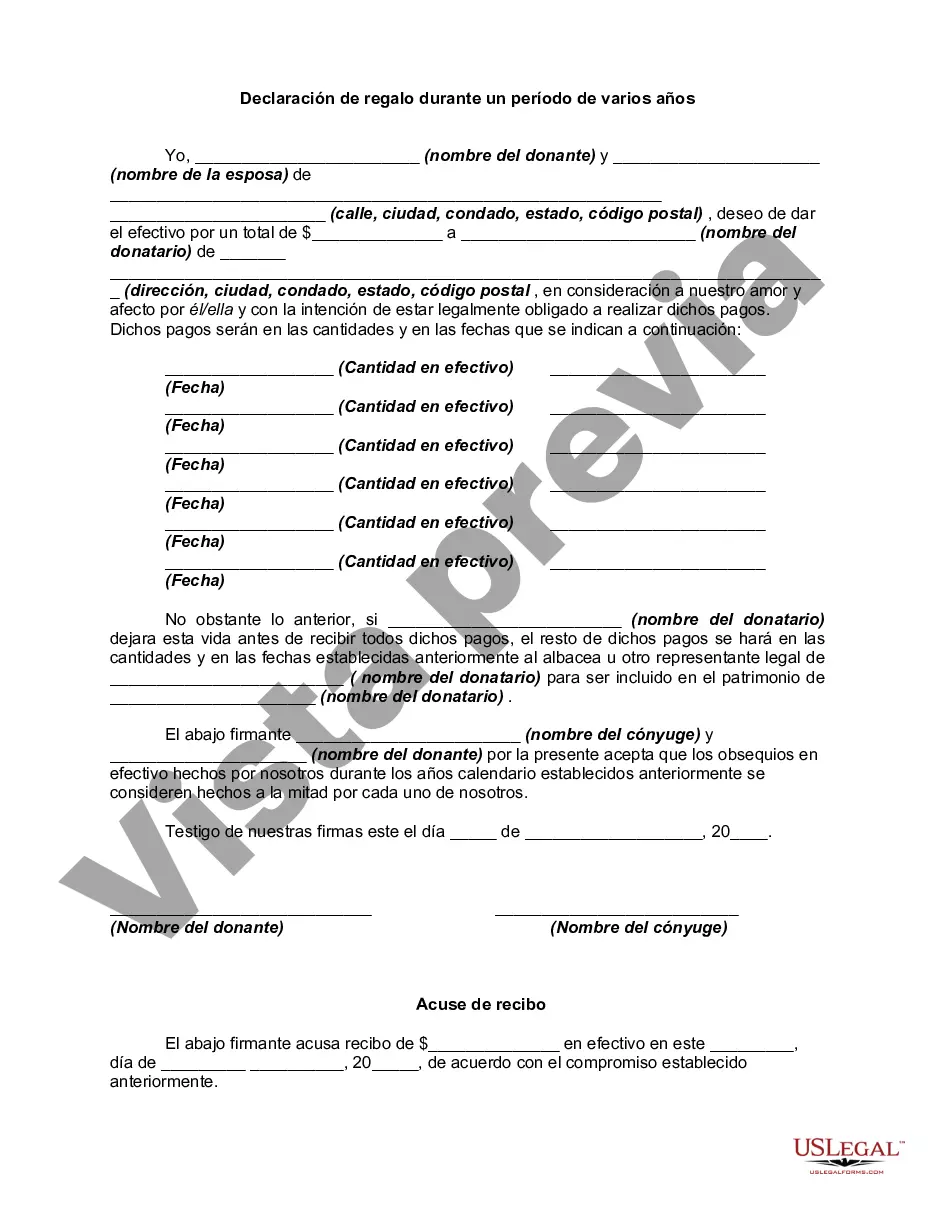

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

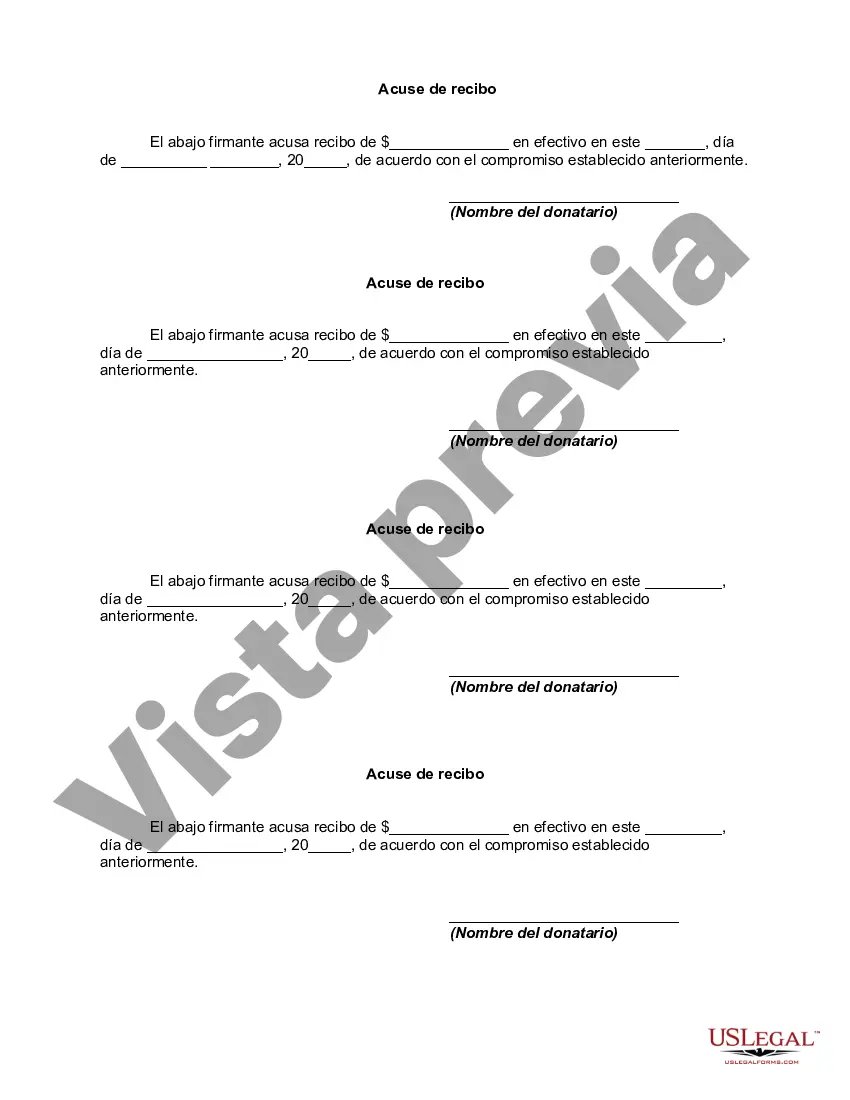

The Arizona Declaration of Gift Over Several Year periods is a legal document that allows individuals residing in Arizona to make gifts over a specified period of time. This declaration is particularly useful for individuals who wish to distribute their assets or wealth gradually rather than in one lump sum. This declaration is a way for individuals to establish a clear plan for gifting their assets to beneficiaries while minimizing tax implications and providing steady financial support. By utilizing this declaration, individuals can distribute their wealth over several years, ensuring the financial stability of their loved ones. There are different types of Arizona Declaration of Gift Over Several Year periods, which vary based on the specific circumstances and preferences of the individual. Some common types include: 1. Annual Gifting Plan: This type of declaration allows individuals to gift a specific amount to designated beneficiaries each year. This strategy is often utilized to reduce estate taxes and provide periodic financial assistance. 2. Gradual Asset Transfer: In this type of declaration, individuals can transfer ownership of assets, such as real estate or investments, gradually over a specific period. This helps minimize tax liabilities and ensures a smooth transfer of ownership. 3. Trust Distribution Schedule: Some individuals may choose to create a trust and specify a distribution schedule over several years. This type of declaration ensures that the trust's assets are distributed gradually and in accordance with the individual's wishes. 4. Educational or Medical Gifting Plan: This type of declaration focuses on gifting funds specifically for educational or medical purposes. It allows individuals to provide ongoing support for expenses related to education or medical care over a defined period. Overall, the Arizona Declaration of Gift Over Several Year periods offers individuals a flexible and strategic approach to distributing their wealth gradually. By considering their unique circumstances and preferences, individuals can develop a comprehensive plan that ensures the financial well-being of