This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Arizona Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions between the client and the credit counseling agency in the state of Arizona. This agreement is specifically designed to address the needs of individuals seeking assistance in managing their debts and improving their financial situation. Below are some relevant keywords and types of Arizona Agreement for Credit Counseling Services: 1. Debt Management Plan (DMP): This type of agreement is focused on developing a personalized plan to repay the client's debts. The agreement will highlight the terms of the DMP, including the proposed monthly payment, interest rates, and the duration of the plan. 2. Financial Education: Some credit counseling agreements in Arizona also include provisions for financial education. This can include workshops, online courses, or one-on-one counseling sessions to help clients gain a better understanding of budgeting, saving, and improving their overall financial literacy. 3. Credit Score Improvement: In certain cases, the agreement may also address strategies to repair and improve the client's credit score. This can involve creating a personalized action plan to address negative credit reporting, disputes with creditors, and implementing strategies to establish a positive credit history. 4. Housing Counseling: The Arizona Agreement for Credit Counseling Services may include provisions for housing counseling. This can involve assisting clients in understanding mortgage options, preventing foreclosure, or finding affordable housing alternatives. 5. Bankruptcy Counseling: In cases where bankruptcy is being considered, the agreement may outline the requirement for pre-filling bankruptcy counseling as mandated by the Bankruptcy Code. The credit counseling agency will offer counseling services to help clients understand the implications of bankruptcy and explore alternative options. 6. Data Privacy and Confidentiality: The agreement will clearly outline the privacy and confidentiality policy of the credit counseling agency, ensuring that the client's personal and financial information is kept secure and not disclosed to unauthorized parties. 7. Termination and Withdrawal: The agreement should include provisions for termination and withdrawal from the credit counseling services. This can outline any fees or penalties associated with early termination, the procedure for canceling services, and any applicable refund policies. It is important to note that the exact content and types of agreements may vary depending on the specific credit counseling agency and the services they offer. Clients are advised to carefully review the agreement and seek clarification on any terms or provisions they may not understand before signing.The Arizona Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions between the client and the credit counseling agency in the state of Arizona. This agreement is specifically designed to address the needs of individuals seeking assistance in managing their debts and improving their financial situation. Below are some relevant keywords and types of Arizona Agreement for Credit Counseling Services: 1. Debt Management Plan (DMP): This type of agreement is focused on developing a personalized plan to repay the client's debts. The agreement will highlight the terms of the DMP, including the proposed monthly payment, interest rates, and the duration of the plan. 2. Financial Education: Some credit counseling agreements in Arizona also include provisions for financial education. This can include workshops, online courses, or one-on-one counseling sessions to help clients gain a better understanding of budgeting, saving, and improving their overall financial literacy. 3. Credit Score Improvement: In certain cases, the agreement may also address strategies to repair and improve the client's credit score. This can involve creating a personalized action plan to address negative credit reporting, disputes with creditors, and implementing strategies to establish a positive credit history. 4. Housing Counseling: The Arizona Agreement for Credit Counseling Services may include provisions for housing counseling. This can involve assisting clients in understanding mortgage options, preventing foreclosure, or finding affordable housing alternatives. 5. Bankruptcy Counseling: In cases where bankruptcy is being considered, the agreement may outline the requirement for pre-filling bankruptcy counseling as mandated by the Bankruptcy Code. The credit counseling agency will offer counseling services to help clients understand the implications of bankruptcy and explore alternative options. 6. Data Privacy and Confidentiality: The agreement will clearly outline the privacy and confidentiality policy of the credit counseling agency, ensuring that the client's personal and financial information is kept secure and not disclosed to unauthorized parties. 7. Termination and Withdrawal: The agreement should include provisions for termination and withdrawal from the credit counseling services. This can outline any fees or penalties associated with early termination, the procedure for canceling services, and any applicable refund policies. It is important to note that the exact content and types of agreements may vary depending on the specific credit counseling agency and the services they offer. Clients are advised to carefully review the agreement and seek clarification on any terms or provisions they may not understand before signing.

