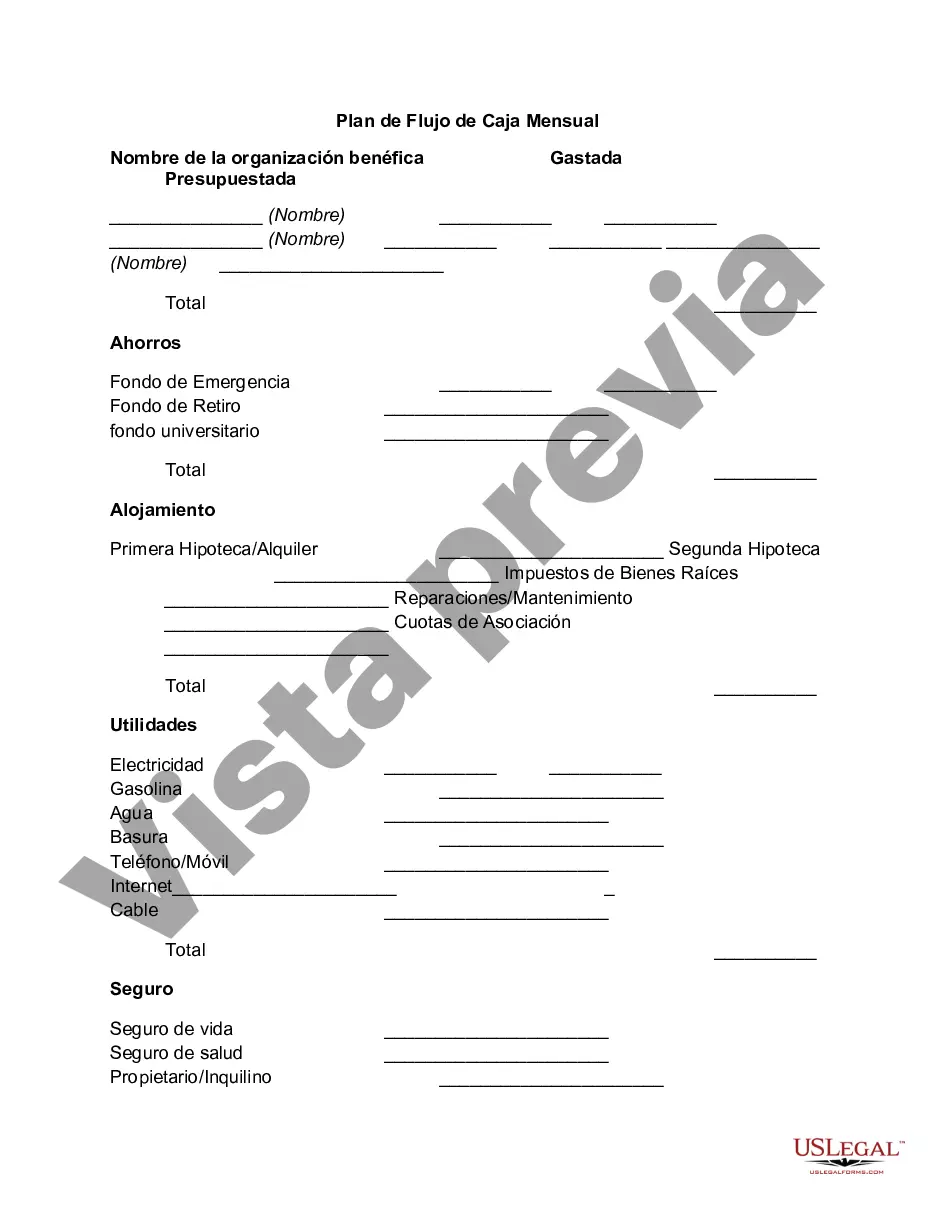

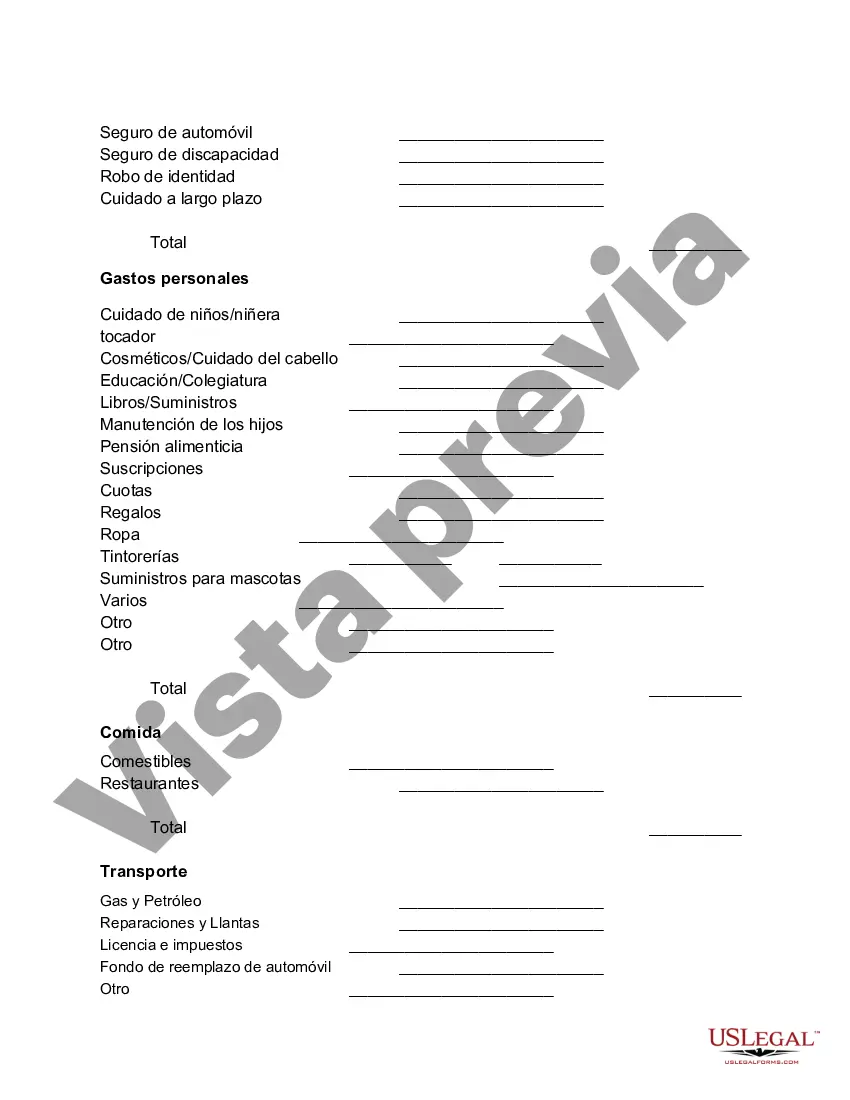

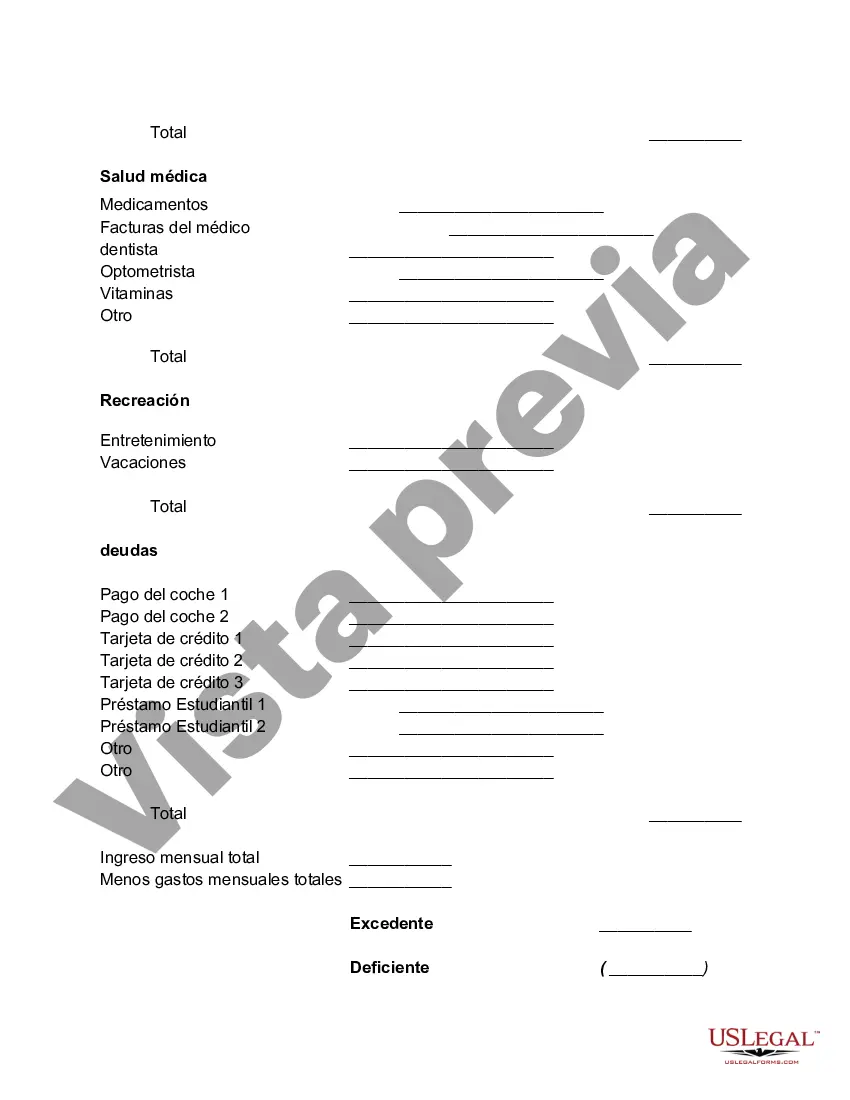

Arizona Monthly Cash Flow Plan is a financial management tool designed to help individuals and families create a detailed budget and track their income and expenses on a monthly basis. This plan offers a structured approach to managing finances and promotes responsible spending and saving habits. Key features of the Arizona Monthly Cash Flow Plan include income tracking, expense categorization, and regular financial analysis. By accurately tracking income from various sources such as salaries, investments, and side gigs, individuals can gain a clear understanding of their net cash inflow. The plan also emphasizes the categorization of expenses into different groups such as housing, transportation, groceries, entertainment, and debt payments. This categorization allows individuals to identify areas where they may be overspending and make necessary adjustments to align their expenses with their financial goals. Additionally, the Arizona Monthly Cash Flow Plan encourages individuals to regularly analyze their financial situation. This involves comparing their actual income and expenses against their planned budget to identify any discrepancies and make informed financial decisions. There are different types of Arizona Monthly Cash Flow Plans tailored to specific circumstances and needs. These variations include plans for individuals, couples, families, and even business owners. Each