their loved ones while minimizing tax obligations.The Arizona Declaration of Gift Over Several Year periods is a legal document that allows individuals residing in Arizona to make gifts over a specified period of time. This declaration is particularly useful for individuals who wish to distribute their assets or wealth gradually rather than in one lump sum. This declaration is a way for individuals to establish a clear plan for gifting their assets to beneficiaries while minimizing tax implications and providing steady financial support. By utilizing this declaration, individuals can distribute their wealth over several years, ensuring the financial stability of their loved ones. There are different types of Arizona Declaration of Gift Over Several Year periods, which vary based on the specific circumstances and preferences of the individual. Some common types include: 1. Annual Gifting Plan: This type of declaration allows individuals to gift a specific amount to designated beneficiaries each year. This strategy is often utilized to reduce estate taxes and provide periodic financial assistance. 2. Gradual Asset Transfer: In this type of declaration, individuals can transfer ownership of assets, such as real estate or investments, gradually over a specific period. This helps minimize tax liabilities and ensures a smooth transfer of ownership. 3. Trust Distribution Schedule: Some individuals may choose to create a trust and specify a distribution schedule over several years. This type of declaration ensures that the trust's assets are distributed gradually and in accordance with the individual's wishes. 4. Educational or Medical Gifting Plan: This type of declaration focuses on gifting funds specifically for educational or medical purposes. It allows individuals to provide ongoing support for expenses related to education or medical care over a defined period. Overall, the Arizona Declaration of Gift Over Several Year periods offers individuals a flexible and strategic approach to distributing their wealth gradually. By considering their unique circumstances and preferences, individuals can develop a comprehensive plan that ensures the financial well-being of their loved ones while minimizing tax obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.