Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation

Description

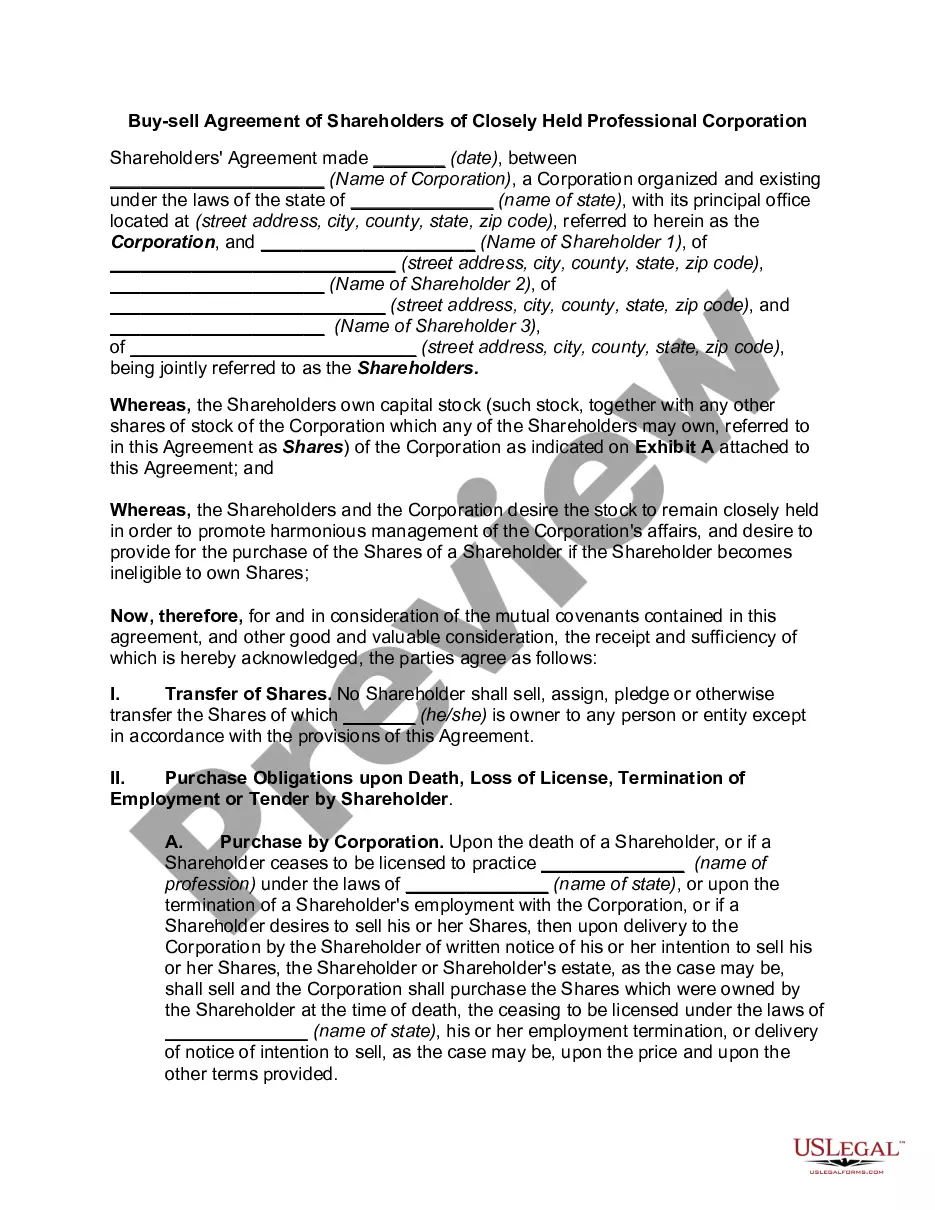

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

How to fill out Buy-Sell Agreement Between Shareholders Of Closely Held Corporation?

Selecting the optimal legal document template may feel like a challenge. Naturally, there is an array of designs available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This service offers a vast selection of templates, such as the Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation, which can be used for both business and personal purposes.

All forms are verified by professionals and comply with state and federal requirements.

Once you are certain the form is appropriate, click the Acquire now button to obtain it. Choose your preferred payment plan and provide the necessary details. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the downloaded Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to acquire well-crafted documents that comply with state regulations.

- If you are already registered, sign in to your account and click the Obtain button to locate the Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation.

- Use your account to access the legal forms you have purchased in the past.

- Visit the My documents section of your account to download another copy of the form you require.

- If you are a new user of US Legal Forms, follow these straightforward steps.

- First, ensure you have chosen the correct form for your city/state. You can browse the template using the Preview option and review the form details to confirm it is suitable for your needs.

- If the template does not meet your requirements, utilize the Search field to find the appropriate form.

Form popularity

FAQ

Yes, typically all shareholders must agree to a shareholders' agreement to ensure its validity. This collective agreement is crucial for establishing mutual understanding among shareholders regarding the operation and management of the corporation. In the context of an Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation, reaching a consensus helps prevent disputes later on. Platforms like uslegalforms can facilitate discussions and provide templates for drafting this essential document.

Filling out a buy-sell agreement involves several key steps to ensure clarity and legality. Begin by clearly identifying the parties involved and detailing the terms of the sale, which includes the valuation method for the shares. Essential elements should reflect the specific provisions of an Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation. You may find it beneficial to use resources available on uslegalforms to ensure compliance and accuracy throughout the process.

