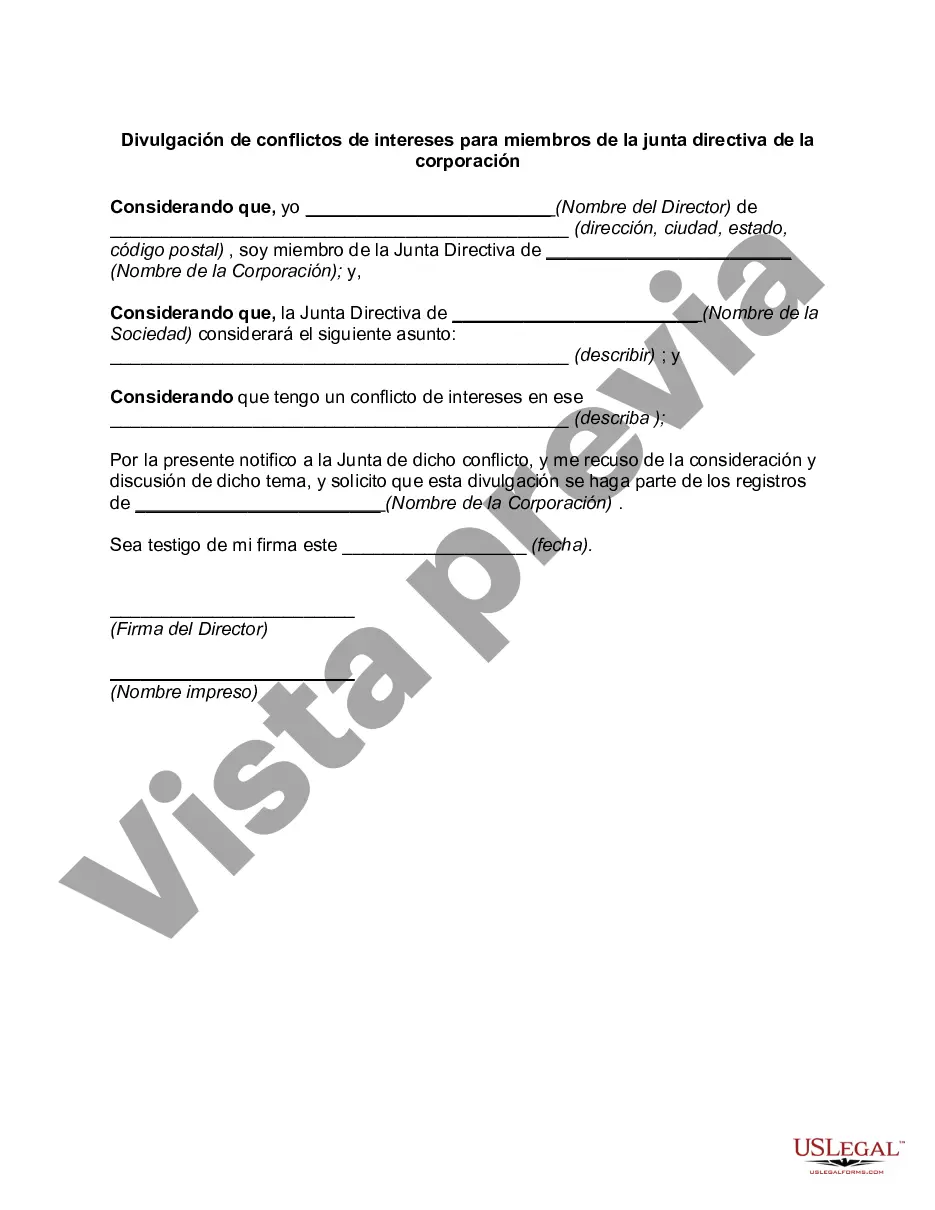

Arizona Conflict of Interest Disclosure for Member of Board of Directors of Corporation is a legal requirement that mandates transparency and accountability when it comes to potential conflicts of interest among board members of corporations in the state of Arizona. This disclosure is crucial to ensure that board members act in the best interest of the corporation and its shareholders, while avoiding any personal gain or bias. Under this requirement, board members are obliged to disclose any financial interest, direct or indirect, that they have in any transaction or decision made by the corporation. This includes, but is not limited to, transactions involving contracts, leases, loans, acquisitions, and sales. The disclosure should cover relationships, investments, or affiliations that may create a conflict of interest or the perception of such. The purpose of the Arizona Conflict of Interest Disclosure is to maintain the integrity of the corporate decision-making process, prevent undue influence, and protect the rights and investments of shareholders. By providing transparency, it allows other members of the board and stakeholders to evaluate potential conflicts and take appropriate action to ensure fair and unbiased decision-making. Different types of conflicts of interest that might require disclosure can include: 1. Financial Interest: Any direct or indirect financial interest a board member has in a transaction or decision made by the corporation. This could involve ownership in competing companies, personal investments related to the corporation's industry, or financial connections to suppliers or customers. 2. Insider Information: If a board member possesses confidential information about the corporation, its operations, or its competitors that could influence their decision-making or create a bias, it is considered an insider conflict of interest. 3. Family and Personal Relationships: Board members must also disclose any personal relationships that may affect their judgment. This could involve family members or close friends who have a stake in a transaction or decision or who are directly involved with the corporation's competitors or partners. 