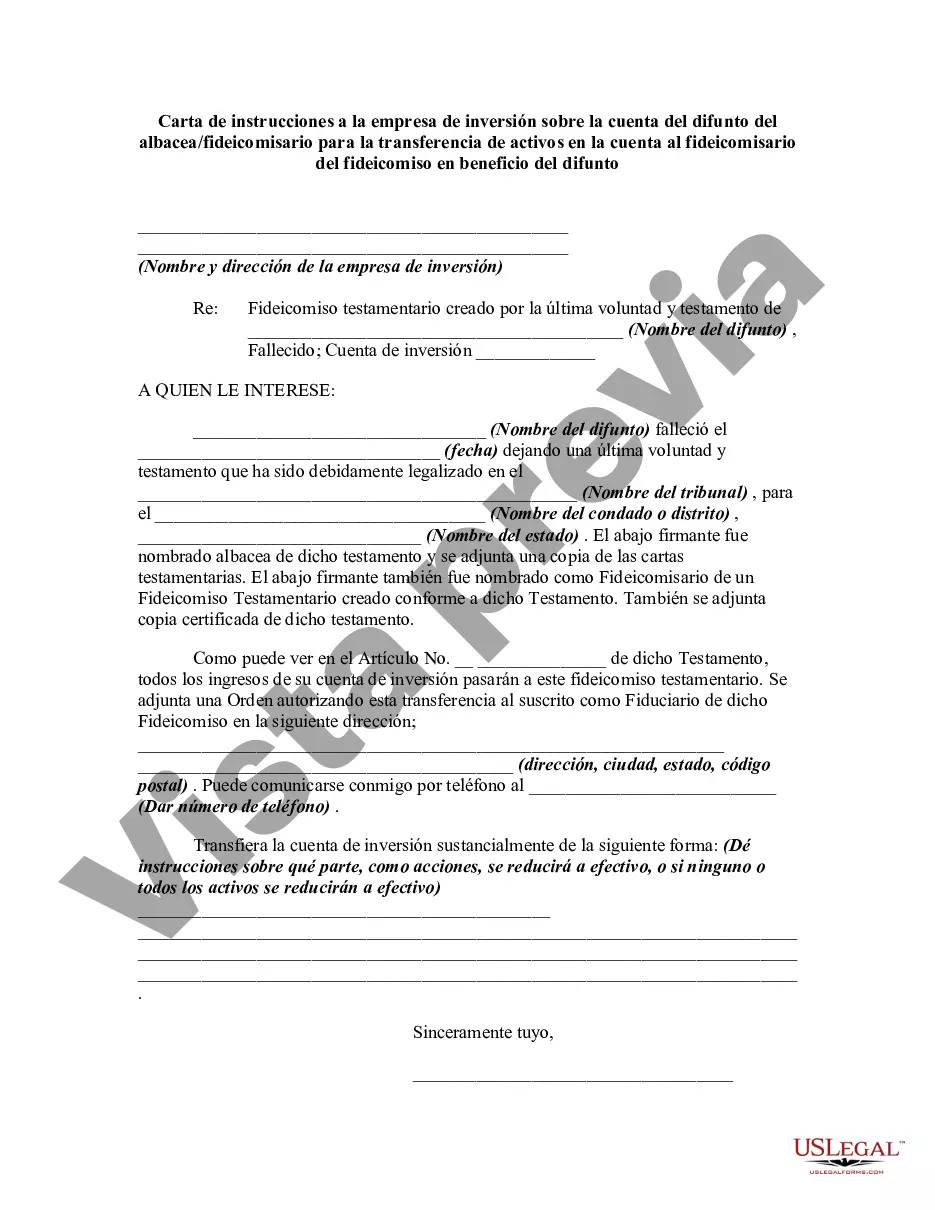

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Title: Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent Keywords: Arizona, letter of instruction, investment firm, account of decedent, executor, trustee, transfer of assets, trustee of trust, benefit of decedent Introduction: In the state of Arizona, when an individual passes away with assets held in an investment account, a Letter of Instruction to the Investment Firm becomes necessary. This letter is typically generated by the Executor or Trustee and aims to guide the investment firm in transferring the assets from the deceased account to the designated Trustee of the Trust, specifically set up for the benefit of the decedent. Types of Arizona Letters of Instruction: 1. Letter of Instruction from Executor: This type of letter is filed by the Executor of the deceased individual's estate. It outlines the necessary steps to be taken by the investment firm for asset transfer and provides specific instructions to ensure compliance with the decedent's intentions. 2. Letter of Instruction from Trustee: In cases where the assets are already held in a Trust, the Trustee files this letter to the investment firm. The Trustee provides detailed instructions to facilitate the seamless transfer of assets from the deceased individual's investment account to the Trust established for the benefit of the decedent. Components of an Arizona Letter of Instruction: 1. Identification Information: The letter should clearly identify the Executor/Trustee and the investment firm involved. This includes the full legal names, addresses, contact numbers, and any account or policy numbers relevant to the transfer. 2. Clearly State the Purpose: The letter should explicitly specify that it is a Letter of Instruction for the transfer of assets from the deceased individual's account to the designated Trustee of the Trust. 3. Detailed Asset List: The Executor/Trustee needs to provide a comprehensive list of assets held in the deceased individual's investment account. This should include descriptions, account numbers, account types, and estimated values to assist the investment firm in accurately processing the transfer. 4. Transfer Instructions: The letter should outline the exact instructions for the investment firm regarding the transfer process. This includes specifying the account or accounts from which assets are to be transferred, the desired timing, and any specific requirements relevant to the transfer. 5. Supporting Documentation: The Executor/Trustee must enclose any necessary documents in support of the asset transfer process. This may include certified copies of the death certificate, trust agreement, and letters testamentary or letters of administration. Conclusion: In Arizona, a Letter of Instruction to an investment firm regarding the account of a decedent is a crucial document that ensures the smooth transfer of assets from the deceased individual's investment account to the designated Trustee of the Trust for the benefit of the decedent. Executors and Trustees must provide detailed instructions, along with necessary documentation, to facilitate the asset transfer process and honor the