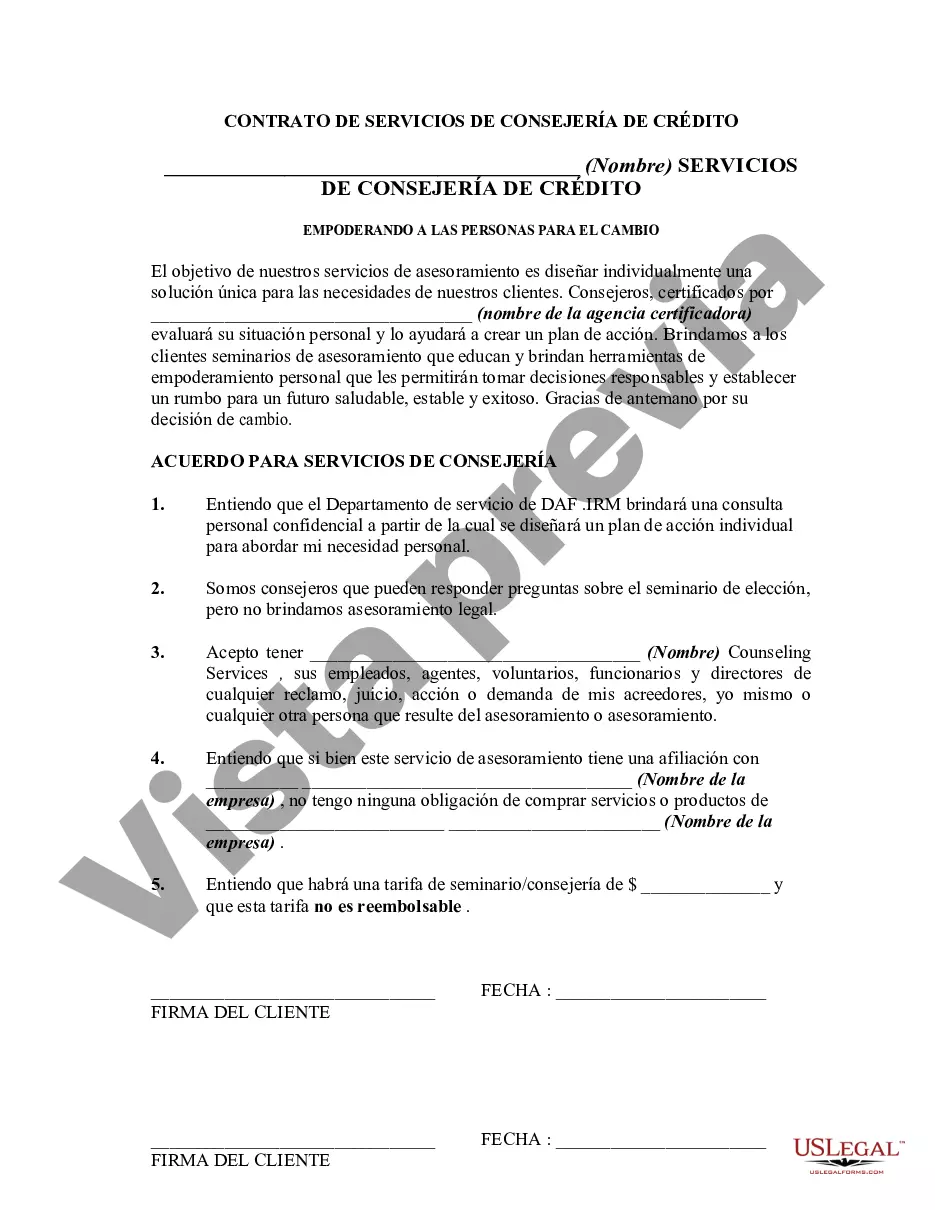

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.