Arizona Outline of Lease of Business Premises

Description

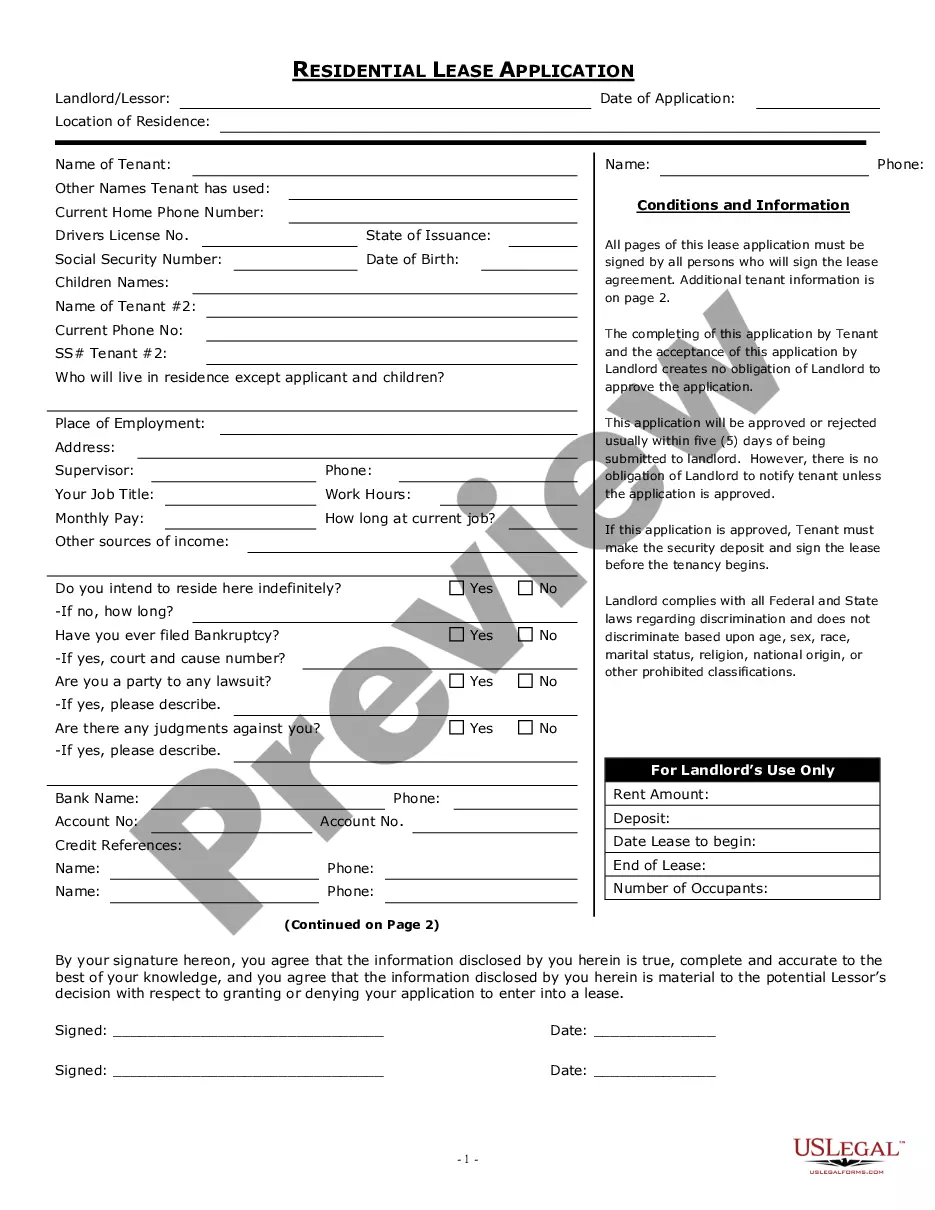

How to fill out Outline Of Lease Of Business Premises?

You can spend hours online looking for the legal document template that meets both state and federal regulations you require.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

It is easy to download or print the Arizona Outline of Lease of Business Premises from my service.

If available, use the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Acquire button.

- Next, you can fill out, modify, print, or sign the Arizona Outline of Lease of Business Premises.

- Every legal document template you obtain is yours forever.

- To get another copy of any purchased form, navigate to the My documents section and click the relevant option.

- If you’re using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the area/city you choose.

- Review the form summary to verify that you have selected the appropriate form.

Form popularity

FAQ

Yes, a nonprofit organization can lease a building just like any other business entity. It's important for nonprofits to follow legal guidelines and have a clear lease agreement that outlines the terms. The Arizona Outline of Lease of Business Premises is a valuable resource to help nonprofits understand their leasing options and responsibilities.

To lease a building for a business, you typically need a business plan, proof of income, and a decent credit history. You should also be prepared to provide personal and business references. Reviewing the Arizona Outline of Lease of Business Premises can assist you in understanding the necessary documentation and requirements to secure a lease.

Leasing a building for a business involves several steps, such as identifying suitable properties, negotiating lease terms, and finalizing the agreement. Start by defining your business needs and budget. Utilizing the Arizona Outline of Lease of Business Premises can help you navigate the complexities of the leasing process and ensure that your rights are protected.

In a lease agreement, 'premises' refers to the property being leased, which may include buildings, land, or specific areas within a building. Understanding the definition of premises is crucial when drafting or signing a lease. The Arizona Outline of Lease of Business Premises can help clarify what constitutes the premises in various contexts.

Yes, you can rent a building to your business, often referred to as a related-party transaction. It is important to structure the lease properly to avoid potential conflicts and tax implications. Review the Arizona Outline of Lease of Business Premises for guidance on drafting an effective lease that safeguards both your personal and business interests.

Yes, an LLC can lease a building. As a recognized legal entity, an LLC can enter into contracts, including leases. It is essential to follow the Arizona Outline of Lease of Business Premises to ensure compliance with state regulations and to protect the interests of the LLC.

A commercial lease agreement should cover critical elements such as the lease duration, payment terms, security deposit, maintenance responsibilities, and termination clauses. It's also important to include the provisions related to the use of the property and any modifications allowed. Reviewing the Arizona Outline of Lease of Business Premises can help ensure that these essential components are addressed in your lease agreement. Utilizing UsLegalForms can further assist in ensuring no crucial elements are overlooked.

Leasing a business property begins with identifying a suitable location that meets your operational needs. Next, conduct negotiations with the landlord on terms, including rent, duration, and responsibilities. It is also advisable to review the Arizona Outline of Lease of Business Premises to understand key considerations. For comprehensive guidance, consider using UsLegalForms, which offers tools for drafting and managing your lease.

Creating your own lease agreement is entirely possible, and it allows for flexibility in terms that suit your needs. However, it is essential to ensure the lease complies with local Arizona laws. The Arizona Outline of Lease of Business Premises outlines necessary guidelines to include. Using UsLegalForms can provide templates that ensure all legal requirements are met while saving you time.

To fill out a commercial lease agreement, start by entering the correct names of the landlord and tenant, followed by the property address and description. Next, specify the lease term, rent payment schedule, and any other agreed-upon terms related to maintenance or utilities. Always consult the Arizona Outline of Lease of Business Premises for important aspects that should not be overlooked, and consider templates from UsLegalForms for accuracy.