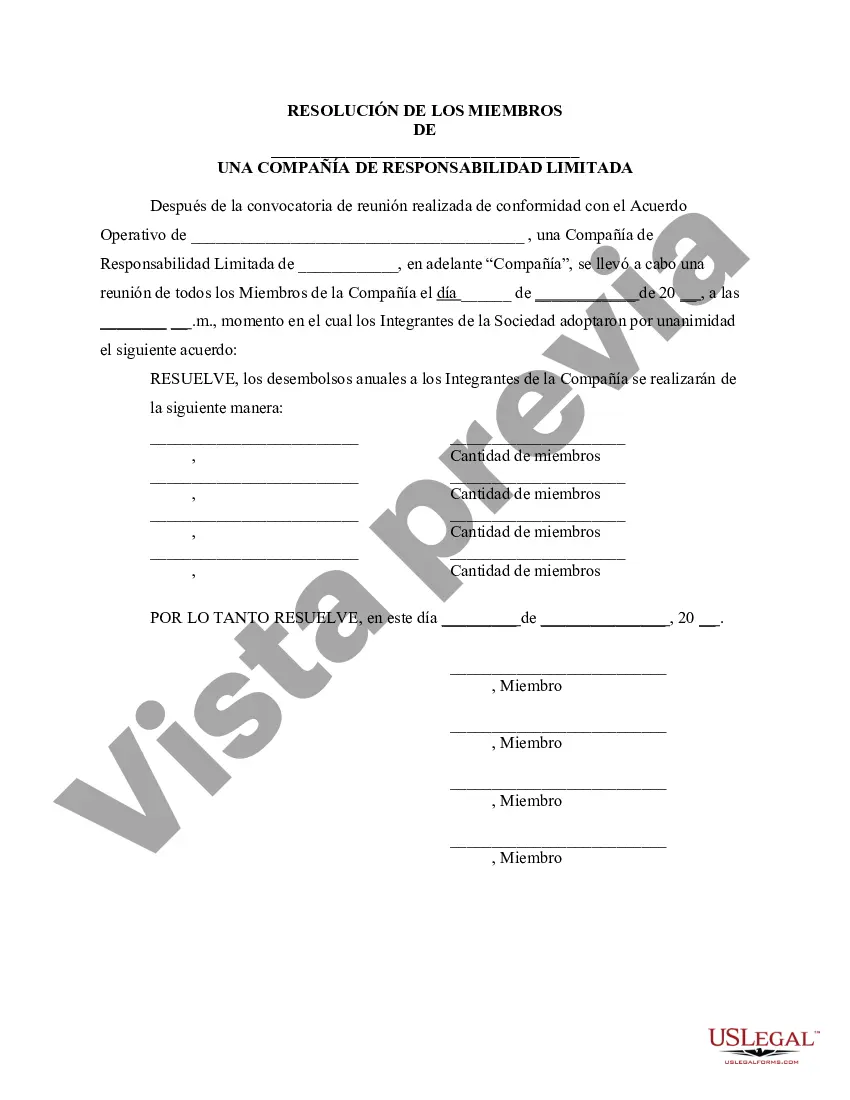

The Arizona Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a legal document that outlines the specific details regarding the distribution of funds among the members of a limited liability company (LLC). This resolution is crucial for ensuring transparency and fair treatment among the LLC members. The resolution begins by stating the purpose of the meeting, which is to discuss and determine the amount of annual disbursements that will be allotted to each member of the company. It highlights the significance of holding such a meeting to establish a clear understanding of the financial distribution process within the LLC. The resolution includes the date, time, and location of the meeting, as well as the names of the LLC members expected to attend. It further identifies the individuals who are authorized to chair the meeting and record the minutes. During the meeting, the LLC members engage in a comprehensive discussion regarding the financial status, profits, and expenses of the company. They review relevant documents and reports to gain a thorough understanding of the organization's financial health. Based on these findings, the members collectively decide upon the annual disbursement amount. There might be different types of Arizona Resolutions of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company based on the specific needs and circumstances of each LLC. These types may include: 1. Basic Resolution: This document outlines the fundamental details of the meeting, such as date, time, location, and a general discussion on annual disbursements. 2. Detailed Financial Analysis Resolution: In this type of resolution, the LLC members extensively evaluate the financial statements, cash flow projections, and profit distribution history to make an informed decision regarding the annual disbursements. 3. Equitable Distribution Resolution: Some LCS may require a resolution that focuses on ensuring an equitable distribution of funds among members, taking into consideration factors such as individual contributions, experience, and current financial needs. 4. Fractional Distribution Resolution: In cases where LLC members have unequal ownership percentages, the resolution may specify a fractional distribution method to allocate the annual disbursements accordingly. After the meeting, the resolution is documented, signed, and retained as an official record of the LLC. It serves as a reference for future financial transactions and provides clarity over the agreed-upon disbursement amounts to avoid any confusion or disputes among the members. Keywords: Arizona Resolution of Meeting, LLC Members, Amount of Annual Disbursements, Company, Legal document, Transparency, Financial Distribution, Funds, Profits, Expenses, Meeting, Financial Status, Financial Health, Basic Resolution, Detailed Financial Analysis Resolution, Equitable Distribution Resolution, Fractional Distribution Resolution, Documented, Official Record.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Arizona Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

Choosing the best legitimate papers template can be quite a have a problem. Needless to say, there are plenty of themes available on the net, but how will you obtain the legitimate develop you require? Utilize the US Legal Forms internet site. The service delivers 1000s of themes, including the Arizona Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, which you can use for business and personal demands. All the types are checked out by experts and satisfy state and federal demands.

In case you are currently authorized, log in to your accounts and click the Acquire option to obtain the Arizona Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company. Make use of accounts to appear throughout the legitimate types you possess bought in the past. Check out the My Forms tab of your own accounts and get yet another duplicate of the papers you require.

In case you are a brand new customer of US Legal Forms, here are straightforward instructions that you should follow:

- Initially, make certain you have chosen the right develop for your personal town/state. You may look over the shape utilizing the Preview option and look at the shape description to guarantee it is the right one for you.

- If the develop does not satisfy your preferences, take advantage of the Seach discipline to obtain the correct develop.

- Once you are sure that the shape is proper, click on the Acquire now option to obtain the develop.

- Choose the prices program you need and enter the required information and facts. Design your accounts and pay for your order making use of your PayPal accounts or credit card.

- Opt for the document structure and down load the legitimate papers template to your product.

- Full, change and print and indicator the attained Arizona Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

US Legal Forms may be the biggest collection of legitimate types where you can see various papers themes. Utilize the company to down load appropriately-produced paperwork that follow state demands.