plan focuses on the unique financial challenges faced by these different groups and provides specific strategies to overcome them. The Arizona Monthly Cash Flow Plan for individuals, for example, may concentrate on personal expenses and debt repayment strategies, while the plan for couples may include joint income tracking and collaborative budgeting techniques. For families, the plan may include considerations for child-related expenses and savings for education or emergencies. Business owners could benefit from a plan that integrates revenue tracking, expense management, and profit reinvestment strategies. In summary, the Arizona Monthly Cash Flow Plan is an effective financial tool that helps individuals, couples, families, and even business owners manage their money more efficiently. By implementing this plan, users can gain a clear understanding of their income and expenses, identify areas for improvement, and make informed financial decisions to achieve their long-term goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Arizona Plan De Flujo De Caja Mensual?

If you wish to comprehensive, down load, or produce legitimate papers templates, use US Legal Forms, the biggest collection of legitimate forms, which can be found on the web. Utilize the site`s simple and practical research to obtain the paperwork you require. Various templates for enterprise and specific uses are categorized by groups and says, or keywords. Use US Legal Forms to obtain the Arizona Monthly Cash Flow Plan with a couple of mouse clicks.

In case you are already a US Legal Forms consumer, log in to your account and click on the Acquire switch to find the Arizona Monthly Cash Flow Plan. Also you can gain access to forms you previously acquired from the My Forms tab of your own account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the shape for that proper metropolis/country.

- Step 2. Take advantage of the Review choice to check out the form`s content. Never neglect to see the outline.

- Step 3. In case you are not satisfied using the kind, use the Research industry near the top of the screen to get other versions of your legitimate kind format.

- Step 4. After you have found the shape you require, click the Purchase now switch. Choose the costs prepare you prefer and add your credentials to sign up to have an account.

- Step 5. Method the purchase. You can use your bank card or PayPal account to complete the purchase.

- Step 6. Select the format of your legitimate kind and down load it on your own product.

- Step 7. Full, edit and produce or sign the Arizona Monthly Cash Flow Plan.

Each legitimate papers format you purchase is your own property eternally. You have acces to each and every kind you acquired with your acccount. Go through the My Forms section and choose a kind to produce or down load yet again.

Remain competitive and down load, and produce the Arizona Monthly Cash Flow Plan with US Legal Forms. There are many expert and status-specific forms you may use for your enterprise or specific requires.