined in their Last Will and Testament. The trust is created and funded using assets from the granter's estate, and it becomes effective upon their passing. 4. Special Needs Trust Transfer: A special needs trust transfer is designed to provide for the needs of a disabled or incapacitated beneficiary without jeopardizing their eligibility for government benefits. This type of transfer allows the granter to leave funds in a trust that can be used to enhance the beneficiary's quality of life, without disqualifying them from important assistance programs. When preparing an Arizona Bill of Transfer to a Trust, it is crucial to consult with an experienced attorney who specializes in estate planning and trust law. They can guide the granter through the process, ensuring that all legal requirements and formalities are met. Moreover, the attorney can help select the most suitable type of trust transfer based on the granter's goals and objectives, while considering any potential tax implications or asset protection strategies. In conclusion, the Arizona Bill of Transfer to a Trust is a vital legal instrument to establish and fund a trust. By utilizing this document, individuals and entities can effectively transfer assets into a trust while safeguarding their interests and providing for their beneficiaries' future wellbeing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Factura de transferencia a un fideicomiso - Bill of Transfer to a Trust

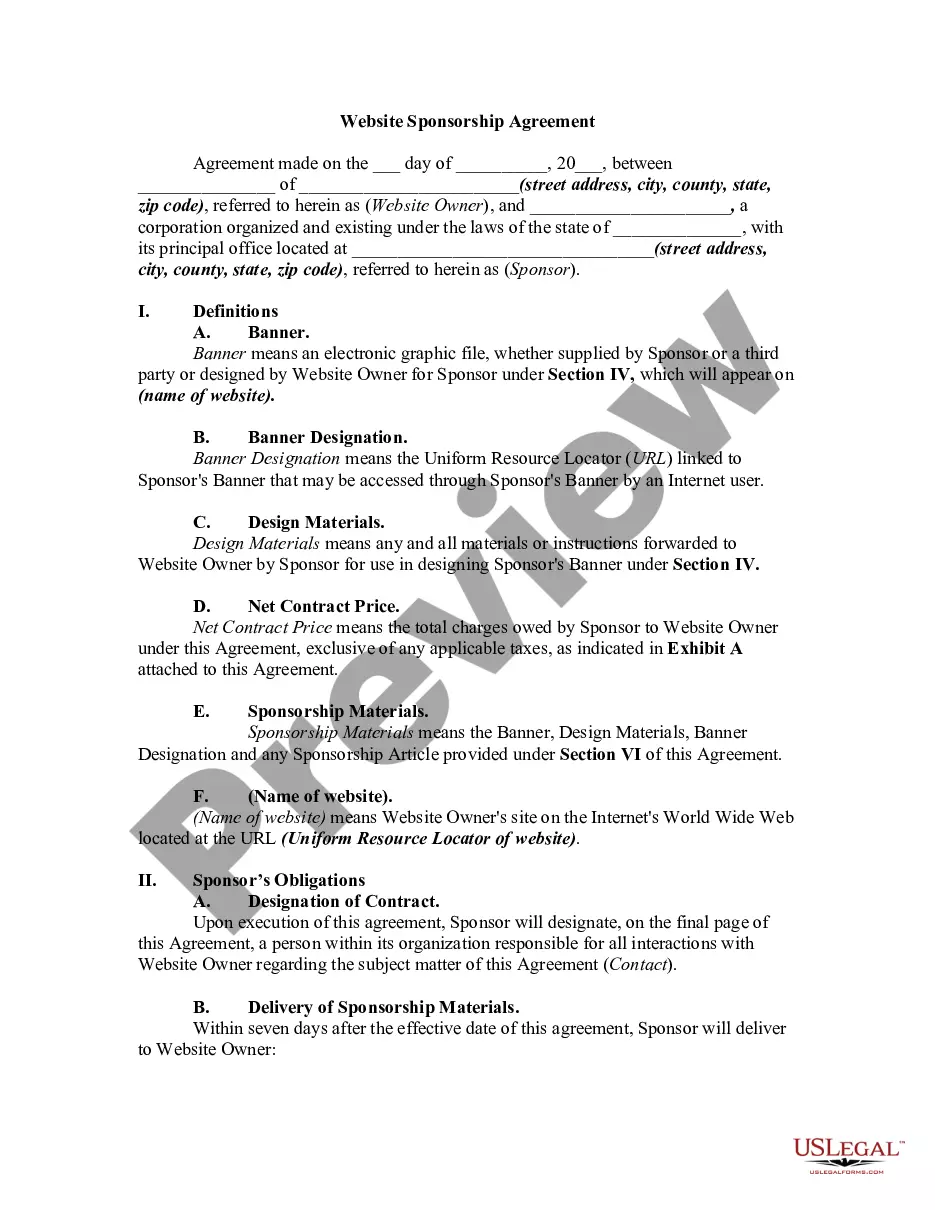

Description

How to fill out Arizona Factura De Transferencia A Un Fideicomiso?

It is possible to invest time online searching for the authorized papers web template which fits the state and federal demands you require. US Legal Forms offers a huge number of authorized types which can be examined by professionals. It is possible to obtain or print the Arizona Bill of Transfer to a Trust from your service.

If you already have a US Legal Forms account, you may log in and then click the Obtain key. Afterward, you may total, modify, print, or signal the Arizona Bill of Transfer to a Trust. Each and every authorized papers web template you get is the one you have forever. To acquire yet another duplicate of the purchased kind, visit the My Forms tab and then click the related key.

If you work with the US Legal Forms site the very first time, stick to the easy instructions listed below:

- Initial, ensure that you have selected the correct papers web template to the region/city of your liking. Read the kind description to ensure you have picked out the right kind. If readily available, use the Review key to search throughout the papers web template also.

- In order to get yet another edition from the kind, use the Research industry to get the web template that suits you and demands.

- Upon having identified the web template you desire, just click Buy now to proceed.

- Find the prices prepare you desire, type in your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your bank card or PayPal account to fund the authorized kind.

- Find the formatting from the papers and obtain it to your gadget.

- Make alterations to your papers if necessary. It is possible to total, modify and signal and print Arizona Bill of Transfer to a Trust.

Obtain and print a huge number of papers themes using the US Legal Forms web site, that offers the largest variety of authorized types. Use specialist and status-specific themes to take on your business or person needs.