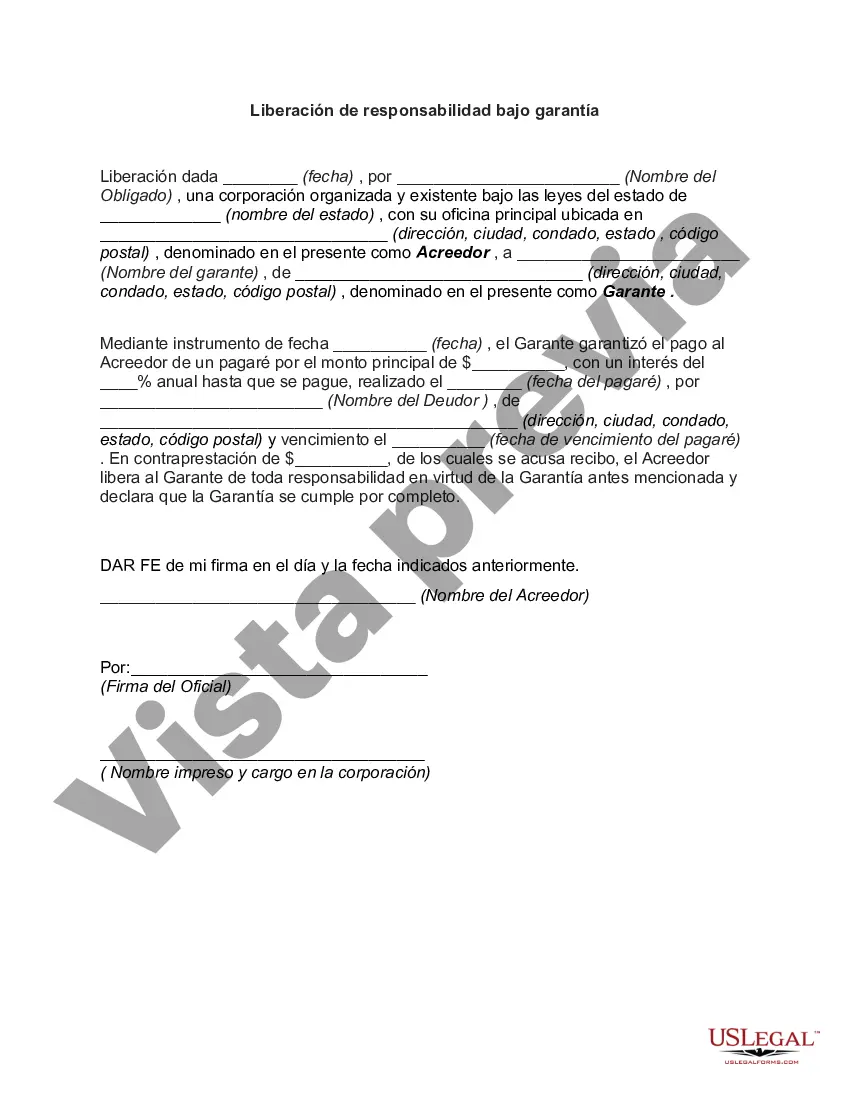

The Arizona Release from Liability under Guaranty is a legal document that serves to absolve one party, known as the guarantor, from any liability or responsibility for the debts or obligations of another party, known as the principal. This release is commonly used in various contractual agreements where a guarantor has agreed to guarantee the performance or payment of a principal's debt. In Arizona, there are several types of releases from liability under guaranty that may be encountered. The most common ones include: 1. Full Release from Liability under Guaranty: This type of release completely absolves the guarantor from any liability for the debt or obligation. It extinguishes the guarantor's legal responsibility, freeing them from any potential claims or actions brought against them in relation to the principal's debt. 2. Partial Release from Liability under Guaranty: In some cases, a guarantor may only seek to be released from a portion of the principal's debt or obligation. This type of release releases the guarantor's liability only to the extent specified in the agreement, while maintaining responsibility for the remaining part of the debt or obligation. 3. Conditional Release from Liability under Guaranty: This type of release is contingent upon certain conditions being met. For example, the guarantor may be released if the principal obtains a certain credit rating or if the principal provides adequate collateral. If the conditions outlined in the agreement are not fulfilled, the release does not take effect. It is important to note that the specific terms and conditions of a release from liability under guaranty may vary depending on the individual contract or agreement. Parties involved should seek legal advice to ensure the release is drafted accurately and comprehensively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Liberación de responsabilidad bajo garantía - Release from Liability under Guaranty

Description

How to fill out Arizona Liberación De Responsabilidad Bajo Garantía?

You are able to spend several hours on the web attempting to find the authorized record template which fits the federal and state specifications you require. US Legal Forms offers 1000s of authorized varieties which are reviewed by professionals. It is simple to acquire or printing the Arizona Release from Liability under Guaranty from our assistance.

If you already possess a US Legal Forms bank account, it is possible to log in and then click the Down load key. Afterward, it is possible to comprehensive, change, printing, or signal the Arizona Release from Liability under Guaranty. Every single authorized record template you buy is your own eternally. To acquire yet another backup for any purchased type, check out the My Forms tab and then click the related key.

If you are using the US Legal Forms site for the first time, stick to the easy directions below:

- Initially, ensure that you have selected the right record template for the region/metropolis that you pick. Browse the type outline to make sure you have picked out the correct type. If accessible, make use of the Review key to check throughout the record template too.

- In order to locate yet another model in the type, make use of the Look for area to find the template that meets your needs and specifications.

- After you have discovered the template you would like, simply click Buy now to move forward.

- Select the pricing prepare you would like, type your references, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You should use your bank card or PayPal bank account to fund the authorized type.

- Select the structure in the record and acquire it to the device.

- Make modifications to the record if needed. You are able to comprehensive, change and signal and printing Arizona Release from Liability under Guaranty.

Down load and printing 1000s of record templates making use of the US Legal Forms site, that offers the largest variety of authorized varieties. Use skilled and express-particular templates to take on your company or person needs.