A stock subscription is an agreement to purchase, at a stated price, a stated number of shares of stock of a corporation which is to be formed. Unless some restriction appears in the enabling statute or in the articles or certificate of incorporation, any natural person, and any corporation with the appropriate power, may be a subscriber to corporate stock. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A stock subscription agreement is a legally binding contract between a company and individual subscribers (commonly known as investors) who wish to purchase securities (stocks) of that company. In the state of Arizona, several types of stock subscription agreements exist, tailored to the different circumstances and requirements of multiple subscribers. Let's delve into a detailed description of what an Arizona Stock Subscription Agreement Among Several Subscribers entails. Keywords: Arizona, stock subscription agreement, subscribers, securities, investors, contract, stocks. Arizona Stock Subscription Agreement Among Several Subscribers: An Arizona Stock Subscription Agreement Among Several Subscribers is a specific type of contract utilized in the state of Arizona when multiple individuals or entities (subscribers) wish to invest in a company by purchasing its stocks or other securities. This agreement serves as a legal document that outlines the terms and conditions of the investment, clarifying the obligations and rights of both the company and the subscribers. In this agreement, the subscribers agree to purchase a specific number of shares or a predetermined dollar amount of stock from the company. The agreement typically includes provisions regarding the purchase price, payment terms, and any additional terms agreed upon between the parties. The subscribers may also have the option to choose the type of securities they wish to acquire, such as common or preferred stock. The Arizona Stock Subscription Agreement Among Several Subscribers includes provisions related to the transferability of the subscribed securities, restrictions on resale, and any applicable limitations on the subscribers' ability to sell or transfer the stocks. It may also address issues such as shareholder rights, board representation, and any protective provisions to safeguard the subscribers' investments. Different types of Arizona Stock Subscription Agreements: 1. Common Stock Subscription Agreement: This type of agreement involves the purchase of common shares in the company, entitling the subscribers to voting rights and potential dividends but offering limited priority rights in case of liquidation or distribution of assets. 2. Preferred Stock Subscription Agreement: This agreement pertains to the purchase of preferred shares, which generally offer preferential treatment in terms of dividends, liquidation proceeds, and voting rights. Preferred stockholders usually have a higher claim on company assets and earnings compared to common stockholders. 3. Convertible Stock Subscription Agreement: This type of agreement allows subscribers to purchase convertible securities, typically convertible preferred shares, which offer the option to convert their holdings into common shares at a later date or upon certain predetermined events, such as an initial public offering (IPO). 4. Restricted Stock Subscription Agreement: In this agreement, the subscribers acquire restricted stock that comes with certain limitations and restrictions on its transfer or sale until specific conditions are met, such as achieving certain performance milestones, reaching a specific vesting period, or obtaining regulatory approval. With the ever-evolving needs of investors and companies in Arizona, these are just a few examples of the various types of Stock Subscription Agreements that may exist among several subscribers. The specifics of each agreement will vary depending on the unique circumstances and objectives of the involved parties, making it crucial to consult legal professionals to ensure compliance with Arizona state laws and regulations.A stock subscription agreement is a legally binding contract between a company and individual subscribers (commonly known as investors) who wish to purchase securities (stocks) of that company. In the state of Arizona, several types of stock subscription agreements exist, tailored to the different circumstances and requirements of multiple subscribers. Let's delve into a detailed description of what an Arizona Stock Subscription Agreement Among Several Subscribers entails. Keywords: Arizona, stock subscription agreement, subscribers, securities, investors, contract, stocks. Arizona Stock Subscription Agreement Among Several Subscribers: An Arizona Stock Subscription Agreement Among Several Subscribers is a specific type of contract utilized in the state of Arizona when multiple individuals or entities (subscribers) wish to invest in a company by purchasing its stocks or other securities. This agreement serves as a legal document that outlines the terms and conditions of the investment, clarifying the obligations and rights of both the company and the subscribers. In this agreement, the subscribers agree to purchase a specific number of shares or a predetermined dollar amount of stock from the company. The agreement typically includes provisions regarding the purchase price, payment terms, and any additional terms agreed upon between the parties. The subscribers may also have the option to choose the type of securities they wish to acquire, such as common or preferred stock. The Arizona Stock Subscription Agreement Among Several Subscribers includes provisions related to the transferability of the subscribed securities, restrictions on resale, and any applicable limitations on the subscribers' ability to sell or transfer the stocks. It may also address issues such as shareholder rights, board representation, and any protective provisions to safeguard the subscribers' investments. Different types of Arizona Stock Subscription Agreements: 1. Common Stock Subscription Agreement: This type of agreement involves the purchase of common shares in the company, entitling the subscribers to voting rights and potential dividends but offering limited priority rights in case of liquidation or distribution of assets. 2. Preferred Stock Subscription Agreement: This agreement pertains to the purchase of preferred shares, which generally offer preferential treatment in terms of dividends, liquidation proceeds, and voting rights. Preferred stockholders usually have a higher claim on company assets and earnings compared to common stockholders. 3. Convertible Stock Subscription Agreement: This type of agreement allows subscribers to purchase convertible securities, typically convertible preferred shares, which offer the option to convert their holdings into common shares at a later date or upon certain predetermined events, such as an initial public offering (IPO). 4. Restricted Stock Subscription Agreement: In this agreement, the subscribers acquire restricted stock that comes with certain limitations and restrictions on its transfer or sale until specific conditions are met, such as achieving certain performance milestones, reaching a specific vesting period, or obtaining regulatory approval. With the ever-evolving needs of investors and companies in Arizona, these are just a few examples of the various types of Stock Subscription Agreements that may exist among several subscribers. The specifics of each agreement will vary depending on the unique circumstances and objectives of the involved parties, making it crucial to consult legal professionals to ensure compliance with Arizona state laws and regulations.

