Title: Arizona Checklist — Health and Disability Insurance: Comprehensive Guide and Types Introduction: Welcome to the Arizona Checklist — Health and Disability Insurance! This detailed description aims to provide you with essential information regarding health and disability insurance options available in Arizona. This checklist will guide you through the process of understanding, selecting, and availing suitable health and disability insurance plans. Let's delve deeper into the various types of insurance coverage available in Arizona. 1. Health Insurance: a. Individual Health Insurance: Individual health insurance plans cater to individuals and their families. These plans provide coverage for medical expenses, hospital stays, prescription drugs, and preventive care services. b. Employer-Provided Health Insurance: Many employers in Arizona offer health insurance benefits as part of their employee compensation packages. These plans often include coverage for routine check-ups, specialized treatments, prescription medications, and more. c. Medicare: Medicare is a federal program that provides health insurance to individuals aged 65 and older, as well as eligible younger individuals with disabilities. Arizona's residents can choose between Original Medicare (Part A and Part B) or Medicare Advantage (Part C) plans. d. Medicaid: Arizona's Medicaid program, known as the Arizona Health Care Cost Containment System (AHC CCS), provides health insurance to low-income individuals and families. Medicaid offers coverage for various medical services, including doctor visits, hospital care, preventive screenings, and long-term care for eligible individuals. 2. Disability Insurance: a. Short-Term Disability Insurance: Short-term disability insurance provides income replacement for a shorter duration (typically a few weeks to a year) due to temporary disabilities or injuries that prevent individuals from working. It ensures financial stability during recuperation. b. Long-Term Disability Insurance: Long-term disability insurance provides income replacement for an extended period (possibly several years or until retirement age) if individuals become unable to work due to disabilities caused by illnesses, accidents, or chronic conditions. It provides financial security to cover daily living expenses. c. Social Security Disability Insurance (SDI): SDI is a federal program administered by the Social Security Administration (SSA), providing income support to eligible individuals with long-term disabilities that prevent substantial gainful employment. To qualify, applicants must have paid Social Security taxes and meet specific criteria. Conclusion: In Arizona, a comprehensive understanding of health and disability insurance options is crucial for individuals and families to protect their well-being and financial stability. The Arizona Checklist — Health and Disability Insurance discussed various types of insurance coverage, including individual plans, employer-provided plans, Medicare, Medicaid, and disability insurance options such as short-term disability, long-term disability, and Social Security Disability Insurance (SDI). Make an informed decision by assessing your unique needs and consulting with insurance professionals to determine the most suitable coverage for you and your loved ones.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Lista de Verificación - Seguro de Salud y Discapacidad - Checklist - Health and Disability Insurance

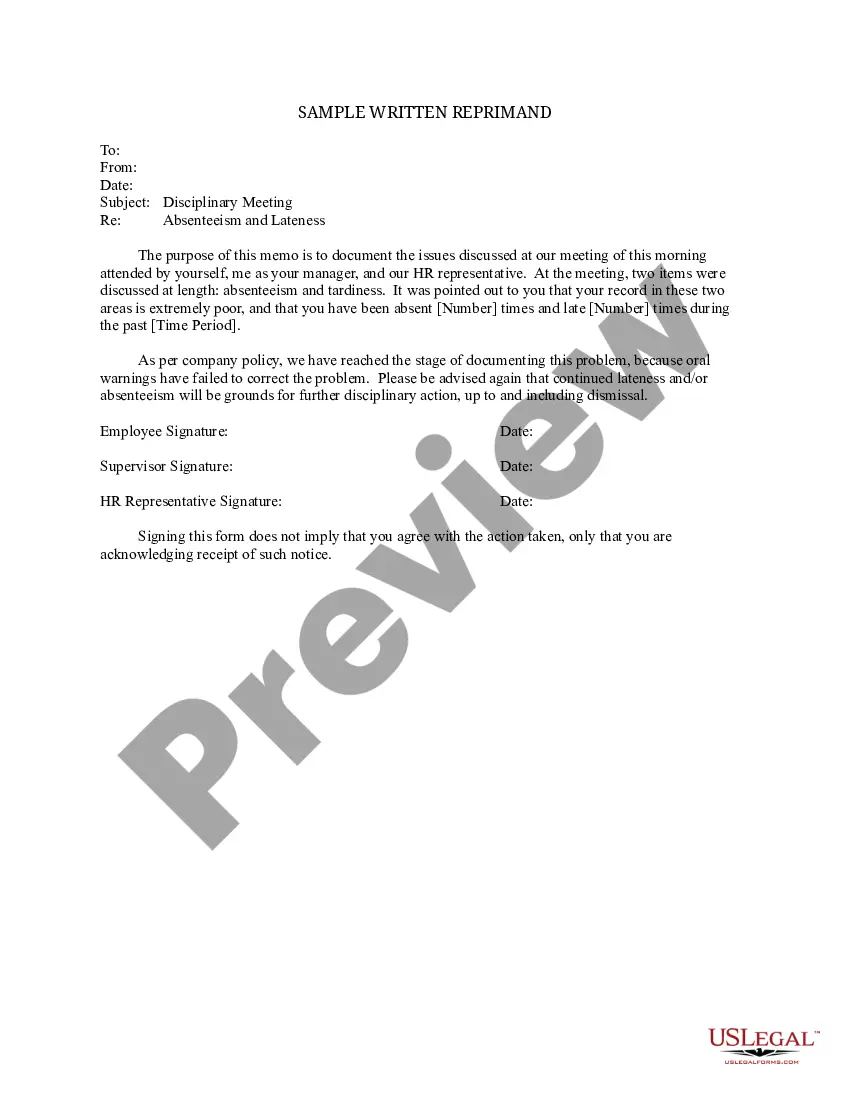

Description

How to fill out Arizona Lista De Verificación - Seguro De Salud Y Discapacidad?

You may devote time on the web searching for the legitimate file design that meets the state and federal specifications you will need. US Legal Forms supplies a large number of legitimate kinds which are examined by specialists. You can actually acquire or print the Arizona Checklist - Health and Disability Insurance from your service.

If you already possess a US Legal Forms bank account, it is possible to log in and then click the Obtain switch. Afterward, it is possible to complete, edit, print, or indicator the Arizona Checklist - Health and Disability Insurance. Each legitimate file design you purchase is your own for a long time. To get an additional backup of the bought type, visit the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms internet site for the first time, keep to the basic recommendations beneath:

- First, make certain you have selected the proper file design for your state/area of your liking. Browse the type description to make sure you have chosen the appropriate type. If readily available, utilize the Review switch to look from the file design at the same time.

- If you would like discover an additional version of the type, utilize the Look for discipline to discover the design that meets your needs and specifications.

- Upon having found the design you desire, just click Purchase now to proceed.

- Choose the pricing plan you desire, key in your accreditations, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You can utilize your credit card or PayPal bank account to cover the legitimate type.

- Choose the structure of the file and acquire it in your gadget.

- Make changes in your file if required. You may complete, edit and indicator and print Arizona Checklist - Health and Disability Insurance.

Obtain and print a large number of file web templates making use of the US Legal Forms Internet site, which provides the biggest selection of legitimate kinds. Use specialist and state-distinct web templates to take on your company or specific requires.