4. Professional Relationships: Disclosures should also be made regarding any professional relationships, such as serving on the board of directors for another corporation that could cause a conflict of interest when making decisions for the current corporation. 5. Non-Financial Interests: Although financial conflicts of interest are the most common, non-financial conflicts of interest should also be disclosed. These could involve matters such as personal favors, potential benefits, or other factors that could impact the board member's objectivity and impartiality. Board members are required to disclose any conflicts of interest promptly and accurately to the best of their knowledge. The disclosure should be made in writing and submitted to the corporation's board of directors or appointed committee responsible for overseeing conflicts of interest. By adhering to these disclosure requirements, board members contribute to the ethical and responsible governance of corporations in Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Divulgación de conflictos de intereses para miembros de la junta directiva de la corporación - Conflict of Interest Disclosure for Member of Board of Directors of Corporation

Description

How to fill out Arizona Divulgación De Conflictos De Intereses Para Miembros De La Junta Directiva De La Corporación?

Finding the right lawful papers template could be a battle. Obviously, there are tons of layouts available online, but how would you obtain the lawful form you require? Use the US Legal Forms web site. The services gives a huge number of layouts, like the Arizona Conflict of Interest Disclosure for Member of Board of Directors of Corporation, which you can use for organization and personal requirements. Every one of the forms are checked out by experts and fulfill federal and state requirements.

In case you are currently listed, log in for your bank account and click on the Obtain key to find the Arizona Conflict of Interest Disclosure for Member of Board of Directors of Corporation. Make use of your bank account to appear throughout the lawful forms you possess ordered previously. Proceed to the My Forms tab of your respective bank account and have yet another version of your papers you require.

