Arizona Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software is a legal contract entered into by two parties to specify the terms and conditions for sharing revenue generated from licensing and custom modification activities related to software in the state of Arizona, United States. This agreement is crucial in ensuring that all parties involved understand their rights and obligations concerning the distribution of income derived from software licensing and customization. The primary purpose of the Arizona Revenue Sharing Agreement is to outline the percentage or ratio in which revenue generated from software activities will be shared between the parties involved. This agreement enables transparency and accountability, preventing future disputes over revenue distribution. Furthermore, it ensures that both parties receive fair compensation for their efforts and contributions to the licensing and customization of the software. The agreement may have different types or variations, depending on the specific parameters and arrangements. These variations could include: 1. Fixed Percentage Revenue Sharing Agreement: This type of agreement states a fixed percentage or ratio in which the revenue will be divided between the parties. For example, if Party A receives 60% and Party B receives 40%, all income from licensing and custom modification will be allocated accordingly. 2. Tiered Revenue Sharing Agreement: In this arrangement, the revenue sharing structure is divided into multiple tiers based on predetermined milestones, thresholds, or performance metrics. Each tier may have a different revenue-sharing ratio, incentivizing higher performance and achieving specific targets. 3. Flexible Revenue Sharing Agreement: This type of agreement allows the parties to negotiate and determine the revenue-sharing ratio on a case-by-case basis. This flexibility enables both parties to adapt to changing circumstances or market conditions that might impact the valuation of their software licensing or custom modification efforts. 4. Expense Deductible Revenue Sharing Agreement: Some agreements may stipulate the deduction of certain expenses, such as marketing, distribution, or support costs, from the total revenue before sharing. This approach ensures that expenses attributable to generating revenue are accounted for before the distribution, allowing for a more accurate and fair sharing arrangement. In summary, the Arizona Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software is designed to establish a fair and transparent structure for sharing revenue generated from software licensing and customization activities. These agreements can vary in terms of revenue-sharing models, such as fixed percentage, tiered, flexible, or expense deductible arrangements, depending on the needs and preferences of the parties involved.

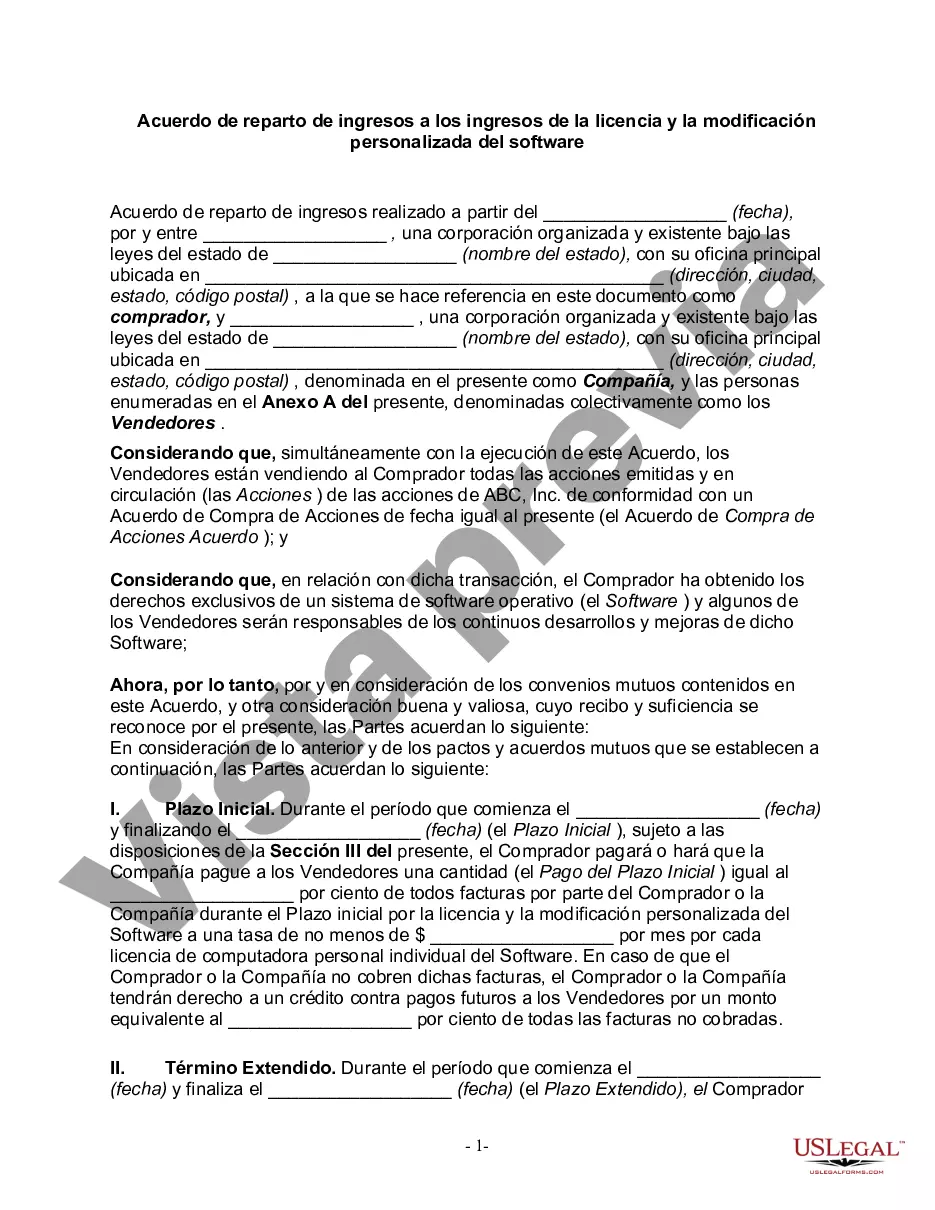

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Acuerdo de reparto de ingresos a los ingresos de la licencia y la modificación personalizada del software - Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out Arizona Acuerdo De Reparto De Ingresos A Los Ingresos De La Licencia Y La Modificación Personalizada Del Software?

You can devote hours on the web looking for the authorized papers web template which fits the state and federal requirements you will need. US Legal Forms offers a large number of authorized kinds that happen to be examined by pros. It is simple to download or print out the Arizona Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software from our services.

If you currently have a US Legal Forms accounts, you may log in and click on the Download key. Afterward, you may total, change, print out, or indication the Arizona Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software. Each authorized papers web template you get is your own property eternally. To get another backup associated with a acquired kind, proceed to the My Forms tab and click on the related key.

If you are using the US Legal Forms website for the first time, follow the basic instructions listed below:

- Initially, make certain you have selected the best papers web template for that area/town that you pick. Read the kind outline to make sure you have picked the proper kind. If offered, use the Preview key to look with the papers web template also.

- In order to discover another variation in the kind, use the Lookup area to get the web template that suits you and requirements.

- After you have found the web template you would like, simply click Buy now to continue.

- Select the costs program you would like, type in your accreditations, and sign up for an account on US Legal Forms.

- Total the deal. You can use your bank card or PayPal accounts to purchase the authorized kind.

- Select the structure in the papers and download it in your gadget.

- Make adjustments in your papers if necessary. You can total, change and indication and print out Arizona Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software.

Download and print out a large number of papers templates while using US Legal Forms Internet site, that provides the greatest selection of authorized kinds. Use professional and state-distinct templates to take on your company or individual requirements.