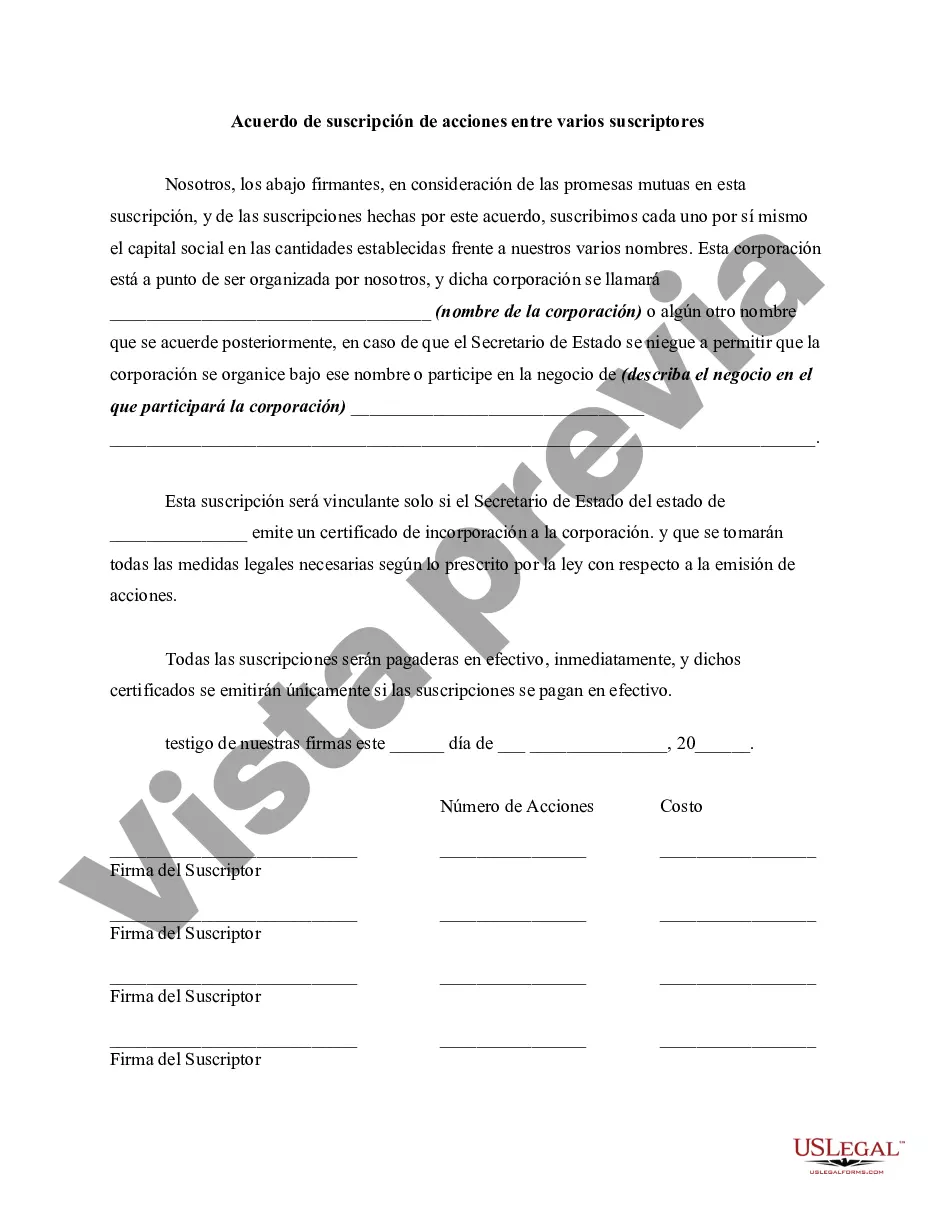

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.