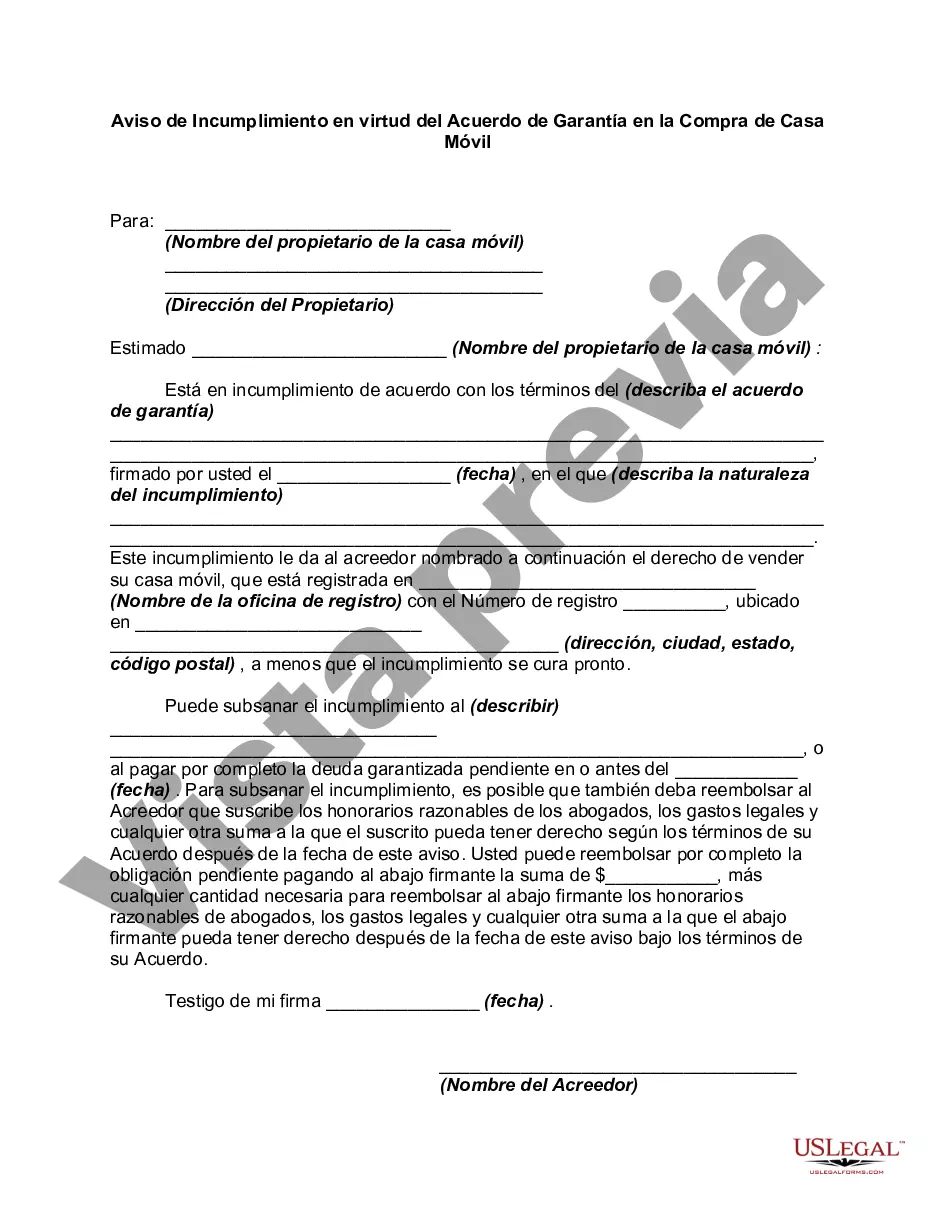

A Notice of Default under Security Agreement in the Purchase of a Mobile Home is a legal document utilized in Arizona to notify a buyer or borrower about their failure to fulfill the terms outlined in the security agreement connected to the purchase of a mobile home. This notice serves as a warning that the buyer is in default and may face potential consequences. In Arizona, there are two main types of Notice of Default under Security Agreement in the Purchase of a Mobile Home: 1. Judicial Notice of Default under Security Agreement: In certain cases, when a mobile home buyer fails to comply with the financial obligations stated in the security agreement, the lender may opt for a judicial notice. This involves seeking legal action through the court system to formally declare the buyer in default. This process allows the lender to enforce the remedies available under the security agreement and applicable laws. 2. Non-Judicial Notice of Default under Security Agreement: Alternatively, the lender may choose to proceed with a non-judicial notice. This involves serving the buyer with a written notice informing them of their default status and giving them a chance to rectify the situation within a specified period. If the buyer fails to resolve the default within the designated timeframe, the lender may initiate foreclosure proceedings. The Notice of Default under Security Agreement typically includes important details such as: 1. Buyer's Information: The notice begins by providing the buyer's name, address, contact information, and any relevant identification or account numbers associated with the purchase of the mobile home. 2. Lender's Information: The document identifies the lender or financing party, including their name, address, and contact information. This ensures that the buyer is aware of whom they should communicate with regarding the default situation. 3. Description of Default: The notice thoroughly outlines the buyer's specific default actions or omissions, including the missed payment amounts, payment due dates, and any other breaches of the security agreement. This section clearly states the reasons for the default and reinforces the lender's claim. 4. Remedies and Consequences: The notice specifies the potential consequences of the buyer's default, such as legal actions, foreclosure proceedings, repossession of the mobile home, and the termination of the security agreement. It also highlights any additional fees or charges that might be applicable due to the default. 5. Opportunity to Cure: To provide the buyer with a chance to resolve the default before further actions are taken, the notice includes a specified timeframe within which the buyer must remedy their default. This window of opportunity may either adhere to Arizona's legal requirements or be explicitly defined in the security agreement. 