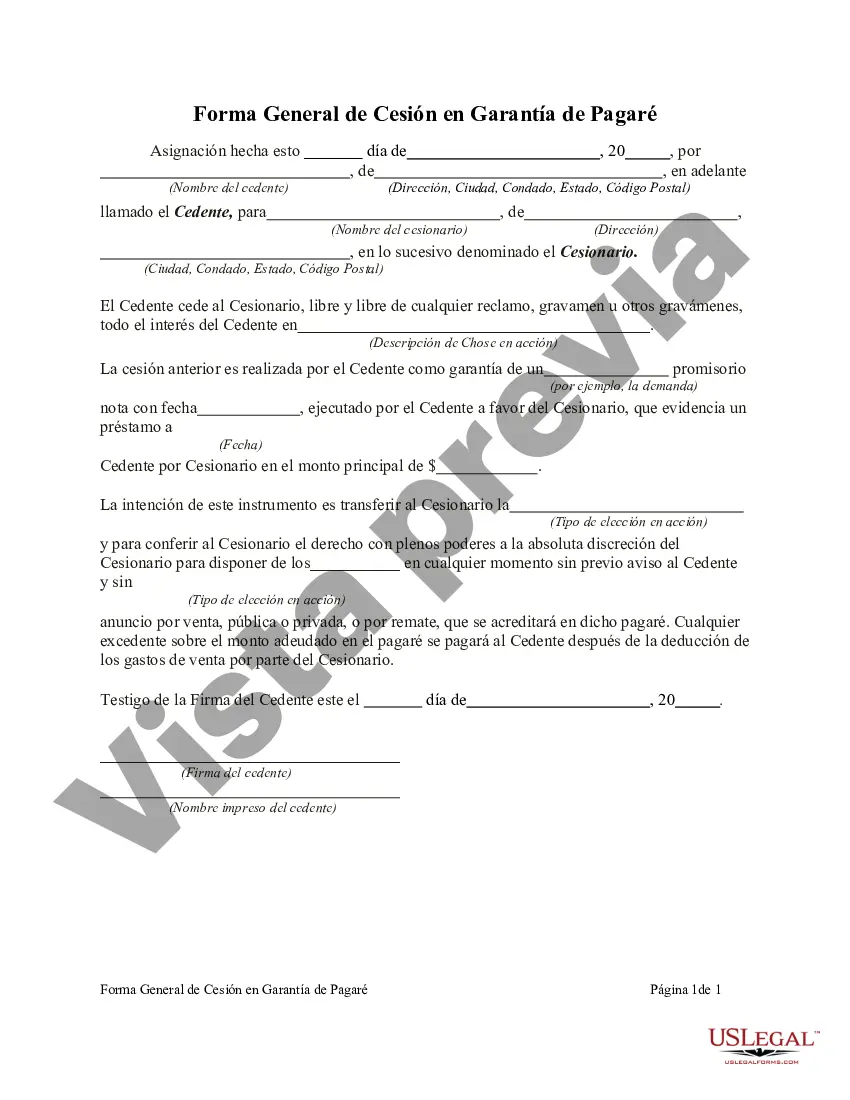

The Arizona General Form of Assignment as Collateral for Note is a legal document that pertains to the assignment of collateral in exchange for a promissory note. This agreement is commonly used in Arizona when parties want to establish a lien on specific assets to secure a loan or debt. The purpose of the Arizona General Form of Assignment as Collateral for Note is to provide a clear and detailed record of the terms and conditions surrounding the assignment. By assigning collateral, the borrower pledges certain assets as security, ensuring that if they default on their obligation, the lender has the right to seize and liquidate the assets mentioned in the agreement to recover their losses. This general form of assignment encompasses various types of collateral, depending on the nature of the transaction. Some common examples include: 1. Real Estate: When a borrower offers real property, such as land, buildings, or houses, as collateral for a note. The lender gains the right to foreclose and sell the property if the borrower fails to meet their obligations. 2. Personal Property: This type involves assets other than real estate, such as vehicles, machinery, equipment, inventory, or valuable personal belongings. If the borrower defaults, the lender can repossess and sell these items to satisfy the debt. 3. Accounts Receivable: In some cases, businesses may assign their accounts receivable as collateral. This means that if the borrower fails to repay the loan, the lender can collect the outstanding payments from the borrower's customers. 4. Intellectual Property: Certain intangible assets, including patents, trademarks, copyrights, or royalties, can also be assigned as collateral. This offers lenders security in case of default and provides an alternative source of repayment. Overall, the Arizona General Form of Assignment as Collateral for Note ensures that both parties clearly understand the terms of the collateral assignment. It helps protect the lender's interest and provides the borrower with a structured framework to secure financing. Properly executing this legal document can help avoid disputes and streamline the process in case of default or non-payment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Arizona Forma General De Cesión En Garantía De Pagaré?

Choosing the best lawful record format might be a struggle. Naturally, there are tons of templates available on the net, but how can you find the lawful kind you require? Take advantage of the US Legal Forms site. The assistance provides thousands of templates, including the Arizona General Form of Assignment as Collateral for Note, that can be used for enterprise and private requires. All of the kinds are inspected by experts and meet state and federal requirements.

When you are already registered, log in to the account and click on the Acquire option to obtain the Arizona General Form of Assignment as Collateral for Note. Utilize your account to appear through the lawful kinds you possess acquired earlier. Go to the My Forms tab of the account and have one more duplicate from the record you require.

When you are a brand new user of US Legal Forms, listed below are straightforward directions for you to comply with:

- Initial, be sure you have selected the appropriate kind for your personal metropolis/county. You are able to look over the shape while using Preview option and read the shape description to ensure this is the best for you.

- If the kind is not going to meet your needs, use the Seach industry to obtain the right kind.

- Once you are certain that the shape is suitable, go through the Get now option to obtain the kind.

- Opt for the pricing plan you need and enter the required info. Design your account and buy an order utilizing your PayPal account or bank card.

- Select the data file structure and download the lawful record format to the device.

- Comprehensive, revise and printing and sign the attained Arizona General Form of Assignment as Collateral for Note.

US Legal Forms will be the biggest collection of lawful kinds that you will find different record templates. Take advantage of the company to download expertly-made documents that comply with state requirements.