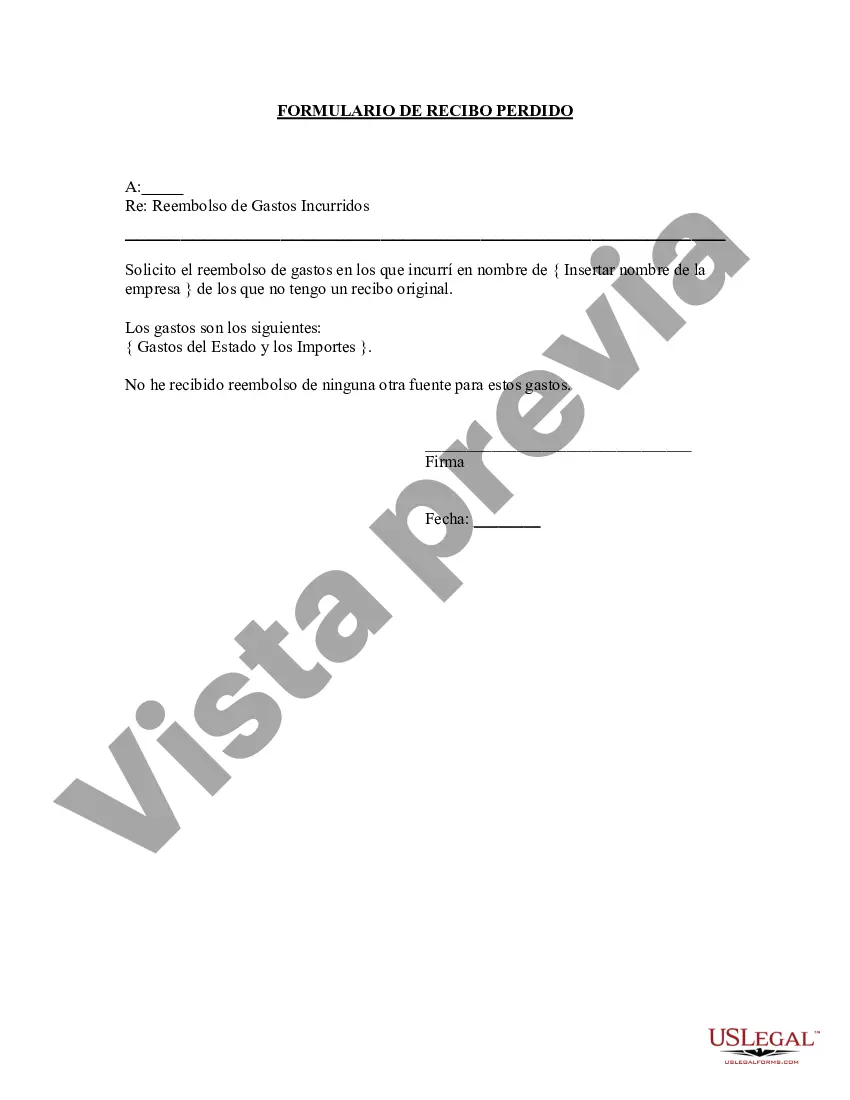

The Arizona Lost Receipt Form is a document used by individuals or businesses to report the loss or misplacement of a receipt in order to claim an expense or reimbursement. This form is specifically designed for residents of Arizona and serves as an official record for expenses incurred. The purpose of the Arizona Lost Receipt Form is to provide a means for individuals to still claim for expenses, even in cases where the original receipt is lost, damaged, or cannot be retrieved. By filling out this form, individuals can maintain accuracy and accountability in their financial records. The Arizona Lost Receipt Form typically includes fields to provide essential details such as the date of the expense, the amount spent, the merchant/vendor name, a description of the purchase, and the individual's contact information. Other relevant information, like the purpose of the expense or any supporting documents, may also be required. It is important to note that there might be different types of Arizona Lost Receipt Forms, depending on the purpose or department associated with the expense. Some common variations could include: 1. Arizona Lost Receipt Form for Personal Expenses: This form is used by individuals to report lost or misplaced receipts related to personal expenses such as groceries, transportation, medical bills, or any other purchases made for personal use. 2. Arizona Lost Receipt Form for Business Expenses: This form is employed by businesses or employees to report the loss of receipts for business-related expenses. These can include travel expenses, office supplies, equipment purchases, or any other costs associated with conducting business operations. 3. Arizona Lost Receipt Form for Tax Purposes: This type of form is specifically designed for individuals who need to provide proof of expenses for tax deductions or refunds. It allows taxpayers to report lost or unavailable receipts that are required for proper documentation during tax audits or assessments. In conclusion, the Arizona Lost Receipt Form is a vital document for individuals and businesses residing in Arizona to claim reimbursements or expenses when the original receipt is lost. By accurately filling out this form, individuals can ensure their financial records are maintained, while also providing accountability and transparency.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Formulario de recibo perdido - Lost Receipt Form

Description

How to fill out Arizona Formulario De Recibo Perdido?

US Legal Forms - one of many biggest libraries of legitimate forms in the United States - gives a wide range of legitimate file themes you are able to acquire or print. Making use of the website, you may get a huge number of forms for company and specific functions, categorized by groups, claims, or keywords and phrases.You will find the most up-to-date types of forms much like the Arizona Lost Receipt Form in seconds.

If you already possess a subscription, log in and acquire Arizona Lost Receipt Form from your US Legal Forms catalogue. The Download switch will appear on each and every kind you see. You gain access to all previously delivered electronically forms inside the My Forms tab of the profile.

If you want to use US Legal Forms for the first time, here are easy directions to help you began:

- Ensure you have picked the best kind for the city/county. Click the Review switch to review the form`s content material. Look at the kind information to actually have selected the correct kind.

- In the event the kind does not satisfy your specifications, use the Research industry at the top of the monitor to get the one who does.

- Should you be content with the shape, confirm your decision by clicking the Purchase now switch. Then, pick the pricing plan you prefer and supply your qualifications to sign up for an profile.

- Method the deal. Utilize your Visa or Mastercard or PayPal profile to complete the deal.

- Find the formatting and acquire the shape on the gadget.

- Make alterations. Load, modify and print and indicator the delivered electronically Arizona Lost Receipt Form.

Each format you added to your bank account does not have an expiry date and is also your own property forever. So, in order to acquire or print an additional version, just visit the My Forms segment and click on in the kind you require.

Get access to the Arizona Lost Receipt Form with US Legal Forms, probably the most comprehensive catalogue of legitimate file themes. Use a huge number of expert and condition-particular themes that fulfill your small business or specific demands and specifications.