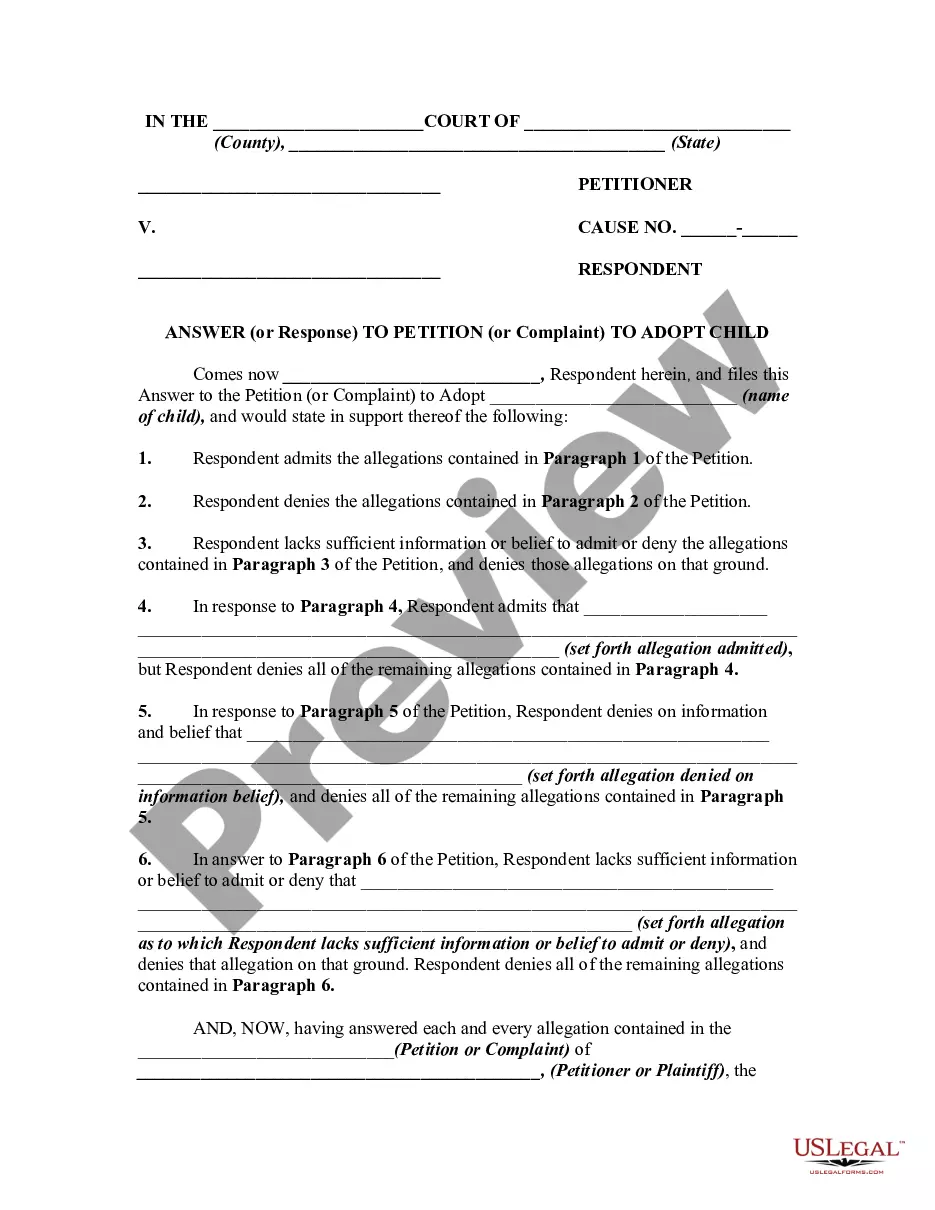

In case you are a whole new end user of US Legal Forms, here are easy recommendations that you can adhere to:

- First, make sure you have selected the right form for the city/state. You may look over the shape utilizing the Review key and read the shape information to ensure it will be the right one for you.

- In the event the form fails to fulfill your requirements, take advantage of the Seach industry to obtain the right form.

- Once you are positive that the shape would work, click the Purchase now key to find the form.

- Choose the rates plan you would like and type in the needed information. Make your bank account and pay money for the transaction with your PayPal bank account or charge card.

- Pick the file formatting and down load the lawful papers template for your system.

- Complete, edit and print out and signal the attained Arizona Conflict of Interest Disclosure for Member of Board of Directors of Corporation.

US Legal Forms may be the largest collection of lawful forms that you can see numerous papers layouts. Use the service to down load expertly-produced paperwork that adhere to status requirements.