An agreement for the sale of shares to another shareholder outlines the terms under which a shareholder can sell their shares. This document is vital for clearly defining the rights and responsibilities of each party involved in the transaction. It's particularly important in the context of an Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation, as it helps to avoid misunderstandings. Utilizing platforms like uslegalforms can simplify creating and managing this agreement.

When shareholders cannot reach an agreement, it can lead to significant disruptions in your corporation. Disputes may delay important decisions, affecting company performance. In some cases, unresolved disagreements can necessitate legal intervention to resolve the conflict. Establishing a solid Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation can help mitigate such risks and streamline communication among shareholders.

In Arizona, shareholder agreements are not legally mandatory, but they are highly recommended. These agreements provide clarity and structure for managing relationships among shareholders. Without a defined agreement, conflicts may occur, leading to uncertainty in operations. Utilizing a well-drafted Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation can help prevent these issues.

Yes, for a shareholders agreement to be effective, typically all current shareholders must agree to its terms. This is especially crucial for an Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation, as it sets the groundwork for future transactions. Without unanimous consent, conflicts may arise when shares change hands. Therefore, discussing the agreement with all shareholders is a wise step.

While both agreements serve shareholders, they are not the same. A shareholder agreement outlines the rights and responsibilities of shareholders, while a buy-sell agreement specifically details the process for buying and selling shares. In Arizona, it’s common to include buy-sell provisions within a broader shareholder agreement. Understanding this distinction helps ensure you create a comprehensive agreement tailored to your business needs.

A shareholders agreement becomes legally binding once all parties sign it. Each shareholder must agree to the terms outlined in the document. Additionally, the agreement must comply with applicable laws and regulations in Arizona. This legal foundation ensures that an Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation can be enforced in a court of law.

In the context of an Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporations, a legal professional usually writes the sales agreement. This ensures the document is legally sound and tailored to the specific circumstances of the transaction. Shareholders must provide input about the terms of sale to reflect their needs accurately. With US Legal Forms, shareholders can access tools and templates to facilitate this writing process effectively.

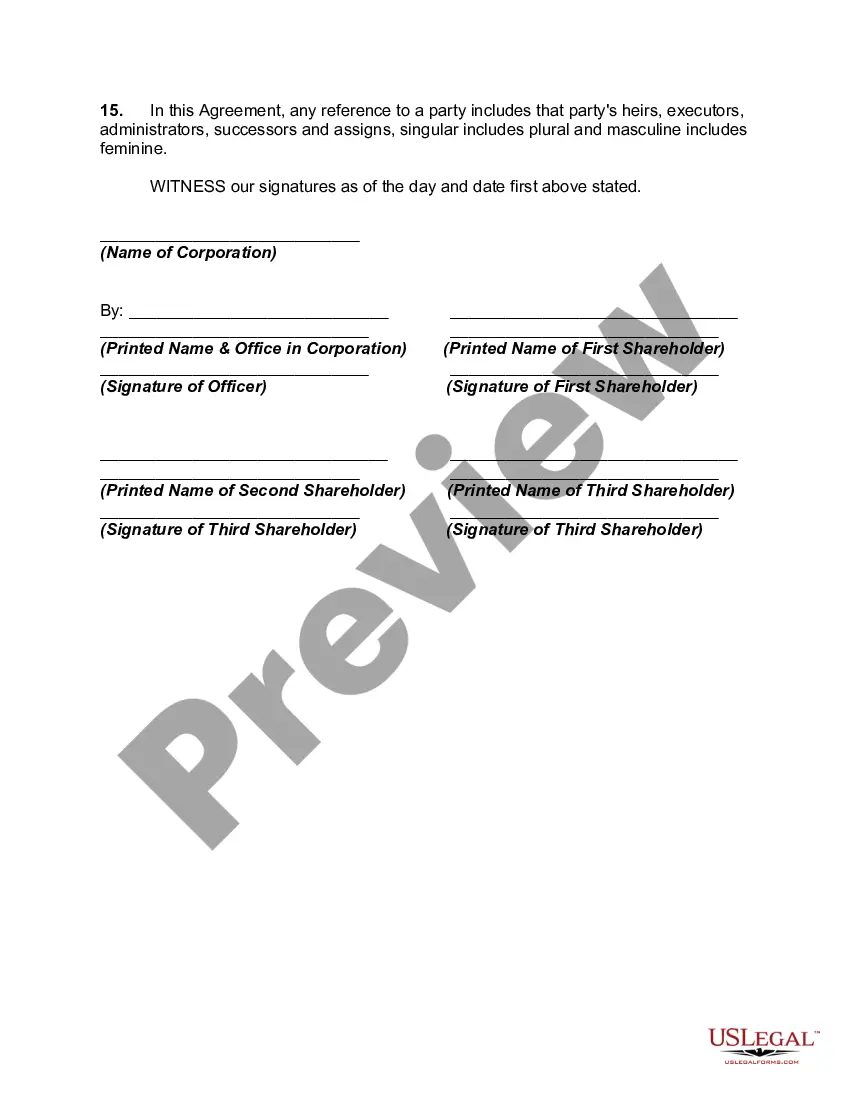

The creation of an Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporations often involves the shareholders themselves, along with legal counsel. Shareholders identify their goals and guidelines for the sale or transfer of shares. They work together with their attorney to ensure the agreement addresses all critical aspects relevant to their business. Using platforms like US Legal Forms can also streamline the creation process with valuable resources and templates.