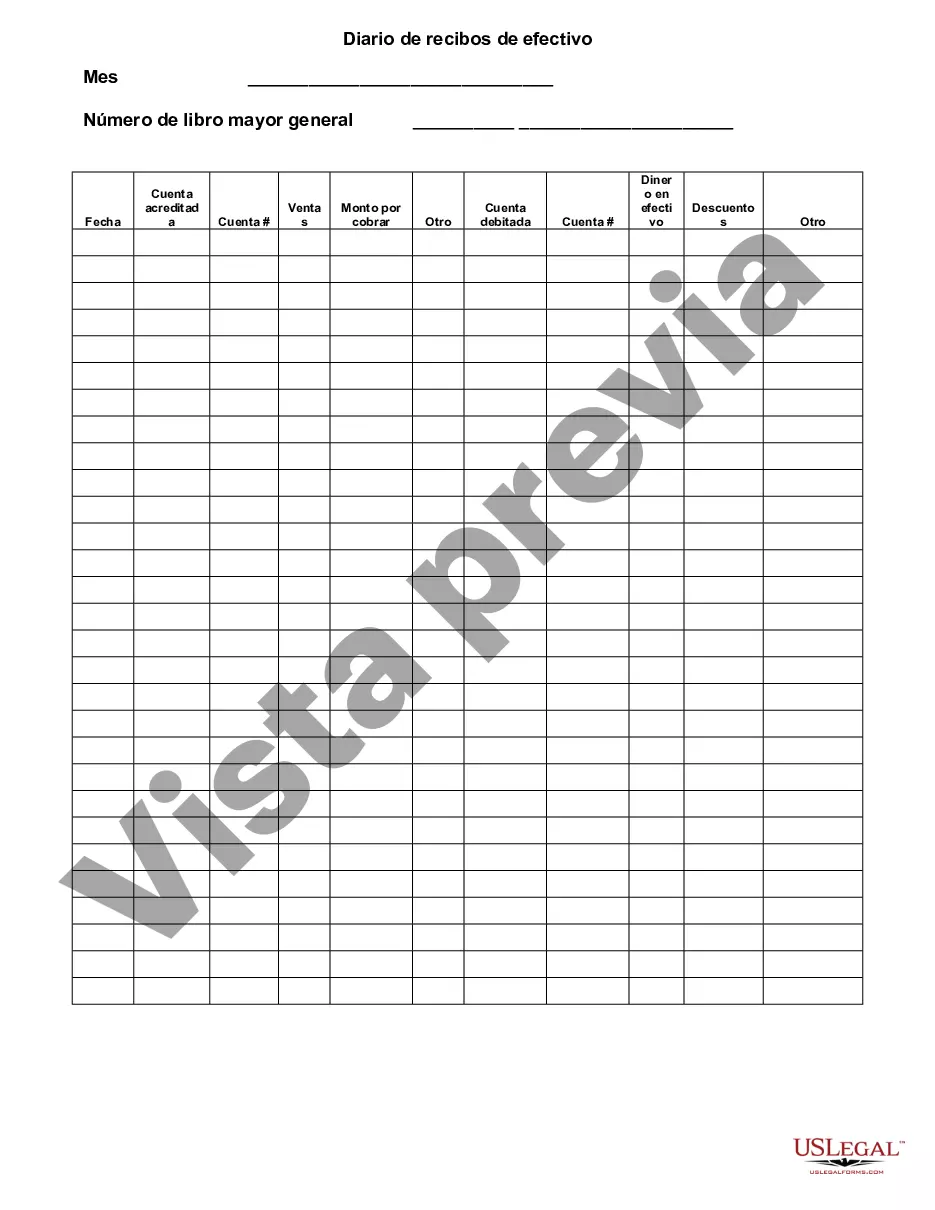

The Arizona Cash Receipts Journal is a financial document used by businesses in Arizona to record all cash payments received. It provides a detailed account of the sources and amounts of cash that a business receives, ensuring accurate and organized record-keeping. The primary purpose of the Arizona Cash Receipts Journal is to track and document all cash transactions, including payments from customers, sales of goods or services, rental income, interest income, dividends, and other cash inflows. This helps businesses maintain transparency and keep their financial records in order. By diligently recording all cash receipts in the journal, businesses can accurately track their cash flow, identify trends, and analyze the financial health of their organization. Additionally, it ensures compliance with Arizona's financial regulations and facilitates proper tax reporting. The Arizona Cash Receipts Journal includes specific columns to record relevant details such as the date of receipt, the source of the cash, the amount, customer information (if applicable), and the nature of the transaction. These columns enable businesses to easily identify and analyze the different sources of cash inflow, aiding in budgeting and decision-making processes. Different types of Arizona Cash Receipts Journals may exist based on the specific needs and nature of a business. For instance, a retail business may have a separate journal dedicated to recording cash receipts from daily sales, while a rental property business may maintain another journal to document rental income. Overall, the Arizona Cash Receipts Journal is crucial for businesses to maintain accurate financial records, ensure compliance with regulations, analyze cash flow, and make informed financial decisions. Incorporating this journal as part of a business's financial management system is essential to maintain transparency and track monetary inflows effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Arizona Diario De Recibos De Efectivo?

Are you in the placement where you will need documents for possibly business or personal reasons virtually every day time? There are plenty of lawful record layouts available online, but finding kinds you can depend on isn`t straightforward. US Legal Forms provides a huge number of develop layouts, such as the Arizona Cash Receipts Journal, which can be created to meet state and federal needs.

In case you are previously familiar with US Legal Forms site and get a free account, merely log in. After that, you can acquire the Arizona Cash Receipts Journal template.

Unless you offer an accounts and want to begin to use US Legal Forms, abide by these steps:

- Discover the develop you require and ensure it is for your right metropolis/area.

- Utilize the Review switch to analyze the form.

- See the explanation to actually have selected the appropriate develop.

- When the develop isn`t what you`re searching for, make use of the Research industry to obtain the develop that meets your needs and needs.

- When you find the right develop, simply click Buy now.

- Pick the rates program you would like, complete the desired details to make your money, and pay for the order using your PayPal or bank card.

- Choose a handy document formatting and acquire your version.

Get all the record layouts you possess purchased in the My Forms menu. You can aquire a more version of Arizona Cash Receipts Journal any time, if needed. Just click on the required develop to acquire or produce the record template.

Use US Legal Forms, one of the most considerable collection of lawful types, to conserve some time and prevent errors. The service provides appropriately manufactured lawful record layouts that you can use for a range of reasons. Produce a free account on US Legal Forms and begin generating your daily life easier.