wishes of the deceased.Title: Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent Keywords: Arizona, letter of instruction, investment firm, account of decedent, executor, trustee, transfer of assets, trustee of trust, benefit of decedent Introduction: In the state of Arizona, when an individual passes away with assets held in an investment account, a Letter of Instruction to the Investment Firm becomes necessary. This letter is typically generated by the Executor or Trustee and aims to guide the investment firm in transferring the assets from the deceased account to the designated Trustee of the Trust, specifically set up for the benefit of the decedent. Types of Arizona Letters of Instruction: 1. Letter of Instruction from Executor: This type of letter is filed by the Executor of the deceased individual's estate. It outlines the necessary steps to be taken by the investment firm for asset transfer and provides specific instructions to ensure compliance with the decedent's intentions. 2. Letter of Instruction from Trustee: In cases where the assets are already held in a Trust, the Trustee files this letter to the investment firm. The Trustee provides detailed instructions to facilitate the seamless transfer of assets from the deceased individual's investment account to the Trust established for the benefit of the decedent. Components of an Arizona Letter of Instruction: 1. Identification Information: The letter should clearly identify the Executor/Trustee and the investment firm involved. This includes the full legal names, addresses, contact numbers, and any account or policy numbers relevant to the transfer. 2. Clearly State the Purpose: The letter should explicitly specify that it is a Letter of Instruction for the transfer of assets from the deceased individual's account to the designated Trustee of the Trust. 3. Detailed Asset List: The Executor/Trustee needs to provide a comprehensive list of assets held in the deceased individual's investment account. This should include descriptions, account numbers, account types, and estimated values to assist the investment firm in accurately processing the transfer. 4. Transfer Instructions: The letter should outline the exact instructions for the investment firm regarding the transfer process. This includes specifying the account or accounts from which assets are to be transferred, the desired timing, and any specific requirements relevant to the transfer. 5. Supporting Documentation: The Executor/Trustee must enclose any necessary documents in support of the asset transfer process. This may include certified copies of the death certificate, trust agreement, and letters testamentary or letters of administration. Conclusion: In Arizona, a Letter of Instruction to an investment firm regarding the account of a decedent is a crucial document that ensures the smooth transfer of assets from the deceased individual's investment account to the designated Trustee of the Trust for the benefit of the decedent. Executors and Trustees must provide detailed instructions, along with necessary documentation, to facilitate the asset transfer process and honor the wishes of the deceased.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.