6. Contact Information: The notice concludes with the lender's contact details, emphasizing whom the buyer should contact to cure the default or seek additional information regarding the situation. In conclusion, an Arizona Notice of Default under Security Agreement in the Purchase of a Mobile Home is a critical legal document that enables lenders to inform buyers of their default status and initiates the necessary steps to resolve the default or protect the lender's interests. Through either a judicial or non-judicial notice, this documentation aims to ensure compliance with the security agreement's terms and safeguard the rights of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Arizona Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

You are able to commit hours on the Internet searching for the lawful file template that meets the state and federal demands you will need. US Legal Forms supplies 1000s of lawful varieties that are analyzed by pros. It is possible to down load or print out the Arizona Notice of Default under Security Agreement in Purchase of Mobile Home from our assistance.

If you already possess a US Legal Forms profile, you are able to log in and click the Acquire switch. After that, you are able to complete, modify, print out, or indicator the Arizona Notice of Default under Security Agreement in Purchase of Mobile Home. Every single lawful file template you get is the one you have for a long time. To obtain yet another backup associated with a obtained kind, go to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms web site the first time, stick to the easy guidelines listed below:

- Very first, be sure that you have chosen the proper file template to the region/town that you pick. Look at the kind description to ensure you have picked the correct kind. If available, use the Review switch to appear from the file template too.

- In order to find yet another model from the kind, use the Research industry to obtain the template that meets your needs and demands.

- Upon having discovered the template you need, just click Buy now to proceed.

- Find the costs prepare you need, type your qualifications, and register for a free account on US Legal Forms.

- Full the purchase. You can use your charge card or PayPal profile to cover the lawful kind.

- Find the structure from the file and down load it to the gadget.

- Make modifications to the file if necessary. You are able to complete, modify and indicator and print out Arizona Notice of Default under Security Agreement in Purchase of Mobile Home.

Acquire and print out 1000s of file layouts utilizing the US Legal Forms Internet site, which offers the greatest collection of lawful varieties. Use specialist and express-certain layouts to deal with your organization or person requirements.