This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arizona Agreement to Extend Debt Payment

Description

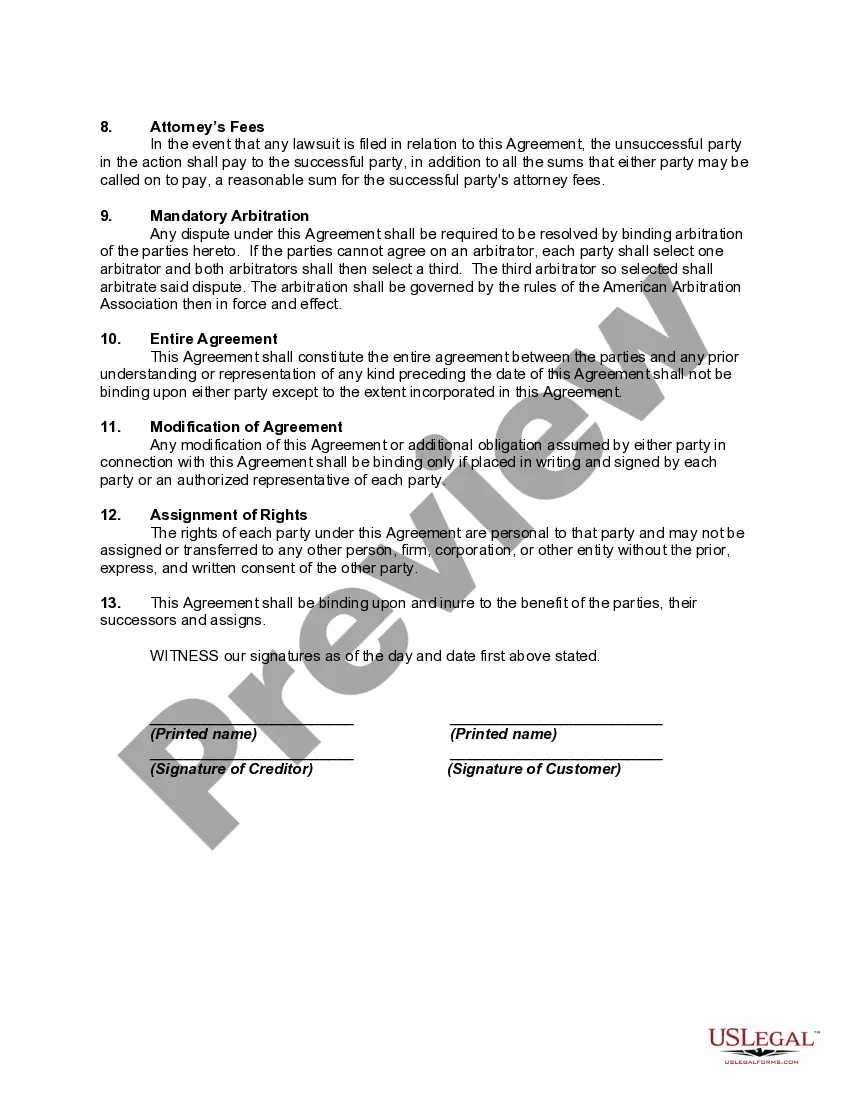

How to fill out Agreement To Extend Debt Payment?

It is feasible to dedicate multiple hours online attempting to locate the sanctioned document template that fulfills the state and federal requirements you need.

US Legal Forms provides numerous legal templates that are examined by experts.

You can conveniently download or print the Arizona Agreement to Extend Debt Payment using my service.

If available, utilize the Preview button to review the document template as well.

- If you own a US Legal Forms account, you may Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Arizona Agreement to Extend Debt Payment.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click the appropriate button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your county/city of choice.

- Review the form information to confirm you have chosen the right form.

Form popularity

FAQ

Arizona does not provide an automatic extension for transaction privilege tax payments. However, taxpayers may file an Arizona Agreement to Extend Debt Payment to request an extension under certain circumstances. By using this agreement, you can gain more time to fulfill your payment responsibilities without incurring severe penalties. Being proactive with your tax obligations is essential to maintain good standing.

In Arizona, the penalty for late payment of transaction privilege tax (TPT) can vary depending on the specific situation. Usually, interest and penalties can accumulate, increasing the total amount owed. To avoid these penalties, many businesses use the Arizona Agreement to Extend Debt Payment, which offers flexibility in managing tax obligations. This agreement can help you stay compliant and mitigate financial strain.

Arizona generally does not grant automatic extensions for payments or filings, but you can request an extension before the deadline. This is particularly relevant when dealing with your Arizona Agreement to Extend Debt Payment, as it allows you to plan your finances accordingly. Always check the Arizona Department of Revenue for any updates or specific procedures regarding extensions.

Yes, Arizona does accept federal extension partnerships when they align with state guidelines. This can benefit businesses looking to manage their finances more effectively. If you are seeking an Arizona Agreement to Extend Debt Payment, understanding your obligations with federal extensions can provide clarity and peace of mind.

To apply for a Transaction Privilege Tax (TPT) in Arizona, start by visiting the Arizona Department of Revenue website. You can complete your application online or download the necessary forms. A well-prepared application ensures you can better manage your Arizona Agreement to Extend Debt Payment, making it easier to navigate your financial obligations.

In Arizona, partnership extensions are not automatically granted. Taxpayers must actively file for an extension, such as those outlined in the Arizona Agreement to Extend Debt Payment, to ensure that their filing deadlines are appropriately extended. Taking this proactive approach allows partnerships to navigate their financial obligations effectively and without unnecessary penalties.

Underpaying taxes, even with an extension, can result in penalties that increase based on the unpaid amount. When dealing with the Arizona Agreement to Extend Debt Payment, it is crucial to estimate tax liability accurately to minimize these penalties. Taking advantage of extended deadlines doesn't eliminate responsibilities but can provide more time to meet your obligations responsibly.

Failing to file an extension in Arizona can lead to penalties that accumulate over time. The penalty typically amounts to a percentage of the total tax owed, and it can add significant costs if no action is taken. By proactively managing your obligations with the Arizona Agreement to Extend Debt Payment, you can avoid costly penalties and maintain financial peace of mind.

Payment type 204 in Arizona refers to a specific form of tax payment that allows taxpayers to extend their tax payment deadlines. This extension is linked to the Arizona Agreement to Extend Debt Payment, which helps individuals manage their financial obligations more efficiently. Utilizing this option can relieve immediate financial pressure, ensuring that taxpayers have adequate time to arrange necessary funds.

In Arizona, the penalty for extension underpayment can range depending on the amount owed and the length of time the payment is overdue. Generally, penalties and interest will compound, which can increase your financial responsibility. To manage this situation better, an Arizona Agreement to Extend Debt Payment can provide a strategic approach, enabling you to handle payments without accruing additional penalties.